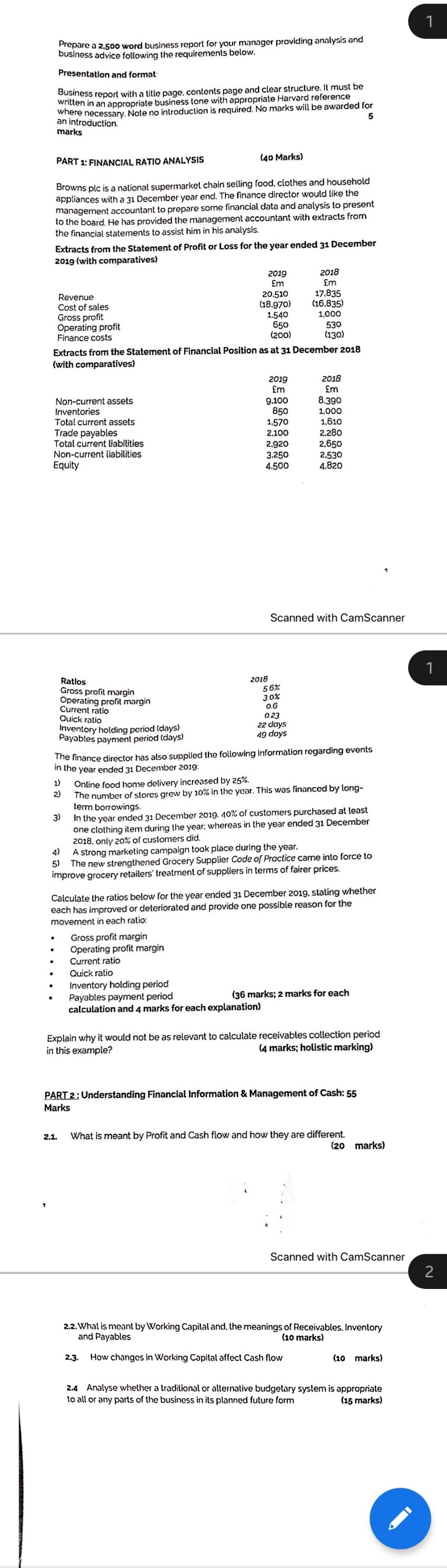

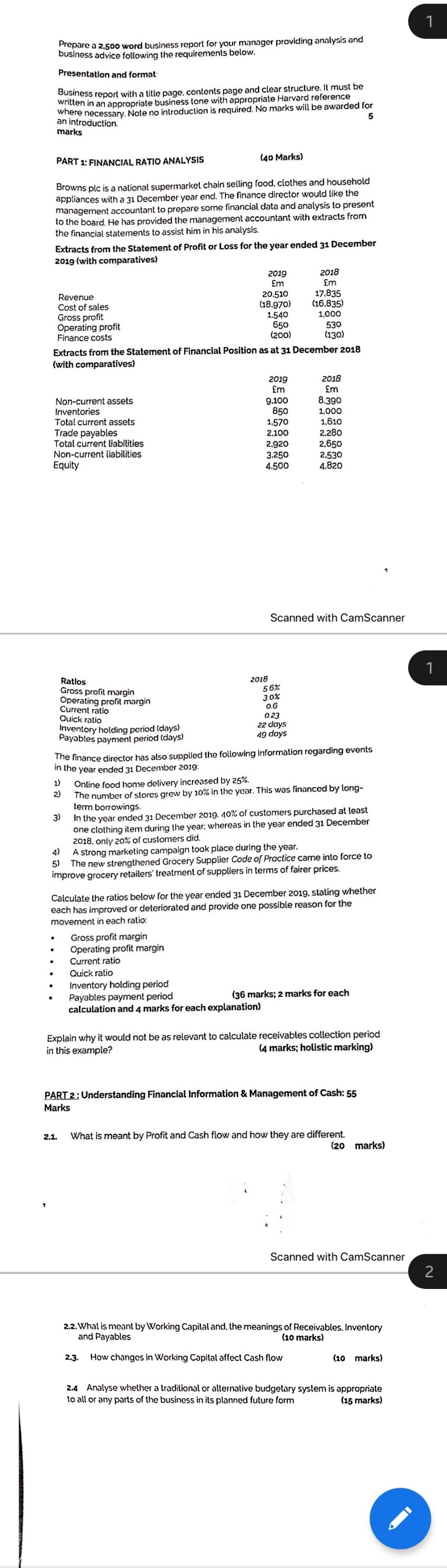

1 Prepare a 2,500 word business report for your manager providing analysis and business advice following the requirements below. Presentation and format Business report with a title page contents page and clear structure. It must be written in an appropriate business tone with appropriate Harvard reference where necessary. Note no introduction is required. No marks will be awarded for 5 an introduction marks (40 Marks) PART 1: FINANCIAL RATIO ANALYSIS Browns plc is a national supermarkel chain selling food, clothes and household appliances with a 31 December year end. The finance director would like the management accountant to prepare some financial data and analysis to present to the board. He has provided the management accountant with extracts from the financial statements to assist him in his analysis. Extracts from the Statement of Profit or Loss for the year ended 31 December 2019 (with comparatives) 2018 m 650 2019 Em Revenue 20.510 17.835 Cost of sales (18.970) (16.835) Gross profit 1.540 1.000 Operating profit 530 Finance costs (200) (130) Extracts from the Statement of Financial Position as at 31 December 2018 (with comparatives) 2019 2018 Em Em Non-current assets 9.100 Inventories 850 1,000 Total current assets 1.570 1,610 Trade payables 2.100 2.280 Total current liabilities 2.920 2.650 Non-current liabilities 3.250 2.530 Equity 4.500 4.820 8.390 1 Scanned with CamScanner 1 2018 56% 30% 0.6 0.23 22 days 49 days Ratios Gross profil margin Operating profit margin Current ratio Quick ratio Inventory holding period (days) Payables payment period (days) The finance director has also supplied the following information regarding events in the year ended 31 December 2019: 1) Online food home delivery increased by 25%. 2) The number of stores grew by 10% the year. This was financed by long- term borrowings. 3) In the year ended 31 December 2019. 40% of customers purchased at least one clothing item during the year; whereas in the year ended 31 December 2018. only 20% of customers did. 4) A strong marketing campaign took place during the year. 5) The new strengthened Grocery Supplier Code of Practice came into force to improve grocery y retailers' treatment of suppliers in terms of fairer prices. . Calculate the ratios below for the year ended 31 December 2015. stating whether each has improved or deteriorated and provide one possible reason for the movement in each ratio: Gross profit margin Operating profit margin Current ratio Quick ratio Inventory holding period Payables payment period (36 marks; 2 marks for each calculation and 4 marks for each explanation) Explain why it would not be as relevant to calculate receivables collection period in this example? (4 marks; holistic marking) PART 2: Understanding Financial Information & Management of Cash: 55 Marks 2.1. What is meant by Profit and Cash flow and how they are different (20 marks) Scanned with CamScanner 2 2.2. What is meant by Working Capital and the meanings of Receivables. Inventory and Payables (10 marks) 2.3. How changes in Working Capital affect Cash flow (10 marks) 2.4 Analyse whether a traditional or alternative budgetary system is appropriate to all or any parts of the business in its planned future form (15 marks) 1 Prepare a 2,500 word business report for your manager providing analysis and business advice following the requirements below. Presentation and format Business report with a title page contents page and clear structure. It must be written in an appropriate business tone with appropriate Harvard reference where necessary. Note no introduction is required. No marks will be awarded for 5 an introduction marks (40 Marks) PART 1: FINANCIAL RATIO ANALYSIS Browns plc is a national supermarkel chain selling food, clothes and household appliances with a 31 December year end. The finance director would like the management accountant to prepare some financial data and analysis to present to the board. He has provided the management accountant with extracts from the financial statements to assist him in his analysis. Extracts from the Statement of Profit or Loss for the year ended 31 December 2019 (with comparatives) 2018 m 650 2019 Em Revenue 20.510 17.835 Cost of sales (18.970) (16.835) Gross profit 1.540 1.000 Operating profit 530 Finance costs (200) (130) Extracts from the Statement of Financial Position as at 31 December 2018 (with comparatives) 2019 2018 Em Em Non-current assets 9.100 Inventories 850 1,000 Total current assets 1.570 1,610 Trade payables 2.100 2.280 Total current liabilities 2.920 2.650 Non-current liabilities 3.250 2.530 Equity 4.500 4.820 8.390 1 Scanned with CamScanner 1 2018 56% 30% 0.6 0.23 22 days 49 days Ratios Gross profil margin Operating profit margin Current ratio Quick ratio Inventory holding period (days) Payables payment period (days) The finance director has also supplied the following information regarding events in the year ended 31 December 2019: 1) Online food home delivery increased by 25%. 2) The number of stores grew by 10% the year. This was financed by long- term borrowings. 3) In the year ended 31 December 2019. 40% of customers purchased at least one clothing item during the year; whereas in the year ended 31 December 2018. only 20% of customers did. 4) A strong marketing campaign took place during the year. 5) The new strengthened Grocery Supplier Code of Practice came into force to improve grocery y retailers' treatment of suppliers in terms of fairer prices. . Calculate the ratios below for the year ended 31 December 2015. stating whether each has improved or deteriorated and provide one possible reason for the movement in each ratio: Gross profit margin Operating profit margin Current ratio Quick ratio Inventory holding period Payables payment period (36 marks; 2 marks for each calculation and 4 marks for each explanation) Explain why it would not be as relevant to calculate receivables collection period in this example? (4 marks; holistic marking) PART 2: Understanding Financial Information & Management of Cash: 55 Marks 2.1. What is meant by Profit and Cash flow and how they are different (20 marks) Scanned with CamScanner 2 2.2. What is meant by Working Capital and the meanings of Receivables. Inventory and Payables (10 marks) 2.3. How changes in Working Capital affect Cash flow (10 marks) 2.4 Analyse whether a traditional or alternative budgetary system is appropriate to all or any parts of the business in its planned future form (15 marks)