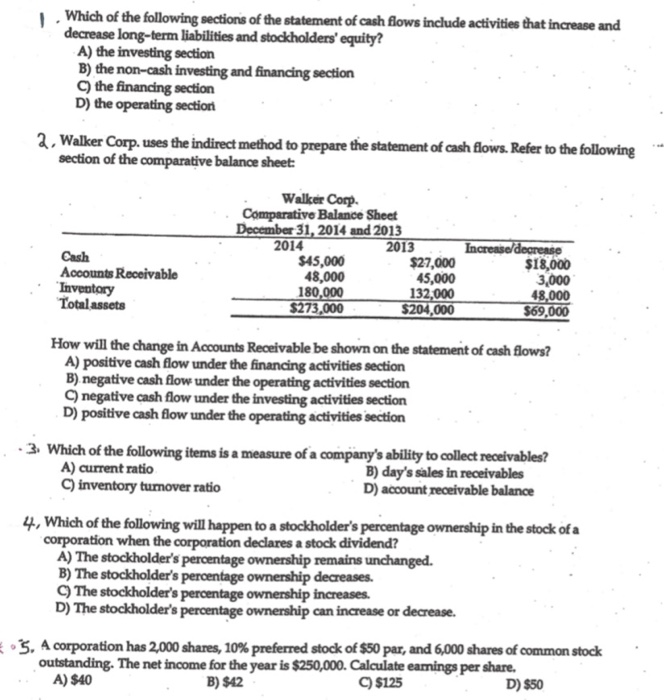

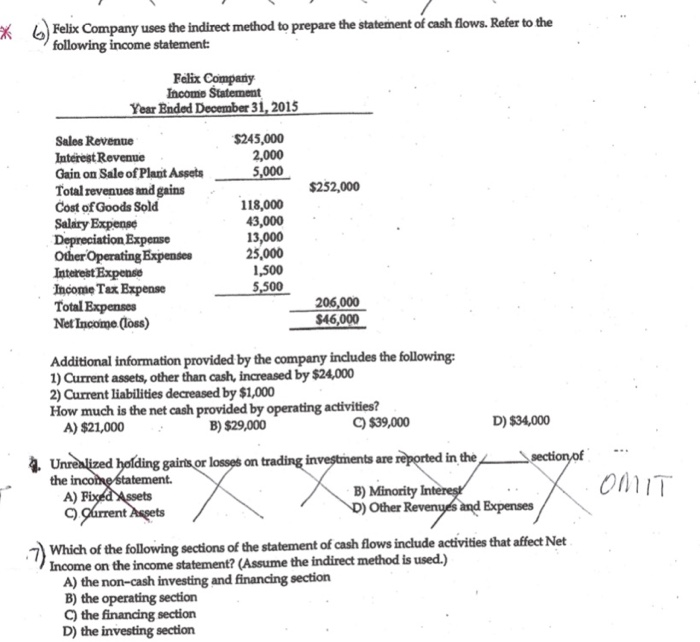

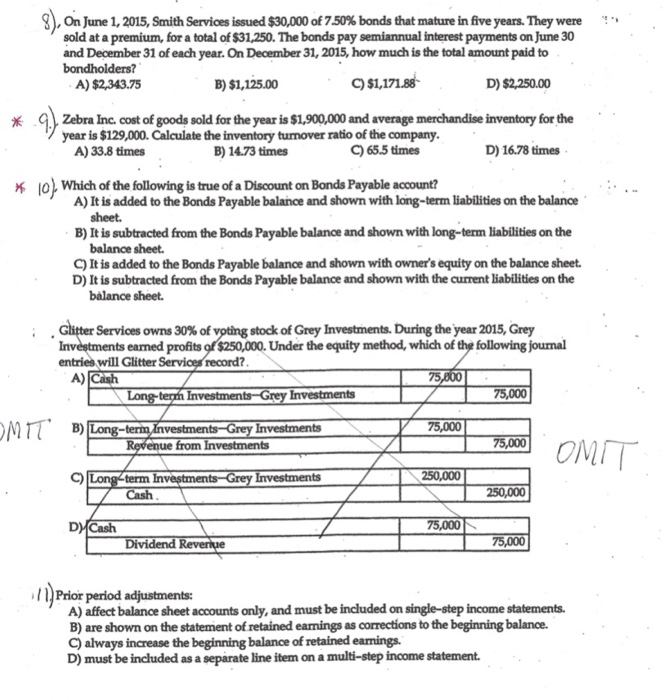

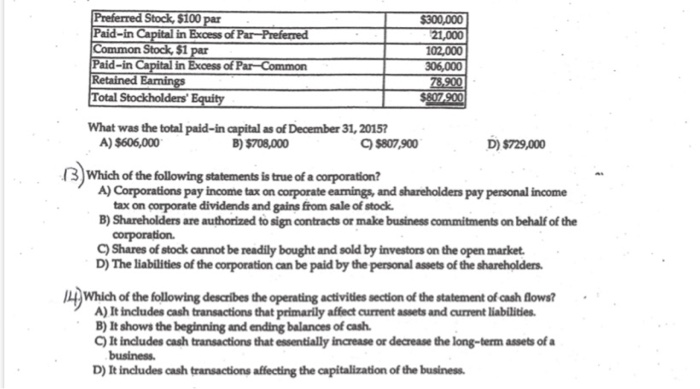

1. Which of the following sections of the statement of cash flows include activities that increase and decrease long-term liabilities and stockholders' equity? A) the investing section B) the non-cash investing and financing section C) the financing section D) the operating section 2. Walker Corp. uses the indirect method to prepare the statement of cash flows. Refer to the following section of the comparative balance sheet: Walker Corp. Comparative Balance Sheet December 31, 2014 and 2013 2014 2013 Increase/degrease Cash $45,000 $27,000 $18,000 Accounts Receivable 48,000 45,000 3,000 Inventory 180,000 132,000 48,000 Total assets $273,000 $204,000 $69,000 How will the change in Accounts Receivable be shown on the statement of cash flows? A) positive cash flow under the financing activities section B) negative cash flow under the operating activities section C) negative cash flow under the investing activities section D) positive cash flow under the operating activities section -3. Which of the following items is a measure of a company's ability to collect receivables? A) current ratio B) day's sales in receivables C) inventory tumover ratio D) account receivable balance 4. Which of the following will happen to a stockholder's percentage ownership in the stock of a corporation when the corporation declares a stock dividend? A) The stockholder's percentage ownership remains unchanged. B) The stockholder's percentage ownership decreases. C) The stockholder's percentage ownership increases. D) The stockholder's percentage ownership can increase or decrease. 5. A corporation has 2,000 shares, 10% preferred stock of $50 par, and 6,000 shares of common stock outstanding. The net income for the year is $250,000. Calculate eamings per share. A) $40 B) $42 C) $125 D) $50 Felix Company uses the indirect method to prepare the statement of cash flows. Refer to the following income statement: $252,000 Felix Company Income Statement Year Ended December 31, 2015 Sales Revenue $245,000 Interest Revenue 2,000 Gain on Sale of Plant Assets 5,000 Total revenues and gains Cost of Goods Sold 118,000 Salary Expense 43,000 Depreciation Expense 13,000 Other Operating Expenses 25,000 Interest Expense 1,500 Income Tax Expense 5,500 Total Expenses Net Income (loss) 206,000 $46,000 Additional information provided by the company includes the following: 1) Current assets, other than cash, increased by $24,000 2) Current liabilities decreased by $1,000 How much is the net cash provided by operating activities? A) $21,000 B) $29,000 C) $39,000 D) $34,000 Unrealized holding gainis or losses on trading investments are reported in the section of the income statement A) Fixed Assets B) Minority Interest Current Assets D) Other Revenues and Expenses Which of the following sections of the statement of cash flows include activities that affect Net Income on the income statement? (Assume the indirect method is used.) A) the non-cash investing and financing section B) the operating section C) the financing section D) the investing section OMIT On June 1, 2015, Smith Services issued $30,000 of 7.50% bonds that mature in five years. They were sold at a premium, for a total of $31,250. The bonds pay semiannual interest payments on June 30 and December 31 of each year. On December 31, 2015, how much is the total amount paid to bondholders? A) $2,343.75 B) $1,125.00 C) $1,171.88 D) $2,250.00 Zebra Inc. cost of goods sold for the year is $1,900,000 and average merchandise inventory for the year is $129,000. Calculate the inventory turnover ratio of the company. A) 33.8 times B) 14.73 times C) 65.5 times D) 16.78 times * 10). Which of the following is true of a Discount on Bonds Payable account? A) It is added to the Bonds Payable balance and shown with long-term liabilities on the balance sheet. B) It is subtracted from the Bonds Payable balance and shown with long-term liabilities on the balance sheet. C) It is added to the Bonds Payable balance and shown with owner's equity on the balance sheet. D) It is subtracted from the Bonds Payable balance and shown with the current liabilities on the balance sheet. Glitter Services owns 30% of voting stock of Grey Investments. During the year 2015, Grey Investments earned profits of $250,000. Under the equity method, which of the following journal entries will Glitter Services record? A) Cash 75,000 Long-term Investments-Grey Investments 75,000 OMIT' B) Long-term, Investments-Grey Investments 75,000 Revenue from Investments 75,000 250,000 c) Long-term Investments-Grey Investments Cash 250,000 D) Cash 75,000 Dividend Revenue 75,000 11) Prior period adjustments: A) affect balance sheet accounts only, and must be included on single-step income statements. B) are shown on the statement of retained earnings as corrections to the beginning balance. C) always increase the beginning balance of retained earnings. D) must be included as a separate line item on a multi-step income statement. Preferred Stock, $100 par Paid-in Capital in Excess of Par-Preferred Common Stock, 51 par Paid-in Capital in Excess of Par-Common Retained Eamings Total Stockholders' Equity $300,000 21,000 102,000 306,000 78.900 $807.900 What was the total paid-in capital as of December 31, 2015? A) $606,000 B) $70,000 C) $807,900 D) $729,000 3) Which of the following statements is true of a corporation? A) Corporations pay income tax on corporate earings, and shareholders pay personal income tax on corporate dividends and gains from sale of stock B) Shareholders are authorized to sign contracts or make business commitments on behalf of the corporation C) Shares of stock cannot be readily bought and sold by investors on the open market. D) The liabilities of the corporation can be paid by the personal assets of the shareholders. 14. Which of the following describes the operating activities section of the statement of cash flows? A) It includes cash transactions that primarily affect current assets and current liabilities. B) It shows the beginning and ending balances of cash. C) It includes cash transactions that essentially increase or decrease the long-term assets of a business. D) It includes cash transactions affecting the capitalization of the business