Answered step by step

Verified Expert Solution

Question

1 Approved Answer

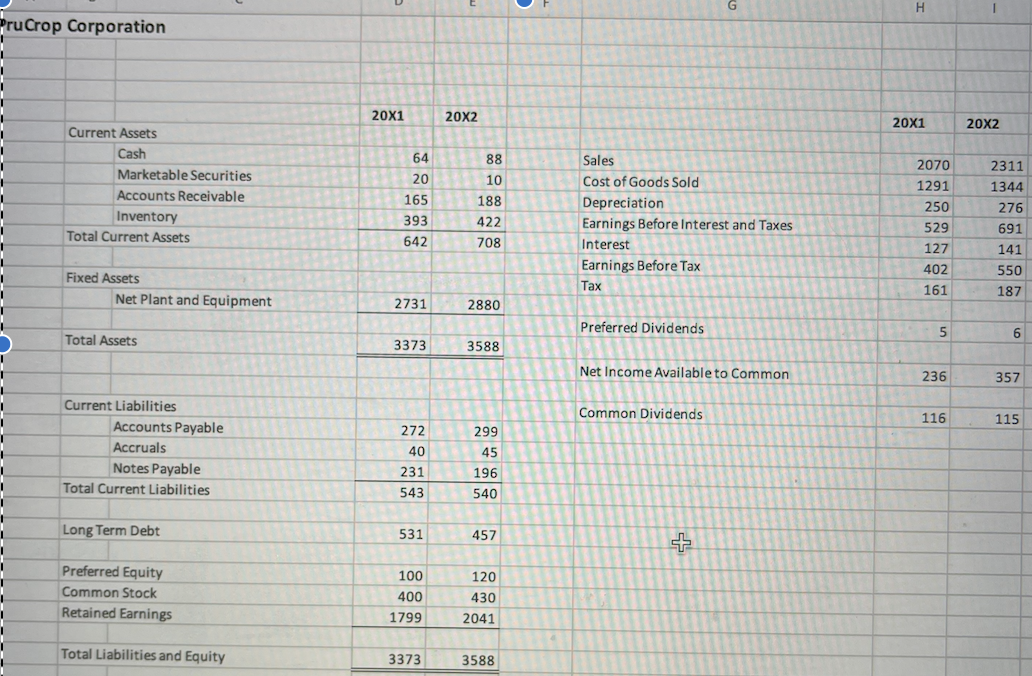

1) Pictured are the financial statements for PruCrop Corporation. Prepare a ratio analysis for the company and be sure to include the Dupont Ratio. 2)

1) Pictured are the financial statements for PruCrop Corporation. Prepare a ratio analysis for the company and be sure to include the Dupont Ratio.

2) Prepare a statement of cash flows for PruCrop Corporation 20X2

H. PruCrop Corporation 20X1 20X2 20X1 20x2 Current Assets Cash 64 88 Marketable Securities Accounts Receivable Inventory Total Current Assets 20 165 393 642 10 188 422 708 Sales Cost of Goods Sold Depreciation Earnings Before Interest and Taxes Interest Earnings Before Tax Tax 2070 1291 250 529 127 402 161 2311 1344 276 691 141 550 187 Fixed Assets Net Plant and Equipment 2731 2880 Preferred Dividends 5 Total Assets 6 3373 3588 Net Income Available to Common 236 357 Common Dividends 116 115 299 Current Liabilities Accounts Payable Accruals Notes Payable Total Current Liabilities 45 272 40 231 543 196 540 Long Term Debt 531 457 Preferred Equity Common Stock Retained Earnings 100 400 1799 120 430 2041 Total Liabilities and Equity 3373 3588 H. PruCrop Corporation 20X1 20X2 20X1 20x2 Current Assets Cash 64 88 Marketable Securities Accounts Receivable Inventory Total Current Assets 20 165 393 642 10 188 422 708 Sales Cost of Goods Sold Depreciation Earnings Before Interest and Taxes Interest Earnings Before Tax Tax 2070 1291 250 529 127 402 161 2311 1344 276 691 141 550 187 Fixed Assets Net Plant and Equipment 2731 2880 Preferred Dividends 5 Total Assets 6 3373 3588 Net Income Available to Common 236 357 Common Dividends 116 115 299 Current Liabilities Accounts Payable Accruals Notes Payable Total Current Liabilities 45 272 40 231 543 196 540 Long Term Debt 531 457 Preferred Equity Common Stock Retained Earnings 100 400 1799 120 430 2041 Total Liabilities and Equity 3373 3588

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started