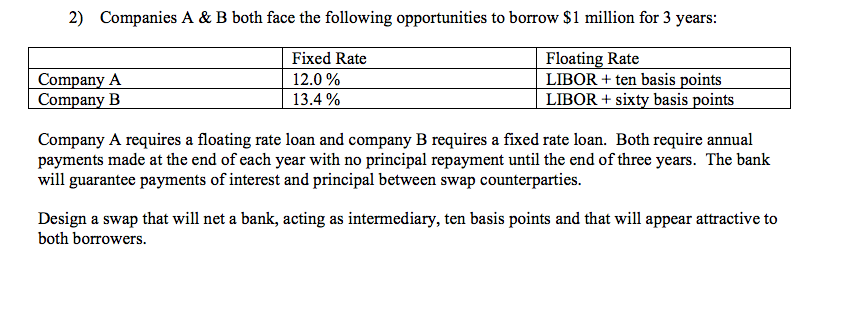

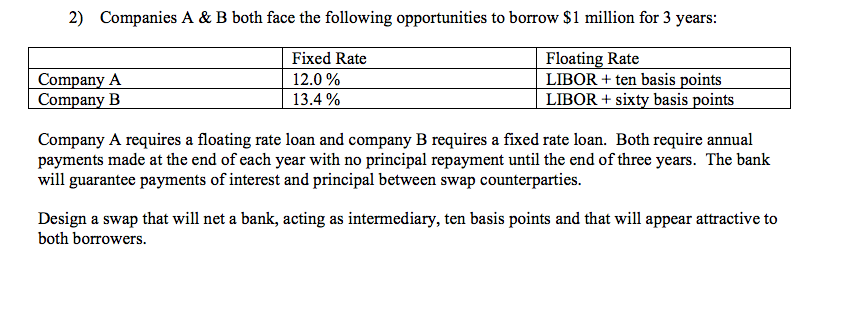

1) The Chocolate Company generates revenue from a large number of consumers of their product in North America. These consumers order online from The Chocolate Company. The Chocolate Company products are not available except though online purchases. The Chocolate Company revenues that are generated are entirely denominated in dollars. The Chocolate Company's balance sheet contains no debt except for current liabilities such as wages payable and accounts payable that are created in the normal course of the operating cycle. All current liabilities are denominated entirely in dollars. All suppliers to The Chocolate Company invoice and are paid in dollars. There are three major ingredients necessary to The Chocolate Company products: cocoa butter, sugar (either from cane or beets), and milk. Cocoa plants necessary to the production of cocoa powder are grown in the equatorial regions of the world. Growers routinely accept dollar payments for their crops, but the price of cocoa is very sensitive to the relative value of the dollar to other world currencies. A weak dollar is often accompanied by higher cocoa prices and vice versa. Of course cocoa farmers are also concerned about weather, crop diseases, and about insects. Both quantity and price of cocoa is also affected by these concerns. Sugar and milk ingredients are purchased from farmers in the United Sates. Recently these farmers have been affected by higher energy prices and by higher prices for corn. The higher prices for corn have been attributed to the greater demand for ethanol. A large French bank arranges commodity swap contracts where the underlying asset is cocoa. These swap contracts are denominated either in dollars or in euros. Swap payments are exchanged between counterparties annually for seven years. This large French bank guarantees performance of the counterparties and in fact acts as a broker in order to arrange these swap contracts. Payments are based on the fixed and variable prices of one million metric tons of cocoa butter. No actual, physical inventory of cocoa is involved in these swap contracts arranged by this large French bank. This French bank offers to pay fixed and receive variable payments or vice versa. The size of the fixed payments and the formula for determining the size of the variable payments is negotiable; however, the market value of any swap agreement must equal zero on the day the contract is signed. What should The Chocolate Company consider doing to hedge the price risk associated with cocoa? 2) Companies A & B both face the following opportunities to borrow $1 million for 3 years: Company A Company B Fixed Rate 12.0% 13.4% Floating Rate LIBOR + ten basis points LIBOR + sixty basis points Company A requires a floating rate loan and company B requires a fixed rate loan. Both require annual payments made at the end of each year with no principal repayment until the end of three years. The bank will guarantee payments of interest and principal between swap counterparties. Design a swap that will net a bank, acting as intermediary, ten basis points and that will appear attractive to both borrowers. 1) The Chocolate Company generates revenue from a large number of consumers of their product in North America. These consumers order online from The Chocolate Company. The Chocolate Company products are not available except though online purchases. The Chocolate Company revenues that are generated are entirely denominated in dollars. The Chocolate Company's balance sheet contains no debt except for current liabilities such as wages payable and accounts payable that are created in the normal course of the operating cycle. All current liabilities are denominated entirely in dollars. All suppliers to The Chocolate Company invoice and are paid in dollars. There are three major ingredients necessary to The Chocolate Company products: cocoa butter, sugar (either from cane or beets), and milk. Cocoa plants necessary to the production of cocoa powder are grown in the equatorial regions of the world. Growers routinely accept dollar payments for their crops, but the price of cocoa is very sensitive to the relative value of the dollar to other world currencies. A weak dollar is often accompanied by higher cocoa prices and vice versa. Of course cocoa farmers are also concerned about weather, crop diseases, and about insects. Both quantity and price of cocoa is also affected by these concerns. Sugar and milk ingredients are purchased from farmers in the United Sates. Recently these farmers have been affected by higher energy prices and by higher prices for corn. The higher prices for corn have been attributed to the greater demand for ethanol. A large French bank arranges commodity swap contracts where the underlying asset is cocoa. These swap contracts are denominated either in dollars or in euros. Swap payments are exchanged between counterparties annually for seven years. This large French bank guarantees performance of the counterparties and in fact acts as a broker in order to arrange these swap contracts. Payments are based on the fixed and variable prices of one million metric tons of cocoa butter. No actual, physical inventory of cocoa is involved in these swap contracts arranged by this large French bank. This French bank offers to pay fixed and receive variable payments or vice versa. The size of the fixed payments and the formula for determining the size of the variable payments is negotiable; however, the market value of any swap agreement must equal zero on the day the contract is signed. What should The Chocolate Company consider doing to hedge the price risk associated with cocoa? 2) Companies A & B both face the following opportunities to borrow $1 million for 3 years: Company A Company B Fixed Rate 12.0% 13.4% Floating Rate LIBOR + ten basis points LIBOR + sixty basis points Company A requires a floating rate loan and company B requires a fixed rate loan. Both require annual payments made at the end of each year with no principal repayment until the end of three years. The bank will guarantee payments of interest and principal between swap counterparties. Design a swap that will net a bank, acting as intermediary, ten basis points and that will appear attractive to both borrowers