1. Provide a critique of the following accounting policies and discuss whether or not you believe Air Canada has adequately applied the accounting principles as per IFRS. Below notes 4 & 7 from the financial statement shows Air Canada accounting treatment for Intangible assets and Impairment.

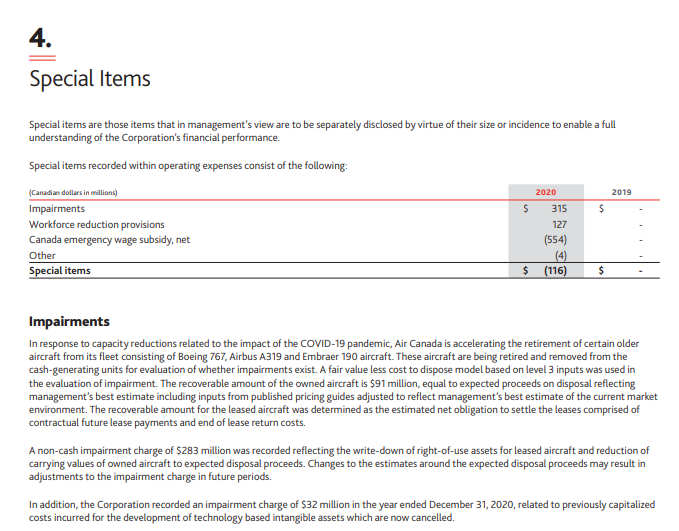

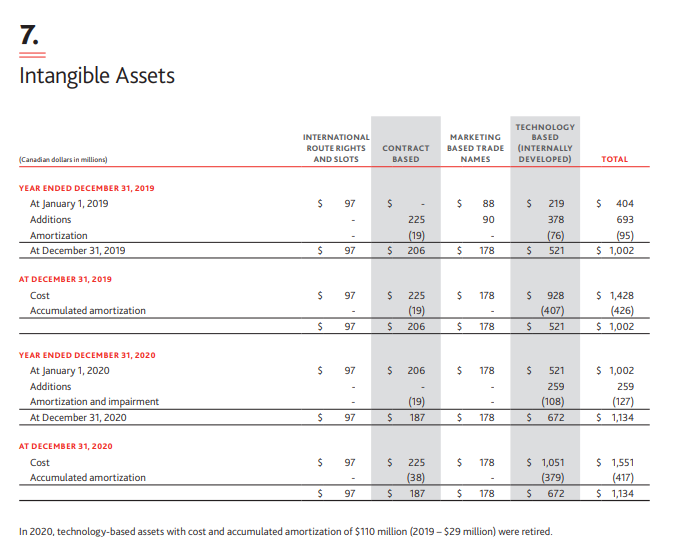

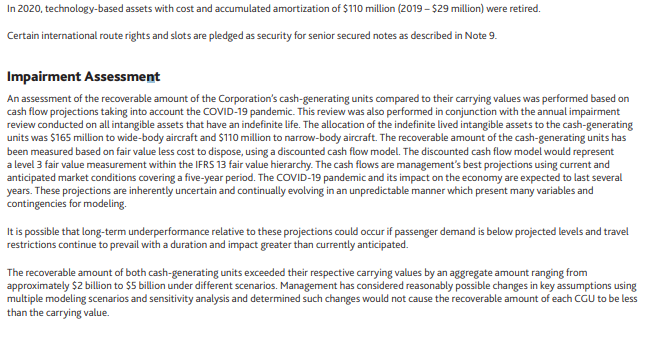

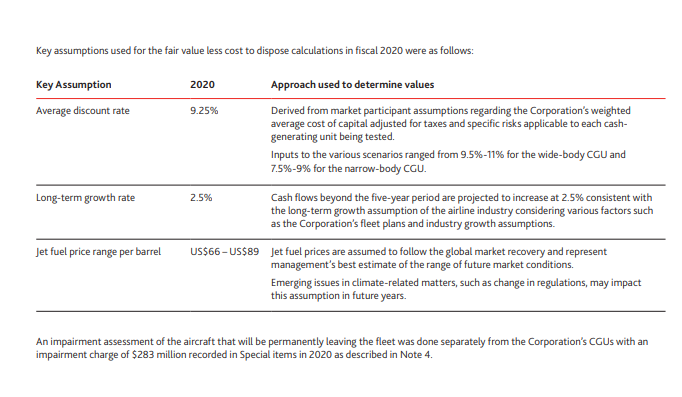

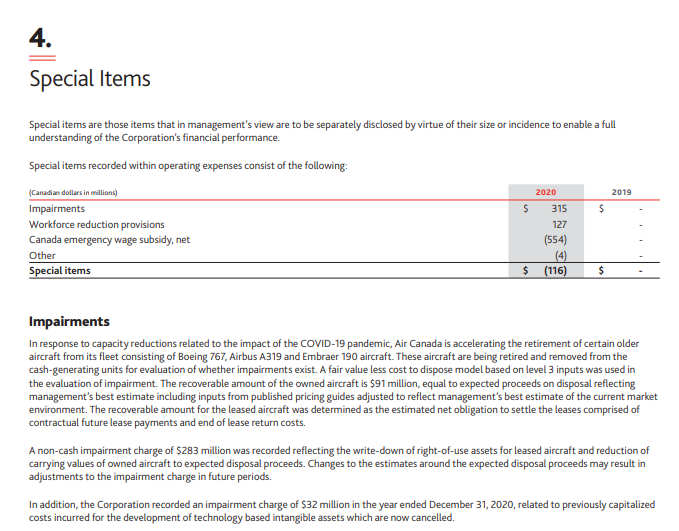

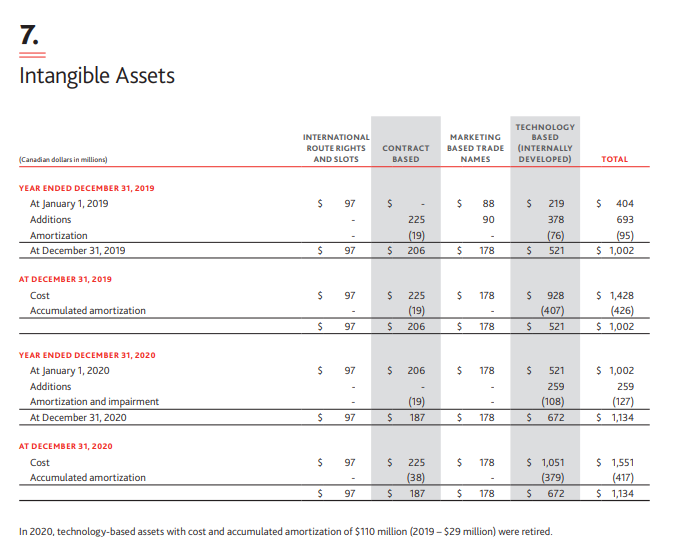

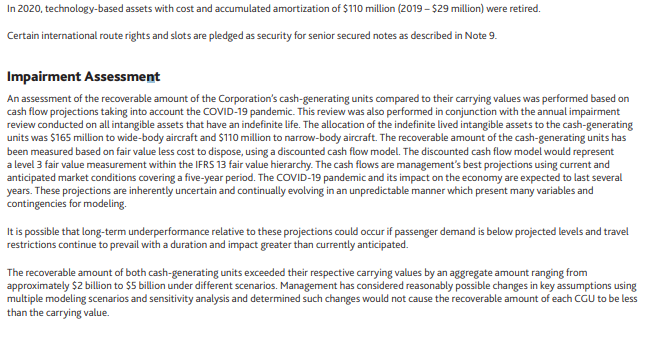

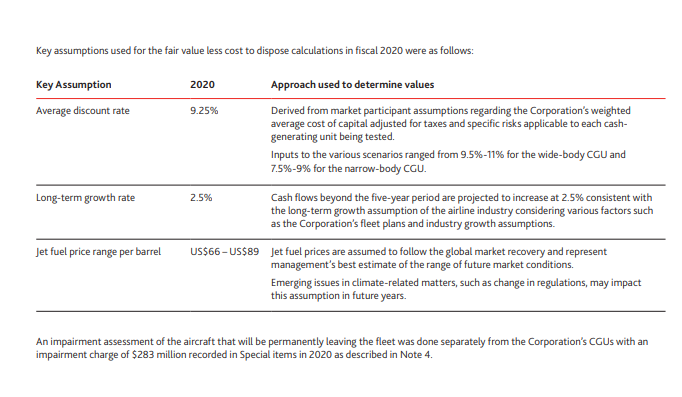

4. Special Items 2019 Special items are those items that in management's view are to be separately disclosed by virtue of their size or incidence to enable a full understanding of the Corporation's financial performance. Special items recorded within operating expenses consist of the following: (Canadian dollars in millions) 2020 Impairments $ 315 Workforce reduction provisions Canada emergency wage subsidy, net (554) Other Special items $ (116) $ 127 Impairments In response to capacity reductions related to the impact of the COVID-19 pandemic, Air Canada is accelerating the retirement of certain older aircraft from its fleet consisting of Boeing 767, Airbus A319 and Embraer 190 aircraft. These aircraft are being retired and removed from the cash-generating units for evaluation of whether impairments exist. A fair value less cost to dispose model based on level 3 inputs was used in the evaluation of impairment. The recoverable amount of the owned aircraft is $91 million, equal to expected proceeds on disposal reflecting management's best estimate including inputs from published pricing guides adjusted to reflect management's best estimate of the current market environment. The recoverable amount for the leased aircraft was determined as the estimated net obligation to settle the leases comprised of contractual future lease payments and end of lease return costs. A non-cash impairment charge of $283 million was recorded reflecting the write-down of right-of-use assets for leased aircraft and reduction of carrying values of owned aircraft to expected disposal proceeds. Changes to the estimates around the expected disposal proceeds may result in adjustments to the impairment charge in future periods. In addition, the Corporation recorded an impairment charge of $32 million in the year ended December 31, 2020, related to previously capitalized costs incurred for the development of technology based intangible assets which are now cancelled. 7. Intangible Assets INTERNATIONAL ROUTE RIGHTS AND SLOTS CONTRACT BASED MARKETING BASED TRADE NAMES TECHNOLOGY BASED (INTERNALLY DEVELOPED) (Canadian dollars in millions) TOTAL $ 97 $ $ $ $ 219 YEAR ENDED DECEMBER 31, 2019 At January 1, 2019 Additions Amortization At December 31, 2019 88 90 225 (19) 206 378 (76) 521 $ 404 693 (95) $ 1,002 $ 97 $ $ 178 $ AT DECEMBER 31, 2019 Cost Accumulated amortization $ 97 $ $ 178 $ 225 (19) 928 (407) $ 1,428 (426) $ 1,002 $ 97 $ 206 $ 178 $ 521 $ 97 $ 206 $ 178 $ 521 YEAR ENDED DECEMBER 31, 2020 At January 1, 2020 Additions Amortization and impairment At December 31, 2020 $ 1,002 259 (127) $ 1,134 259 (108) 672 (19) 187 $ 97 $ $ 178 $ AT DECEMBER 31, 2020 Cost Accumulated amortization S 97 $ $ 178 225 (38) 187 $ 1,051 (379) $ 672 $ 1,551 (417) $ 1,134 $ 97 in $ $ 178 In 2020, technology-based assets with cost and accumulated amortization of $110 million (2019 - $29 million) were retired. In 2020, technology-based assets with cost and accumulated amortization of $110 million (2019 - $29 million) were retired. Certain international route rights and slots are pledged as security for senior secured notes as described in Note 9. Impairment Assessment An assessment of the recoverable amount of the Corporation's cash-generating units compared to their carrying values was performed based on cash flow projections taking into account the COVID-19 pandemic. This review was also performed in conjunction with the annual impairment review conducted on all intangible assets that have an indefinite life. The allocation of the indefinite lived intangible assets to the cash-generating units was $165 million to wide-body aircraft and $110 million to narrow-body aircraft. The recoverable amount of the cash-generating units has been measured based on fair value less cost to dispose, using a discounted cash flow model. The discounted cash flow model would represent a level 3 fair value measurement within the IFRS 13 fair value hierarchy. The cash flows are management's best projections using current and anticipated market conditions covering a five-year period. The COVID-19 pandemic and its impact on the economy are expected to last several years. These projections are inherently uncertain and continually evolving in an unpredictable manner which present many variables and contingencies for modeling It is possible that long-term underperformance relative to these projections could occur if passenger demand is below projected levels and travel restrictions continue to prevail with a duration and impact greater than currently anticipated. The recoverable amount of both cash-generating units exceeded their respective carrying values by an aggregate amount ranging from approximately $2 billion to $5 billion under different scenarios. Management has considered reasonably possible changes in key assumptions using multiple modeling scenarios and sensitivity analysis and determined such changes would not cause the recoverable amount of each CGU to be less than the carrying value Key assumptions used for the fair value less cost to dispose calculations in fiscal 2020 were as follows: 2020 Key Assumption Average discount rate 9.25% Approach used to determine values Derived from market participant assumptions regarding the Corporation's weighted average cost of capital adjusted for taxes and specific risks applicable to each cash- generating unit being tested. Inputs to the various scenarios ranged from 9.5% -11% for the wide-body CGU and 7.5%-9% for the narrow-body CGU. Long-term growth rate 2.5% Jet fuel price range per barrel Cash flows beyond the five-year period are projected to increase at 2.5% consistent with the long-term growth assumption of the airline industry considering various factors such as the Corporation's fleet plans and industry growth assumptions. US$66 - US$89 jet fuel prices are assumed to follow the global market recovery and represent management's best estimate of the range of future market conditions. Emerging issues in climate-related matters, such as change in regulations, may impact this assumption in future years. An impairment assessment of the aircraft that will be permanently leaving the fleet was done separately from the Corporation's CGUs with an impairment charge of $283 million recorded in Special items in 2020 as described in Note 4. 4. Special Items 2019 Special items are those items that in management's view are to be separately disclosed by virtue of their size or incidence to enable a full understanding of the Corporation's financial performance. Special items recorded within operating expenses consist of the following: (Canadian dollars in millions) 2020 Impairments $ 315 Workforce reduction provisions Canada emergency wage subsidy, net (554) Other Special items $ (116) $ 127 Impairments In response to capacity reductions related to the impact of the COVID-19 pandemic, Air Canada is accelerating the retirement of certain older aircraft from its fleet consisting of Boeing 767, Airbus A319 and Embraer 190 aircraft. These aircraft are being retired and removed from the cash-generating units for evaluation of whether impairments exist. A fair value less cost to dispose model based on level 3 inputs was used in the evaluation of impairment. The recoverable amount of the owned aircraft is $91 million, equal to expected proceeds on disposal reflecting management's best estimate including inputs from published pricing guides adjusted to reflect management's best estimate of the current market environment. The recoverable amount for the leased aircraft was determined as the estimated net obligation to settle the leases comprised of contractual future lease payments and end of lease return costs. A non-cash impairment charge of $283 million was recorded reflecting the write-down of right-of-use assets for leased aircraft and reduction of carrying values of owned aircraft to expected disposal proceeds. Changes to the estimates around the expected disposal proceeds may result in adjustments to the impairment charge in future periods. In addition, the Corporation recorded an impairment charge of $32 million in the year ended December 31, 2020, related to previously capitalized costs incurred for the development of technology based intangible assets which are now cancelled. 7. Intangible Assets INTERNATIONAL ROUTE RIGHTS AND SLOTS CONTRACT BASED MARKETING BASED TRADE NAMES TECHNOLOGY BASED (INTERNALLY DEVELOPED) (Canadian dollars in millions) TOTAL $ 97 $ $ $ $ 219 YEAR ENDED DECEMBER 31, 2019 At January 1, 2019 Additions Amortization At December 31, 2019 88 90 225 (19) 206 378 (76) 521 $ 404 693 (95) $ 1,002 $ 97 $ $ 178 $ AT DECEMBER 31, 2019 Cost Accumulated amortization $ 97 $ $ 178 $ 225 (19) 928 (407) $ 1,428 (426) $ 1,002 $ 97 $ 206 $ 178 $ 521 $ 97 $ 206 $ 178 $ 521 YEAR ENDED DECEMBER 31, 2020 At January 1, 2020 Additions Amortization and impairment At December 31, 2020 $ 1,002 259 (127) $ 1,134 259 (108) 672 (19) 187 $ 97 $ $ 178 $ AT DECEMBER 31, 2020 Cost Accumulated amortization S 97 $ $ 178 225 (38) 187 $ 1,051 (379) $ 672 $ 1,551 (417) $ 1,134 $ 97 in $ $ 178 In 2020, technology-based assets with cost and accumulated amortization of $110 million (2019 - $29 million) were retired. In 2020, technology-based assets with cost and accumulated amortization of $110 million (2019 - $29 million) were retired. Certain international route rights and slots are pledged as security for senior secured notes as described in Note 9. Impairment Assessment An assessment of the recoverable amount of the Corporation's cash-generating units compared to their carrying values was performed based on cash flow projections taking into account the COVID-19 pandemic. This review was also performed in conjunction with the annual impairment review conducted on all intangible assets that have an indefinite life. The allocation of the indefinite lived intangible assets to the cash-generating units was $165 million to wide-body aircraft and $110 million to narrow-body aircraft. The recoverable amount of the cash-generating units has been measured based on fair value less cost to dispose, using a discounted cash flow model. The discounted cash flow model would represent a level 3 fair value measurement within the IFRS 13 fair value hierarchy. The cash flows are management's best projections using current and anticipated market conditions covering a five-year period. The COVID-19 pandemic and its impact on the economy are expected to last several years. These projections are inherently uncertain and continually evolving in an unpredictable manner which present many variables and contingencies for modeling It is possible that long-term underperformance relative to these projections could occur if passenger demand is below projected levels and travel restrictions continue to prevail with a duration and impact greater than currently anticipated. The recoverable amount of both cash-generating units exceeded their respective carrying values by an aggregate amount ranging from approximately $2 billion to $5 billion under different scenarios. Management has considered reasonably possible changes in key assumptions using multiple modeling scenarios and sensitivity analysis and determined such changes would not cause the recoverable amount of each CGU to be less than the carrying value Key assumptions used for the fair value less cost to dispose calculations in fiscal 2020 were as follows: 2020 Key Assumption Average discount rate 9.25% Approach used to determine values Derived from market participant assumptions regarding the Corporation's weighted average cost of capital adjusted for taxes and specific risks applicable to each cash- generating unit being tested. Inputs to the various scenarios ranged from 9.5% -11% for the wide-body CGU and 7.5%-9% for the narrow-body CGU. Long-term growth rate 2.5% Jet fuel price range per barrel Cash flows beyond the five-year period are projected to increase at 2.5% consistent with the long-term growth assumption of the airline industry considering various factors such as the Corporation's fleet plans and industry growth assumptions. US$66 - US$89 jet fuel prices are assumed to follow the global market recovery and represent management's best estimate of the range of future market conditions. Emerging issues in climate-related matters, such as change in regulations, may impact this assumption in future years. An impairment assessment of the aircraft that will be permanently leaving the fleet was done separately from the Corporation's CGUs with an impairment charge of $283 million recorded in Special items in 2020 as described in Note 4