Answered step by step

Verified Expert Solution

Question

1 Approved Answer

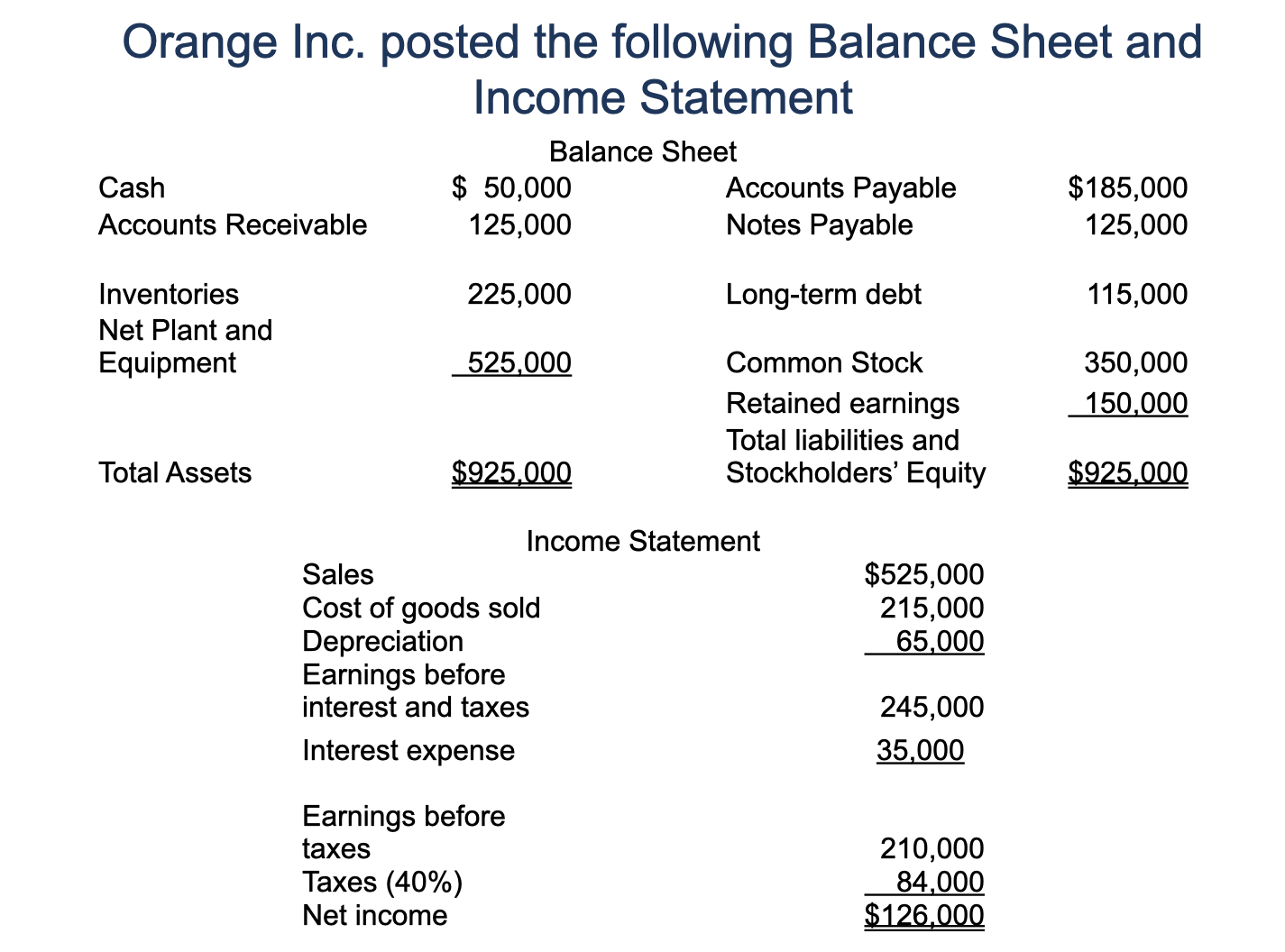

1. What is Orange Inc. ? s days sales outstanding ( DSO ) ? 2. What is Orange Inc. ? s quick ratio? 3. What

1. What is Orange Inc.s days sales outstanding DSO

2. What is Orange Inc.s quick ratio?

3. What is Orange Inc.s total debt to total capital ratio?

Orange Inc. posted the following Balance Sheet and Income Statement Balance Sheet Cash $ 50,000 Accounts Payable $185,000 Accounts Receivable 125,000 Notes Payable 125,000 Inventories 225,000 Long-term debt 115,000 Net Plant and Equipment 525,000 Common Stock 350,000 Total Assets $925,000 Income Statement Retained earnings Total liabilities and Stockholders' Equity 150,000 $925,000 Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest expense $525,000 215,000 65,000 245,000 35,000 Earnings before taxes 210,000 Taxes (40%) 84,000 Net income $126,000

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

DSO Accounts Receivable Sales 365 days From the balance sheet we can see that Accounts Receivable 12...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started