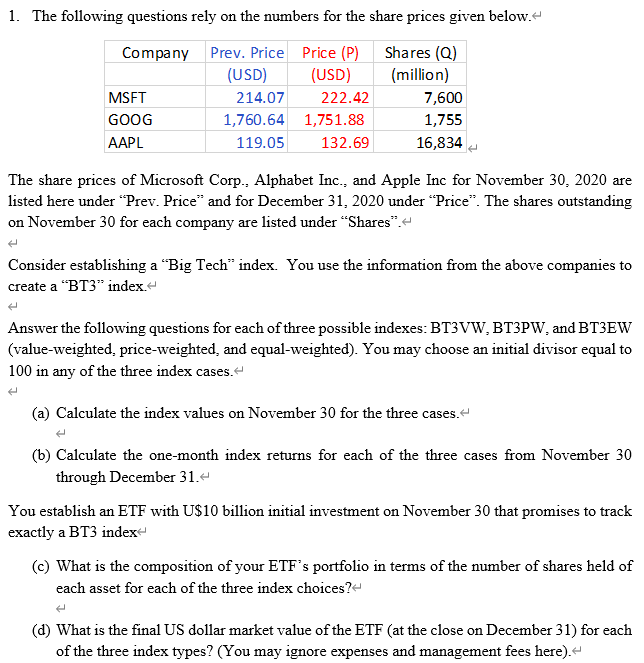

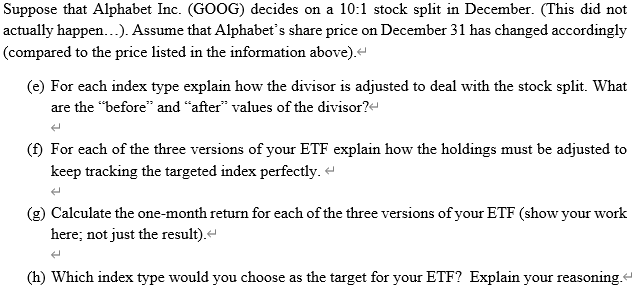

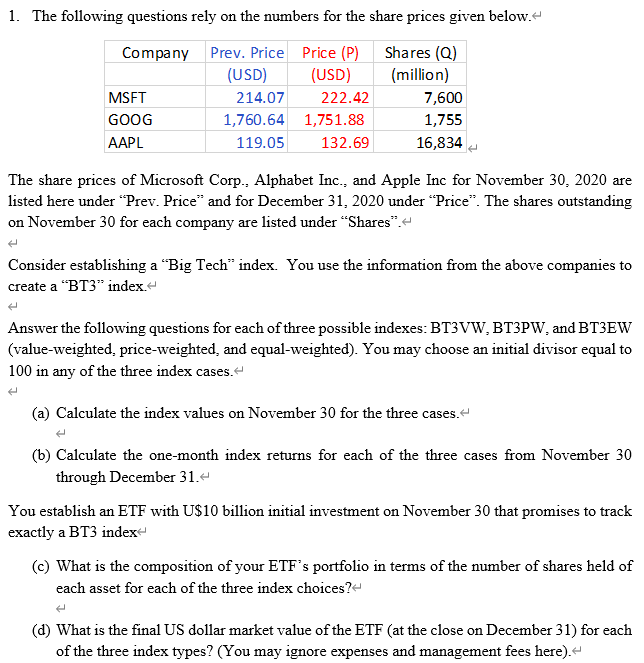

1. The following questions rely on the numbers for the share prices given below. Company Prev. Price Price (P) (USD) (USD) MSFT 214.07 222.42 GOOG 1,760.64 1,751.88 AAPL 119.05 132.69 Shares (0) (million) 7,600 1,755 16,834 The share prices of Microsoft Corp., Alphabet Inc., and Apple Inc for November 30, 2020 are listed here under "Prev. Price and for December 31, 2020 under Price". The shares outstanding on November 30 for each company are listed under "Shares. Consider establishing a "Big Tech index. You use the information from the above companies to create a "BT3" index Answer the following questions for each of three possible indexes: BT3VW, BT3PW, and BT3EW (value-weighted, price-weighted and equal-weighted). You may choose an initial divisor equal to 100 in any of the three index cases. (a) Calculate the index values on November 30 for the three cases. (b) Calculate the one-month index returns for each of the three cases from November 30 through December 31.- You establish an ETF with U$10 billion initial investment on November 30 that promises to track exactly a BT3 index (c) What is the composition of your ETF's portfolio in terms of the number of shares held of each asset for each of the three index choices? (d) What is the final US dollar market value of the ETF (at the close on December 31) for each of the three index types? (You may ignore expenses and management fees here). Suppose that Alphabet Inc. (GOOG) decides on a 10:1 stock split in December. (This did not actually happen...). Assume that Alphabet's share price on December 31 has changed accordingly (compared to the price listed in the information above). (e) For each index type explain how the divisor is adjusted to deal with the stock split. What are the "before" and "after" values of the divisor?- (f) For each of the three versions of your ETF explain how the holdings must be adjusted to keep tracking the targeted index perfectly. (g) Calculate the one-month return for each of the three versions of your ETF (show your work here; not just the result). (h) Which index type would you choose as the target for your ETF? Explain your reasoning. 1. The following questions rely on the numbers for the share prices given below. Company Prev. Price Price (P) (USD) (USD) MSFT 214.07 222.42 GOOG 1,760.64 1,751.88 AAPL 119.05 132.69 Shares (0) (million) 7,600 1,755 16,834 The share prices of Microsoft Corp., Alphabet Inc., and Apple Inc for November 30, 2020 are listed here under "Prev. Price and for December 31, 2020 under Price". The shares outstanding on November 30 for each company are listed under "Shares. Consider establishing a "Big Tech index. You use the information from the above companies to create a "BT3" index Answer the following questions for each of three possible indexes: BT3VW, BT3PW, and BT3EW (value-weighted, price-weighted and equal-weighted). You may choose an initial divisor equal to 100 in any of the three index cases. (a) Calculate the index values on November 30 for the three cases. (b) Calculate the one-month index returns for each of the three cases from November 30 through December 31.- You establish an ETF with U$10 billion initial investment on November 30 that promises to track exactly a BT3 index (c) What is the composition of your ETF's portfolio in terms of the number of shares held of each asset for each of the three index choices? (d) What is the final US dollar market value of the ETF (at the close on December 31) for each of the three index types? (You may ignore expenses and management fees here). Suppose that Alphabet Inc. (GOOG) decides on a 10:1 stock split in December. (This did not actually happen...). Assume that Alphabet's share price on December 31 has changed accordingly (compared to the price listed in the information above). (e) For each index type explain how the divisor is adjusted to deal with the stock split. What are the "before" and "after" values of the divisor?- (f) For each of the three versions of your ETF explain how the holdings must be adjusted to keep tracking the targeted index perfectly. (g) Calculate the one-month return for each of the three versions of your ETF (show your work here; not just the result). (h) Which index type would you choose as the target for your ETF? Explain your reasoning