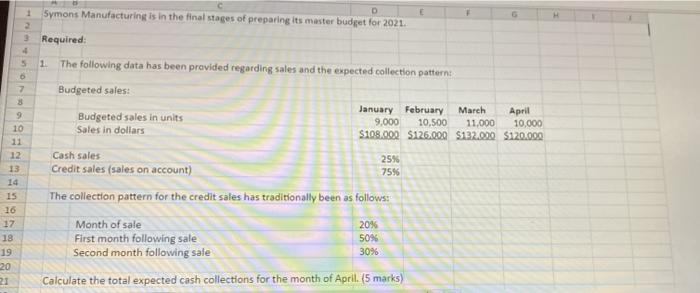

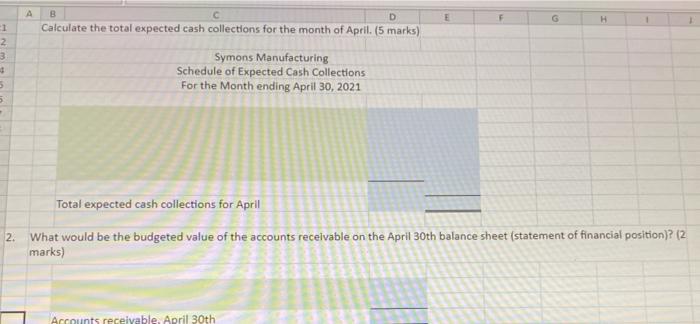

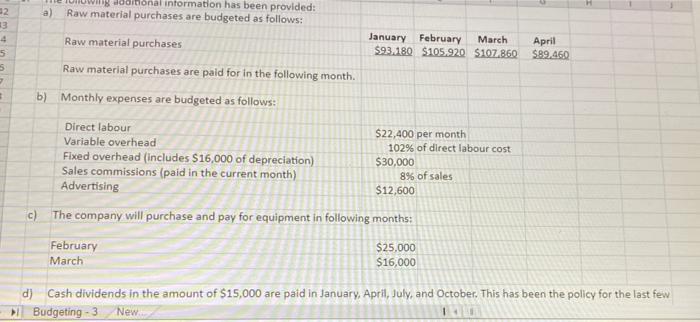

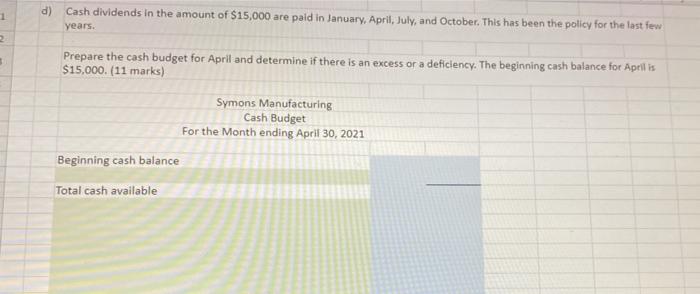

1 Symons Manufacturing is in the final stages of preparing its master budget for 2021. D Required: 3 4 5 1 7 9 10 11 12 13 14 15 16 17 The following data has been provided regarding sales and the expected collection patterns Budgeted sales: January February March April Budgeted sales in units 9,000 10,500 11,000 10,000 Sales in dollars S108.000 $126.000 $132.000 $120.000 Cash sales 25% Credit sales (sales on account) 75% The collection pattern for the credit sales has traditionally been as follows: Month of sale 20% First month following sale 50% Second month following sale 30% Calculate the total expected cash collections for the month of April. (5 marks) 18 19 20 21 A D H B Calculate the total expected cash collections for the month of April. (5 marks) 2 3 Symons Manufacturing Schedule of Expected Cash Collections For the Month ending April 30, 2021 5 5 Total expected cash collections for April 2. What would be the budgeted value of the accounts receivable on the April 30th balance sheet (statement of financial position)? (2 marks) Accounts receivable, April 30th a) 2 3 4 5 5 8 dinonal information has been provided: Raw material purchases are budgeted as follows: Raw material purchases January February March $93.180 $105.920 $107.860 April $89.460 Raw material purchases are paid for in the following month. b) Monthly expenses are budgeted as follows: Direct labour $22,400 per month Variable overhead 102% of direct labour cost Fixed overhead (includes $16,000 of depreciation) $30,000 Sales commissions (paid in the current month) 8% of sales Advertising $12,600 c) The company will purchase and pay for equipment in following months: February March $25.000 $16,000 d) Cash dividends in the amount of $15,000 are paid in January, April, July, and October. This has been the policy for the last few > Budgeting - 3 New 1 Cash dividends in the amount of $15,000 are paid in January, April, July, and October. This has been the policy for the last few years. 2 3 Prepare the cash budget for April and determine if there is an excess or a deficiency. The beginning cash balance for Apell is $15,000. (11 marks) Symons Manufacturing Cash Budget For the Month ending April 30, 2021 Beginning cash balance Total cash available A B D F G H 1 77 78 79 80 81 Excess (deficiency) 83 4. 24 The company must maintain a minimum cash balance of $12,000 each month. Money is borrowed at the beginning of the month, There are no loans currently outstanding. Interest is paid in the following month and the rate is 6% per year. Based this Information and the final answer for part 3, determine the amount that needs to be borrowed, not including interest, to ensure that there is at least $12,000 on hand at the end of April. If no borrowing is required, Indicate this and provide an appropriate explanation why. (2 marks) 5 5 Amount to be borrowed