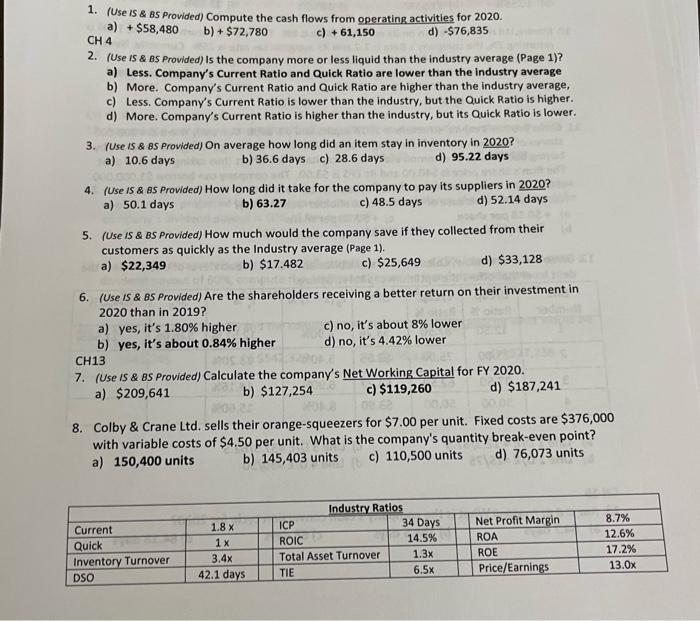

1. (Use is \& BS Provided) Compute the cash flows from operating activities for 2020 . a) +$58,480 b) +$72,780 c) +61,150 d) $76,835 2. (Use is \& BS Provided) Is the company more or less liquid than the industry average (Page 1)? a) Less. Company's Current Ratio and Quick Ratio are lower than the industry average b) More. Company's Current Ratio and Quick Ratio are higher than the industry average, c) Less. Company's Current Ratio is lower than the industry, but the Quick Ratio is higher. d) More. Company's Current Ratio is higher than the industry, but its Quick Ratio is lower. 3. (Use IS \& BS Provided) On average how long did an item stay in inventory in 2020 ? a) 10.6 days b) 36.6 days c) 28.6 days d) 95.22 days 4. (Use is \& BS Provided) How long did it take for the company to pay its suppliers in 2020 ? a) 50.1 days b) 63.27 c) 48.5 days d) 52.14 days 5. (Use is \& BS Provided) How much would the company save if they collected from their customers as quickly as the Industry average (Page 1). a) $22,349 b) $17.482 c) $25,649 d) $33,128 6. (Use is \& B S Provided) Are the shareholders receiving a better return on their investment in 2020 than in 2019? a) yes, it's 1.80% higher c) no, it's about 8% lower b) yes, it's about 0.84% higher d) no, it's 4.42% lower CH13 7. (Use is \& BS Provided) Calculate the company's Net Working Capital for FY 2020. a) $209,641 b) $127,254 c) $119,260 d) $187,241 8. Colby \& Crane Ltd. sells their orange-squeezers for $7.00 per unit. Fixed costs are $376,000 with variable costs of $4.50 per unit. What is the company's quantity break-even point? a) 150,400 units b) 145,403 units c) 110,500 units d) 76,073 units 1. (Use is \& BS Provided) Compute the cash flows from operating activities for 2020 . a) +$58,480 b) +$72,780 c) +61,150 d) $76,835 2. (Use is \& BS Provided) Is the company more or less liquid than the industry average (Page 1)? a) Less. Company's Current Ratio and Quick Ratio are lower than the industry average b) More. Company's Current Ratio and Quick Ratio are higher than the industry average, c) Less. Company's Current Ratio is lower than the industry, but the Quick Ratio is higher. d) More. Company's Current Ratio is higher than the industry, but its Quick Ratio is lower. 3. (Use IS \& BS Provided) On average how long did an item stay in inventory in 2020 ? a) 10.6 days b) 36.6 days c) 28.6 days d) 95.22 days 4. (Use is \& BS Provided) How long did it take for the company to pay its suppliers in 2020 ? a) 50.1 days b) 63.27 c) 48.5 days d) 52.14 days 5. (Use is \& BS Provided) How much would the company save if they collected from their customers as quickly as the Industry average (Page 1). a) $22,349 b) $17.482 c) $25,649 d) $33,128 6. (Use is \& B S Provided) Are the shareholders receiving a better return on their investment in 2020 than in 2019? a) yes, it's 1.80% higher c) no, it's about 8% lower b) yes, it's about 0.84% higher d) no, it's 4.42% lower CH13 7. (Use is \& BS Provided) Calculate the company's Net Working Capital for FY 2020. a) $209,641 b) $127,254 c) $119,260 d) $187,241 8. Colby \& Crane Ltd. sells their orange-squeezers for $7.00 per unit. Fixed costs are $376,000 with variable costs of $4.50 per unit. What is the company's quantity break-even point? a) 150,400 units b) 145,403 units c) 110,500 units d) 76,073 units