Answered step by step

Verified Expert Solution

Question

1 Approved Answer

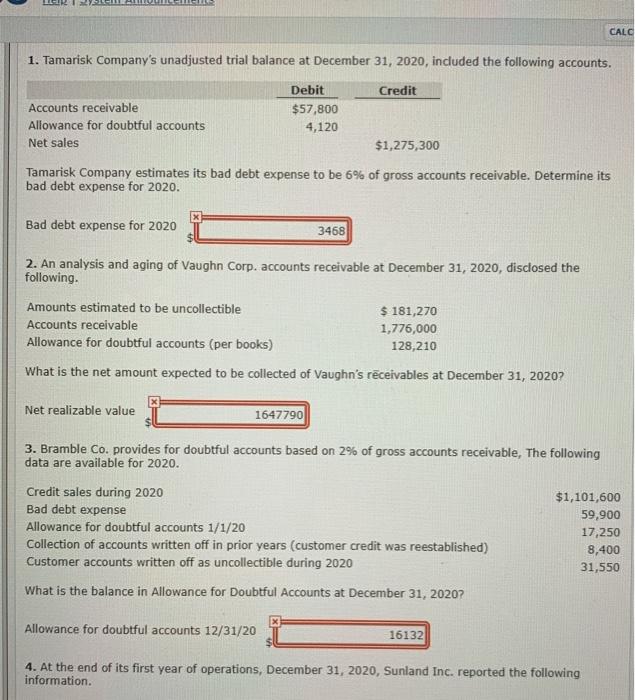

1. Tamarisk Company's unadjusted trial balance at December 31, 2020, included the following accounts. Debit $57,800 4,120 Accounts receivable Allowance for doubtful accounts Net

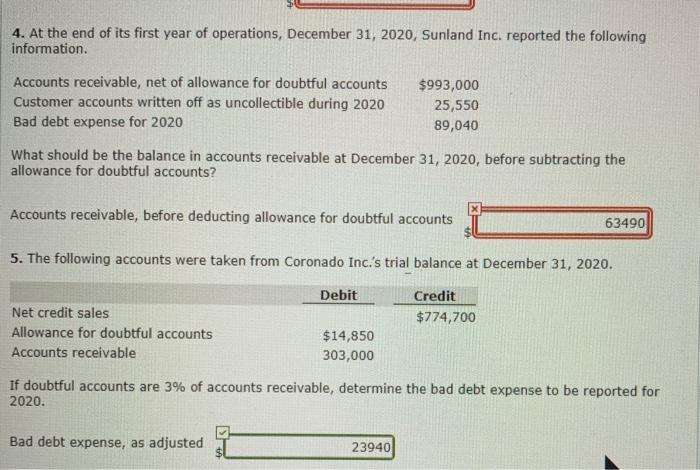

1. Tamarisk Company's unadjusted trial balance at December 31, 2020, included the following accounts. Debit $57,800 4,120 Accounts receivable Allowance for doubtful accounts Net sales Bad debt expense for 2020 Tamarisk Company estimates its bad debt expense to be 6% of gross accounts receivable. Determine its bad debt expense for 2020. x Net realizable value 2. An analysis and aging of Vaughn Corp. accounts receivable at December 31, 2020, disclosed the following. Credit sales during 2020 Bad debt expense Credit 3468 Amounts estimated to be uncollectible Accounts receivable Allowance for doubtful accounts (per books) What is the net amount expected to be collected of Vaughn's receivables at December 31, 2020? 1647790 $1,275,300 Allowance for doubtful accounts 12/31/20 3. Bramble Co. provides for doubtful accounts based on 2% of gross accounts receivable, The following data are available for 2020. $ 181,270 1,776,000 128,210 Allowance for doubtful accounts 1/1/20 Collection of accounts written off in prior years (customer credit was reestablished) Customer accounts written off as uncollectible during 2020 What is the balance in Allowance for Doubtful Accounts at December 31, 2020? CALC 16132 $1,101,600 59,900 17,250 8,400 31,550 4. At the end of its first year of operations, December 31, 2020, Sunland Inc. reported the following information. 4. At the end of its first year of operations, December 31, 2020, Sunland Inc. reported the following information. Accounts receivable, net of allowance for doubtful accounts Customer accounts written off as uncollectible during 2020 Bad debt expense for 2020 What should be the balance in accounts receivable at December 31, 2020, before subtracting the allowance for doubtful accounts? Accounts receivable, before deducting allowance for doubtful accounts Net credit sales Allowance for doubtful accounts Accounts receivable 5. The following accounts were taken from Coronado Inc.'s trial balance at December 31, 2020. $993,000 25,550 89,040 Debit Bad debt expense, as adjusted $14,850 303,000 23940 63490 Credit $774,700 If doubtful accounts are 3% of accounts receivable, determine the bad debt expense to be reported for 2020.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

3 Allowance for doubtful accounts 1120 17250 Add Bad debt expense 59900 Add Collection of accounts w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started