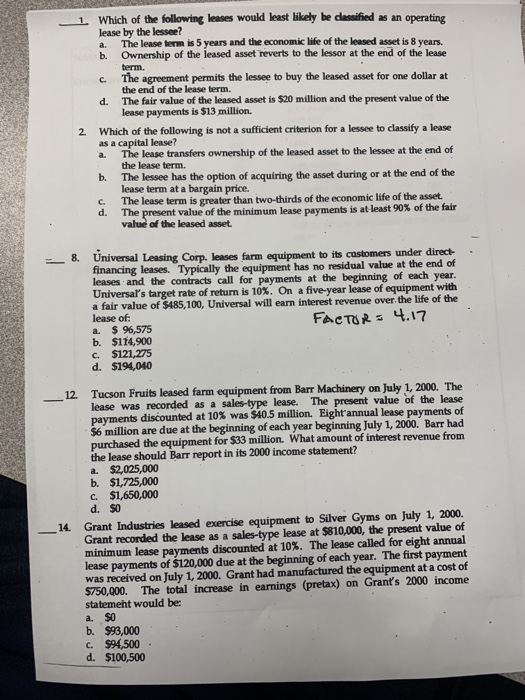

1. Which of the following leases would least likely be classified as an operating lease by the lessee? a. The lease term is 5 years and the economic life of the leased asset is 8 years. b. Ownership of the leased asset reverts to the lessor at the end of the lease term. c. The agreement permits the lessee to buy the leased asset for one dollar at the end of the lease term. d. The fair value of the leased asset is $20 million and the present value of the lease payments is $13 million. 2. Which of the following is not a sufficient criterion for a lessee to classify a lease as a capital lease? a. The lease transfers ownership of the leased asset to the lessee at the end of the lease term. b. The lessee has the option of acquiring the asset during or at the end of the lease term at a bargain price. c. The lease term is greater than two-thirds of the economic life of the asset d. The present value of the minimum lease payments is at least 90% of the fair value of the leased asset Universal Leasing Corp. leases farm equipment to its customers under direct financing leases. Typically the equipment has no residual value at the end of leases and the contracts call for payments at the beginning of each year. Universal's target rate of return is 10%. On a five-year lease of equipment with a fair value of $485,100, Universal will earn interest revenue over the life of the lease of: FACTOR = 4.17 a. $ 96,575 b. $114,900 c. $121,275 d. $194,010 - 12 lease was recorded at 10% was $40.5 million inning Tuly 1, 2000. Barr had 14. Tucson Fruits leased farm equipment from Barr Machinery on July 1, 2000. The lease was recorded as a sales-type lease. The present value of the lease payments discounted at 10% was $40.5 million. Eight'annual lease payments of $6 million are due at the beginning of each year beginning July 1, 2000. Barr had purchased the equipment for $33 million. What amount of interest revenue from the lease should Barr report in its 2000 income statement? a $2,025,000 b. $1,725,000 c. $1,650,000 d. $0 Grant Industries leased exercise equipment to Silver Gyms on July 1, 2000. Grant recorded the lease as a sales-type lease at $810,000, the present value of minimum lease payments discounted at 10%. The lease called for eight annual lease payments of $120,000 due at the beginning of each year. The first payment was received on July 1, 2000. Grant had manufactured the equipment at a cost of $750,000. The total increase in earnings (pretax) on Grant's 2000 income statement would be: a. $0 b. $93.000 .- c. $94,500 d. $100,500