Answered step by step

Verified Expert Solution

Question

1 Approved Answer

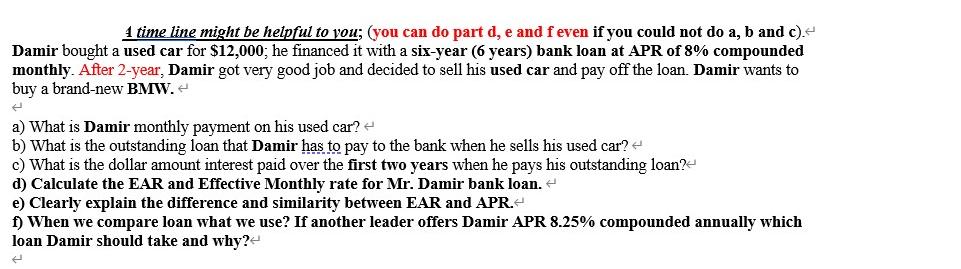

1 time line might be helpful to you; (you can do part d, e and f even if you could not do a, b

1 time line might be helpful to you; (you can do part d, e and f even if you could not do a, b and c). < Damir bought a used car for $12,000; he financed it with a six-year (6 years) bank loan at APR of 8% compounded monthly. After 2-year, Damir got very good job and decided to sell his used car and pay off the loan. Damir wants to buy a brand-new BMW. < a) What is Damir monthly payment on his used car? < b) What is the outstanding loan that Damir has to pay to the bank when he sells his used car? c) What is the dollar amount interest paid over the first two years when he pays his outstanding loan? < d) Calculate the EAR and Effective Monthly rate for Mr. Damir bank loan. < e) Clearly explain the difference and similarity between EAR and APR. < f) When we compare loan what we use? If another leader offers Damir APR 8.25% compounded annually which loan Damir should take and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer So Damirs monthly payment on his used car loan ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started