1. what was the balance of investment in miller on Cathy's book as of December 31 2020

2 what is the amount of equity in miller earning for year 2021

3. what is the amount of non controlling interest net income for 2021

4 determine the consolidated total of sale for 2021

5 determine the consolidated total of cost of good sold for 2021

6 consolidated total of operating expense for 2021

7. determine the consolidated total of inventory as of December 31 2021

8 determine the consolidated total of building as of December 312021

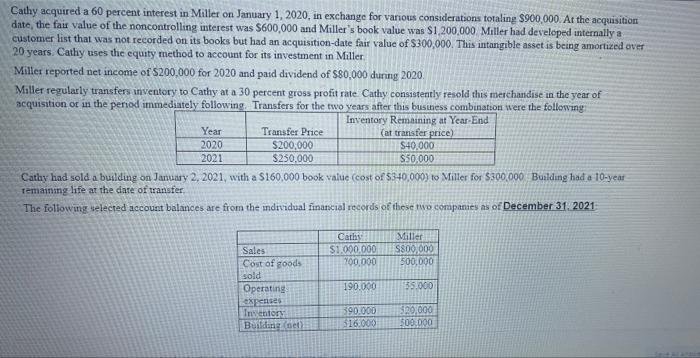

Cathy acquired a 60 percent interest in Miller on January 1, 2020, in exchange for various considerations totaling $900,000. Ar the acquisition date the fair value of the noncontrolling interest was $600,000 and Miller's book value was $1,200,000 Miller had developed internally a customer list that was not recorded on its books but had an acquisition date fair value of $300,000. This intangible asset is being amortized over 20 years Cathy uses the equity method to account for its investment in Miller Millet reported net income of $200,000 for 2020 and paid dividend of $80,000 during 2020 Miller regularly transfers inventory to Cathy at a 30 percent gross profit rate Cathy consistently resold this merchandise in the year of acquisition or in the period immediately following. Transfers for the two years after this business combination were the following Inventory Remaining at Year-End Year Transfer Price (at transfer price) 2020 $200,000 S40.000 2021 $250.000 S50,000 Cathy had sold a building on January 2, 2021, with a S160,000 book value (cost of 5340 000) to Miller for $300.000 Building had a 10-year Temaining life at the date of transfer The following selected account balances are from the individual financial records of these two companies as of December 31, 2021 Caths $1.000.000 700.000 Miller S800,000 500,000 Sales Cost of goods sold Operating expenses Inventory Building (net) 190.000 35.000 390.000 $16.000 $20,000 500.000 Cathy acquired a 60 percent interest in Miller on January 1, 2020, in exchange for various considerations totaling $900,000. Ar the acquisition date the fair value of the noncontrolling interest was $600,000 and Miller's book value was $1,200,000 Miller had developed internally a customer list that was not recorded on its books but had an acquisition date fair value of $300,000. This intangible asset is being amortized over 20 years Cathy uses the equity method to account for its investment in Miller Millet reported net income of $200,000 for 2020 and paid dividend of $80,000 during 2020 Miller regularly transfers inventory to Cathy at a 30 percent gross profit rate Cathy consistently resold this merchandise in the year of acquisition or in the period immediately following. Transfers for the two years after this business combination were the following Inventory Remaining at Year-End Year Transfer Price (at transfer price) 2020 $200,000 S40.000 2021 $250.000 S50,000 Cathy had sold a building on January 2, 2021, with a S160,000 book value (cost of 5340 000) to Miller for $300.000 Building had a 10-year Temaining life at the date of transfer The following selected account balances are from the individual financial records of these two companies as of December 31, 2021 Caths $1.000.000 700.000 Miller S800,000 500,000 Sales Cost of goods sold Operating expenses Inventory Building (net) 190.000 35.000 390.000 $16.000 $20,000 500.000