Answered step by step

Verified Expert Solution

Question

1 Approved Answer

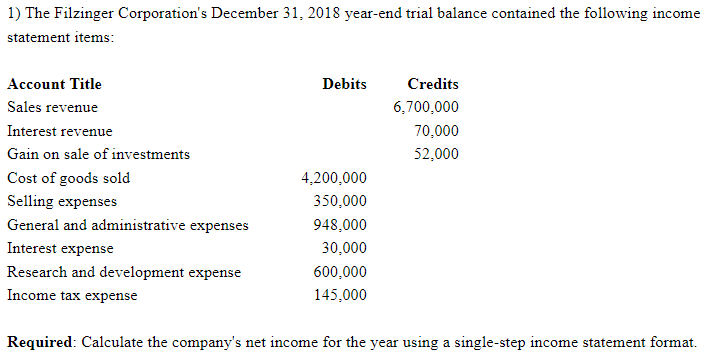

1) The Filzinger Corporation's December 31, 2018 year-end trial balance contained the following income statement items: Account Title Sales revenue Debits Credits 6,700,000 Interest

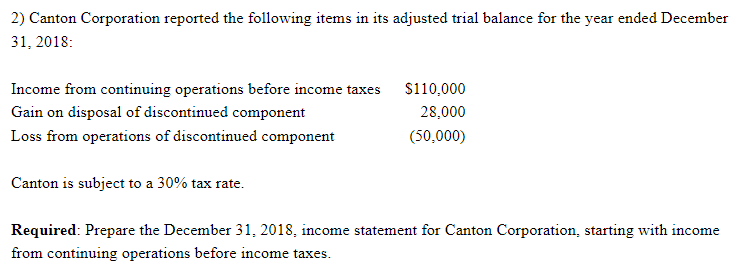

1) The Filzinger Corporation's December 31, 2018 year-end trial balance contained the following income statement items: Account Title Sales revenue Debits Credits 6,700,000 Interest revenue 70,000 Gain on sale of investments 52,000 Cost of goods sold 4,200,000 Selling expenses 350,000 General and administrative expenses 948,000 Interest expense 30,000 Research and development expense 600,000 Income tax expense 145,000 Required: Calculate the company's net income for the year using a single-step income statement format. 2) Canton Corporation reported the following items in its adjusted trial balance for the year ended December 31, 2018: Income from continuing operations before income taxes Gain on disposal of discontinued component Loss from operations of discontinued component Canton is subject to a 30% tax rate. $110,000 28,000 (50,000) Required: Prepare the December 31, 2018, income statement for Canton Corporation, starting with income from continuing operations before income taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started