Answered step by step

Verified Expert Solution

Question

1 Approved Answer

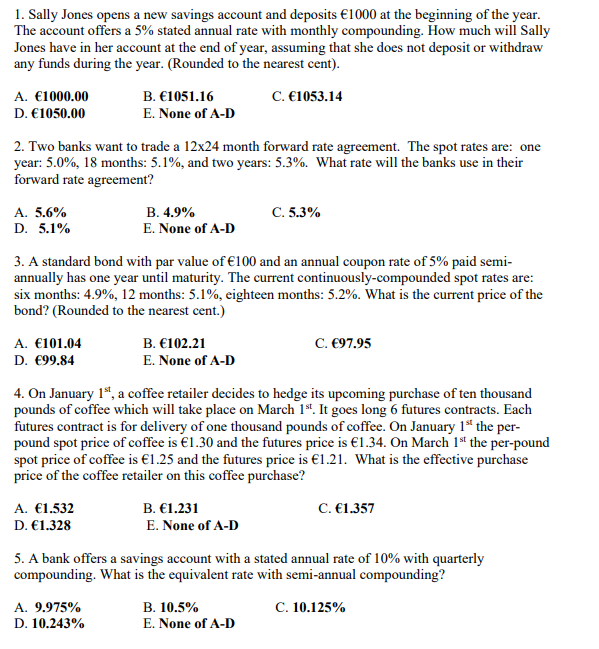

1. Sally Jones opens a new savings account and deposits 1000 at the beginning of the year. The account offers a 5% stated annual

1. Sally Jones opens a new savings account and deposits 1000 at the beginning of the year. The account offers a 5% stated annual rate with monthly compounding. How much will Sally Jones have in her account at the end of year, assuming that she does not deposit or withdraw any funds during the year. (Rounded to the nearest cent). C. 1053.14 A. 1000.00 D. 1050.00 2. Two banks want to trade a 12x24 month forward rate agreement. The spot rates are: one year: 5.0%, 18 months: 5.1%, and two years: 5.3%. What rate will the banks use in their forward rate agreement? A. 5.6% D. 5.1% A. 101.04 D. 99.84 B. 1051.16 E. None of A-D 3. A standard bond with par value of 100 and an annual coupon rate of 5% paid semi- annually has one year until maturity. The current continuously-compounded spot rates are: six months: 4.9%, 12 months: 5.1%, eighteen months: 5.2%. What is the current price of the bond? (Rounded to the nearest cent.) A. 1.532 D. 1.328 B. 4.9% E. None of A-D A. 9.975% D. 10.243% B. 102.21 E. None of A-D 4. On January 1st, a coffee retailer decides to hedge its upcoming purchase of ten thousand pounds of coffee which will take place on March 1st. It goes long 6 futures contracts. Each futures contract is for delivery of one thousand pounds of coffee. On January 1st the per- pound spot price of coffee is 1.30 and the futures price is 1.34. On March 1st the per-pound spot price of coffee is 1.25 and the futures price is 1.21. What is the effective purchase price of the coffee retailer on this coffee purchase? C. 5.3% B. 1.231 E. None of A-D C. 97.95 B. 10.5% E. None of A-D 5. A bank offers a savings account with a stated annual rate of 10% with quarterly compounding. What is the equivalent rate with semi-annual compounding? C. 10.125% C. 1.357

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 Monthly compounding interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started