Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Ricky Corp. budgeted $700,000 of ovechead cost for the current jeit, Actual orethesd cores for the year were $650,000. Pinnacle's plantwide allocation base, machine

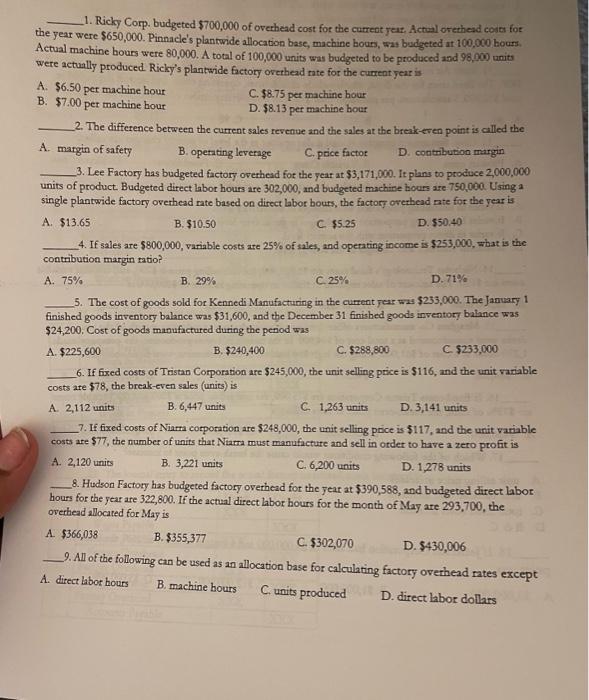

1. Ricky Corp. budgeted $700,000 of ovechead cost for the current jeit, Actual orethesd cores for the year were $650,000. Pinnacle's plantwide allocation base, machine bours, was budgeted at 100,000 bouss. Actual machine bours were 80,000 . A total of 100,000 units was budgeted to be produced and 98,000 units were actually produced. Ricky's plantwide factory orerhead nte for the current year is A. $6.50 per machine hour B. $7.00 per machine hour C. $8.75 per machine bour D. $8.13 per machine bour 2. The difference between the current sales revenue and the sales at the break-eren point is alled the A. margin of safety B. openting leverage C. price factor D. contribution margin 3. Lee Factory has budgeted factory orethead fot the year at $3,171,000. It plans to produce 2,000,000 units of product. Budgeted direct labor hours are 302,000, and budgeted machine bours are 750,000 Using 2 single plantwide factory overhead rate based on direct labor bous, the factory orerhead me for the year is A. $13.65 B. $10.50 C $5.25 D. 550.40 4. If sales are $800,000, variable costs are 25% of sales, and operating income is $253,000, what is the contribution margin tatio? A. 75% B. 29% C. 25% D. 71% 5. The cost of goods sold for Kennedi Manufacturing in the curtent fear wus $233,000. The January 1 finished goods inventory balance was $31,600, and the December 31 finished goods inventory bahance was $24,200. Cost of goods manufactured during the period was A. $225,600 B. $240,400 C. $288,800 C $233,000 6. If fixed costs of Tristan Corporation ate $245,000, the unit selling price is $116, and the unit rariable costs are $78, the break-even sales (units) is A. 2,112 units B. 6,447 units C. 1,263 units D. 3,141 units 7. If fixed costs of Niarm copporation are $248,000, the unit selling price is $117, and the unit variable costs are $77, the number of units that Niarra must manufacture and sell in order to have a zero profit is A. 2,120 units B. 3,221 units C. 6,200 units D. 1,278 units 8. Hudson Factory has budgeted factory overhead for the year at $390,588, and budgeted direct labor hours for the year are 322,800 . If the actual direct labor bours for the month of May are 293,700 , the overiead allocated for May is A. $366,038 B. $355,377 C. $302,070 D. $430,006 9. All of the following can be used as an allocation base for calculating factory ovethead rates except A. direct bbot hours B.machinehoursC.unitsproduced D. direct labor dollars

1. Ricky Corp. budgeted $700,000 of ovechead cost for the current jeit, Actual orethesd cores for the year were $650,000. Pinnacle's plantwide allocation base, machine bours, was budgeted at 100,000 bouss. Actual machine bours were 80,000 . A total of 100,000 units was budgeted to be produced and 98,000 units were actually produced. Ricky's plantwide factory orerhead nte for the current year is A. $6.50 per machine hour B. $7.00 per machine hour C. $8.75 per machine bour D. $8.13 per machine bour 2. The difference between the current sales revenue and the sales at the break-eren point is alled the A. margin of safety B. openting leverage C. price factor D. contribution margin 3. Lee Factory has budgeted factory orethead fot the year at $3,171,000. It plans to produce 2,000,000 units of product. Budgeted direct labor hours are 302,000, and budgeted machine bours are 750,000 Using 2 single plantwide factory overhead rate based on direct labor bous, the factory orerhead me for the year is A. $13.65 B. $10.50 C $5.25 D. 550.40 4. If sales are $800,000, variable costs are 25% of sales, and operating income is $253,000, what is the contribution margin tatio? A. 75% B. 29% C. 25% D. 71% 5. The cost of goods sold for Kennedi Manufacturing in the curtent fear wus $233,000. The January 1 finished goods inventory balance was $31,600, and the December 31 finished goods inventory bahance was $24,200. Cost of goods manufactured during the period was A. $225,600 B. $240,400 C. $288,800 C $233,000 6. If fixed costs of Tristan Corporation ate $245,000, the unit selling price is $116, and the unit rariable costs are $78, the break-even sales (units) is A. 2,112 units B. 6,447 units C. 1,263 units D. 3,141 units 7. If fixed costs of Niarm copporation are $248,000, the unit selling price is $117, and the unit variable costs are $77, the number of units that Niarra must manufacture and sell in order to have a zero profit is A. 2,120 units B. 3,221 units C. 6,200 units D. 1,278 units 8. Hudson Factory has budgeted factory overhead for the year at $390,588, and budgeted direct labor hours for the year are 322,800 . If the actual direct labor bours for the month of May are 293,700 , the overiead allocated for May is A. $366,038 B. $355,377 C. $302,070 D. $430,006 9. All of the following can be used as an allocation base for calculating factory ovethead rates except A. direct bbot hours B.machinehoursC.unitsproduced D. direct labor dollars

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started