Answered step by step

Verified Expert Solution

Question

1 Approved Answer

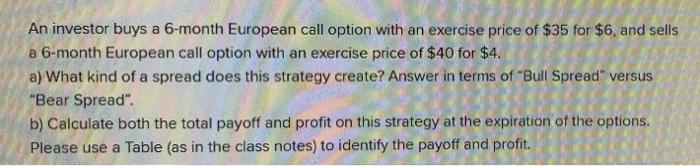

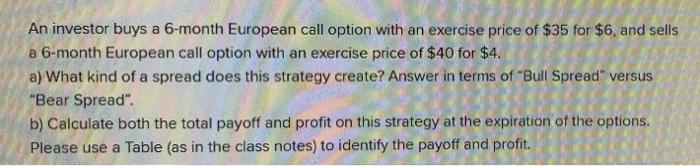

Please solve for A and B Please show your work. Please explain your reasoning. An investor buys a 6-month European call option with an exercise

Please solve for A and B

An investor buys a 6-month European call option with an exercise price of $35 for $6 and sells a 6-month European call option with an exercise price of $40 for $4. a) What kind of a spread does this strategy create? Answer in terms of "Bull Spread" versus "Bear Spread". b) Calculate both the total payoff and profit on this strategy at the expiration of the options. Please use a Table (as in the class notes) to identify the payoff and profit Please show your work.

Please explain your reasoning.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started