Question

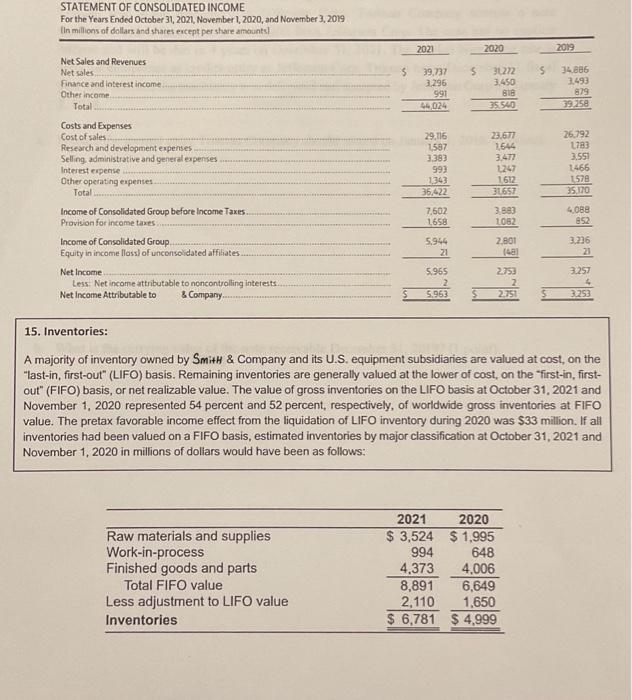

1. The income statement for fiscal years ended October 31, 2021, November 1, 2020, and November 3, 2019, of the smith & Company is attached

1. The income statement for fiscal years ended October 31, 2021, November 1, 2020, and November 3, 2019, of the smith & Company is attached below. smith & Co also provides a disclosure note regarding its inventory valuation. Please use the information to answer the following questions

a. What will be the company's "Cost of sales" and "Income of Consolidated Group before Income Taxes" for the fiscal year ended October 31, 2021, had it used FIFO to account for all of its inventories?

b. How much income taxes that the firm was able to defer in 2021 by using LIFO to account for its inventories? Assume that the firm's tax rate is 22%.

c. Assume that the firm's tax rate is 22%, as of October 31, 2021, what is the firm's cumulative tax savings by using LIFO instead of solely using FIFO?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started