Answered step by step

Verified Expert Solution

Question

1 Approved Answer

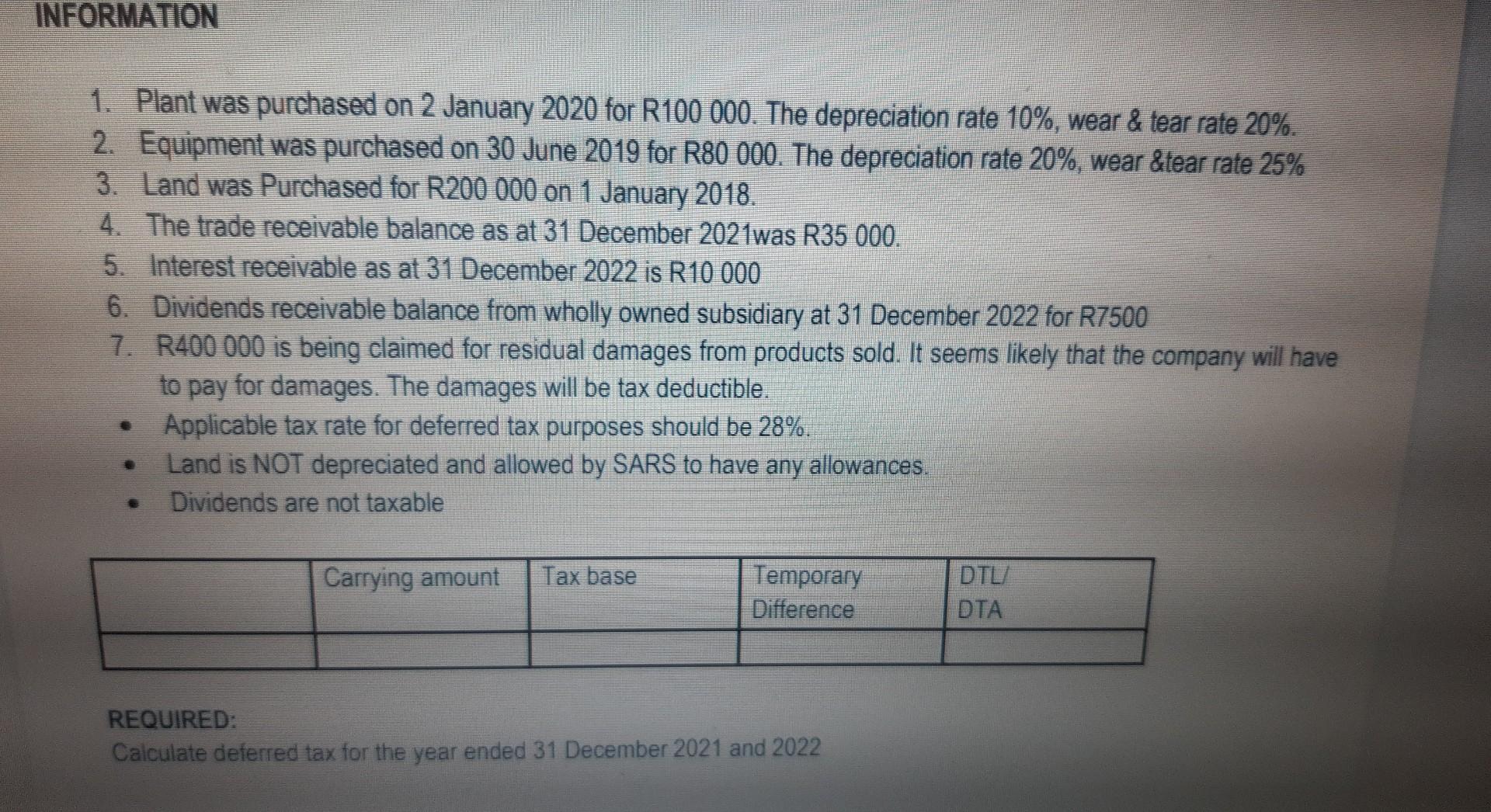

1. Plant was purchased on 2 January 2020 for R 100000 . The depreciation rate 10%, wear & tear rate 20%. 2. Equipment was purchased

1. Plant was purchased on 2 January 2020 for R 100000 . The depreciation rate 10%, wear \& tear rate 20%. 2. Equipment was purchased on 30 June 2019 for R80 000. The depreciation rate 20%, wear \& tear rate 25% 3. Land was Purchased for R200 000 on 1 January 2018. 4. The trade receivable balance as at 31 December 2021 was R35 000 . 5. Interest receivable as at 31 December 2022 is R10000 6. Dividends receivable balance from wholly owned subsidiary at 31 December 2022 for R7500 7. R400000 is being claimed for residual damages from products sold. It seems likely that the company will have to pay for damages. The damages will be tax deductible. - Applicable tax rate for deferred tax purposes should be 28%. - Land is NOT depreciated and allowed by SARS to have any allowances. - Dividends are not taxable REQUIRED: Calculate deferred tax for the year ended 31 December 2021 and 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started