Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The payroll of Yellow Stone Company for September 2025 is as follows (6 points). Total payroll was $500,100, of which $100.000 is paid

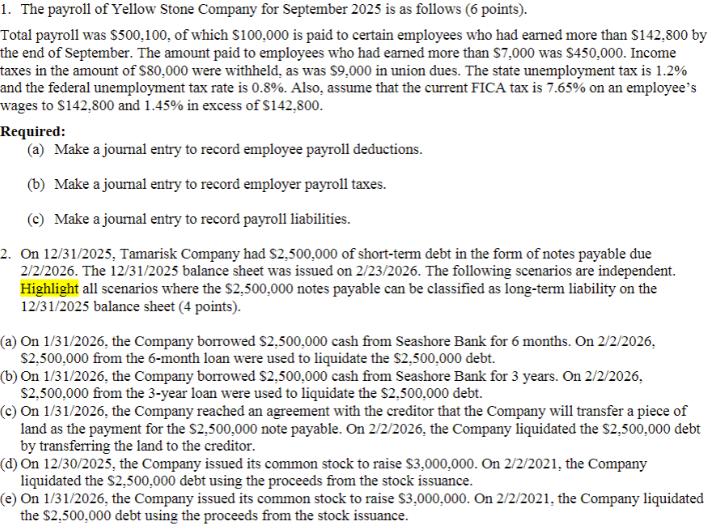

1. The payroll of Yellow Stone Company for September 2025 is as follows (6 points). Total payroll was $500,100, of which $100.000 is paid to certain employees who had earned more than $142,800 by the end of September. The amount paid to employees who had earned more than $7,000 was $450,000. Income taxes in the amount of $80,000 were withheld, as was $9,000 in union dues. The state unemployment tax is 1.2% and the federal unemployment tax rate is 0.8%. Also, assume that the current FICA tax is 7.65% on an employee's wages to $142,800 and 1.45% in excess of $142,800. Required: (a) Make a journal entry to record employee payroll deductions. (b) Make a journal entry to record employer payroll taxes. (c) Make a journal entry to record payroll liabilities. 2. On 12/31/2025, Tamarisk Company had $2,500,000 of short-term debt in the form of notes payable due 2/2/2026. The 12/31/2025 balance sheet was issued on 2/23/2026. The following scenarios are independent. Highlight all scenarios where the $2,500,000 notes payable can be classified as long-term liability on the 12/31/2025 balance sheet (4 points). (a) On 1/31/2026, the Company borrowed $2,500,000 cash from Seashore Bank for 6 months. On 2/2/2026, $2,500,000 from the 6-month loan were used to liquidate the $2,500,000 debt. (b) On 1/31/2026, the Company borrowed $2,500,000 cash from Seashore Bank for 3 years. On 2/2/2026, $2,500,000 from the 3-year loan were used to liquidate the $2.500.000 debt. (c) On 1/31/2026, the Company reached an agreement with the creditor that the Company will transfer a piece of land as the payment for the $2,500,000 note payable. On 2/2/2026, the Company liquidated the $2,500,000 debt by transferring the land to the creditor. (d) On 12/30/2025, the Company issued its common stock to raise $3,000,000. On 2/2/2021, the Company liquidated the $2,500,000 debt using the proceeds from the stock issuance. (e) On 1/31/2026, the Company issued its common stock to raise $3,000,000. On 2/2/2021, the Company liquidated the $2,500,000 debt using the proceeds from the stock issuance.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Payroll Journal Entries a Employee Deductions Payroll Expense 500100 Employee WH ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started