1. Calculate and comment ratios: current ratio, quick ratio, receivables turnover, average collection period, inventory turnover, inventory turnover days and return on equity. 2. According

1. Calculate and comment ratios: current ratio, quick ratio, receivables turnover, average collection period, inventory turnover, inventory turnover days and return on equity.

2. According to your opinion, describe the role and importance of receivables factoring.

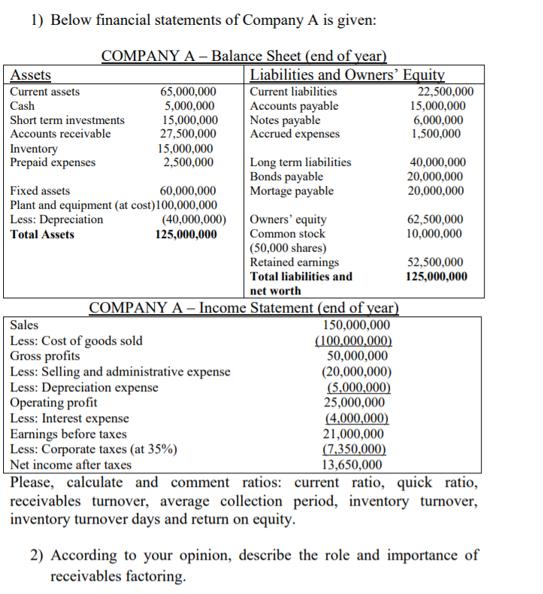

1) Below financial statements of Company A is given: COMPANY A - Balance Sheet (end of vear) Liabilities and Owners Equity Current liabilities Accounts payable Notes payable Accrued expenses Assets Current assets 65,000,000 22,500,000 15,000,000 6,000,000 1,500,000 Cash 5,000,000 15,000,000 27,500,000 15,000,000 2,500,000 Short term investments Accounts receivable Inventory Prepaid expenses Long term liabilities Bonds payable Mortage payable 40,000,000 20,000,000 Fixed assets 60,000,000 20,000,000 Plant and equipment (at cost)100,000,000 Less: Depreciation Total Assets (40,000,000) 62,500,000 Owners' equity Common stock 125,000,000 10,000,000 (50,000 shares) Retained earnings Total liabilities and net worth 52,500,000 125,000,000 COMPANY A- Income Statement (end of year) 150,000,000 Sales Less: Cost of goods sold Gross profits Less: Selling and administrative expense Less: Depreciation expense Operating profit Less: Interest expense Earnings before taxes Less: Corporate taxes (at 35%) Net income after taxes Please, calculate and comment ratios: current ratio, quick ratio, receivables turnover, average collection period, inventory turnover, inventory turnover days and return on equity. (100,000,000) 50,000,000 (20,000,000) (5,000,000) 25,000,000 (4,000,000) 21,000,000 (7,350,000) 13,650,000 2) According to your opinion, describe the role and importance of receivables factoring.

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Quick assets Current assets Inventory Prepaid expenses 65000000150000002500000 47500000 Current ratio Current assets Current liabilities 6500000022500000 289 to 1 Quick ratio Quick assets current liab...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started