1. using the CAMEL approach compute only one ratio under the camel

2. Present a report for the rations

3. estimate and discuss the descriptive statistics of the ratios under the Camel.

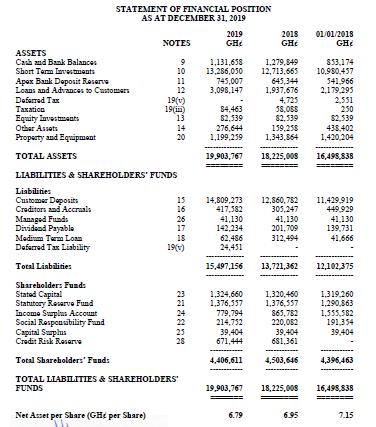

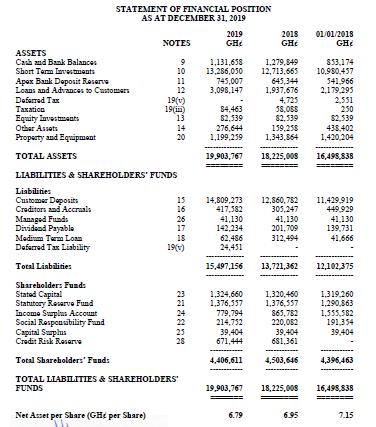

STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31, 2019 2019 2018 NOTES GH GH 9 1,131,658 1,279,849 13,286,050 12,713,665 745,007 645,344 3,098,147 1,937,676 4,725 84,463 58,088 82,539 $2,539 276,644 159,258 1,199,259 1,343,864 1,420,204 19,903,767 18,225,008 16,498,838 14,809,273 12,860,782 11,429,919 417,582 305,247 449,929 41,130 41,130 41,130 142,234 201,709 139,731 312,494 41,666 62,486 24,451 15,497,156 13,721,362 12,102,375 1,320,460 1,319,260 1,376,557 1,290,863 1,324,660 1,376,357 779,794 214,752 865,782 1,555,582 220,082 191,354 39,404 39,404 671,444 681,361 4,406,611 4,503,646 19,903,767 18,225,008 6.79 6.95 ASSETS Cash and Bank Balances Short Term Investments 10 11 Apex Bank Deposit Reserve Loans and Advances to Customers 12 19(v) Deferred Tax Taxation 19(i) Equity Investments 13 Other Assets Property and Equipment 20 TOTAL ASSETS LIABILITIES & SHAREHOLDERS' FUNDS Liabilities Customer Deposits Creditors and Accruals Managed Funds Dividend Payable Medium Term Loan Deferred Tax Liability Total Liabilities Shareholders Funds Stated Capital Statutory Reserve Fund Income Surplus Account Social Responsibility Fund Capital Surplus Credit Risk Reserve 28 Total Shareholders Funds TOTAL LIABILITIES & SHAREHOLDERS' FUNDS Net Asset per Share (GH per Share) 342 DIO 56676 15 16 26 17 18 19(x) 23 SEBRED 21 24 25 01/01/2018 GH $53,174 10,980,457 541,966 2,179,295 2,551 250 82,539 438,402 39,404 4,396,463 16,498,838 7.15 STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31, 2019 2019 2018 NOTES GH GH 9 1,131,658 1,279,849 13,286,050 12,713,665 745,007 645,344 3,098,147 1,937,676 4,725 84,463 58,088 82,539 $2,539 276,644 159,258 1,199,259 1,343,864 1,420,204 19,903,767 18,225,008 16,498,838 14,809,273 12,860,782 11,429,919 417,582 305,247 449,929 41,130 41,130 41,130 142,234 201,709 139,731 312,494 41,666 62,486 24,451 15,497,156 13,721,362 12,102,375 1,320,460 1,319,260 1,376,557 1,290,863 1,324,660 1,376,357 779,794 214,752 865,782 1,555,582 220,082 191,354 39,404 39,404 671,444 681,361 4,406,611 4,503,646 19,903,767 18,225,008 6.79 6.95 ASSETS Cash and Bank Balances Short Term Investments 10 11 Apex Bank Deposit Reserve Loans and Advances to Customers 12 19(v) Deferred Tax Taxation 19(i) Equity Investments 13 Other Assets Property and Equipment 20 TOTAL ASSETS LIABILITIES & SHAREHOLDERS' FUNDS Liabilities Customer Deposits Creditors and Accruals Managed Funds Dividend Payable Medium Term Loan Deferred Tax Liability Total Liabilities Shareholders Funds Stated Capital Statutory Reserve Fund Income Surplus Account Social Responsibility Fund Capital Surplus Credit Risk Reserve 28 Total Shareholders Funds TOTAL LIABILITIES & SHAREHOLDERS' FUNDS Net Asset per Share (GH per Share) 342 DIO 56676 15 16 26 17 18 19(x) 23 SEBRED 21 24 25 01/01/2018 GH $53,174 10,980,457 541,966 2,179,295 2,551 250 82,539 438,402 39,404 4,396,463 16,498,838 7.15