Question: 1) Two corporate bonds (from two different issuers) were issued at par (i.e., priced at notional value at their issuance) 2 years ago with notional

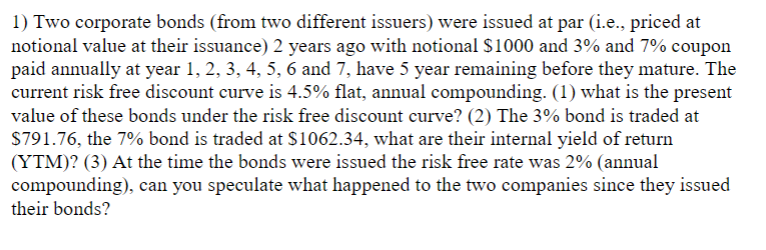

1) Two corporate bonds (from two different issuers) were issued at par (i.e., priced at notional value at their issuance) 2 years ago with notional $1000 and 3% and 7% coupon paid annually at year 1,2,3,4,5,6 and 7 , have 5 year remaining before they mature. The current risk free discount curve is 4.5% flat, annual compounding. (1) what is the present value of these bonds under the risk free discount curve? (2) The 3% bond is traded at $791.76, the 7% bond is traded at $1062.34, what are their internal yield of return (YTM)? (3) At the time the bonds were issued the risk free rate was 2% (annual compounding), can you speculate what happened to the two companies since they issued their bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts