Question

1. You are an employee at a full-service bookkeeping and auditing firm called Accounting Solutions. Two different retail operations have asked you for some help.

1. You are an employee at a full-service bookkeeping and auditing firm called Accounting Solutions. Two different retail operations have asked you for some help.

One of the businesses near your office is The Candy Store. The owner of The Candy Store, Mr. Taffy, stopped by your office. His bookkeeper was called out of town, and Mr. Taffy needs some transactions recorded before the month ends. There are a few purchases and sales transactions to record. The Candy Store uses a perpetual inventory.

During January the following purchase transactions occurred:

8-Jan Purchased $5,900 of merchandise from The Chocolate Shop. Terms 2/15, n/45, FOB shipping point. The Candy Store prepaid $300 in shipping and the amount was added it to their invoice.

10-Jan Purchased $350 of supplies on account from The Office Barn.Terms 2/10, n/30, FOB destination.

17-Jan A return was recorded for $1400 of the merchandise purchased on January 8 and the customer received credit.

19-Jan Paid for the supplies purchased on January 10.

22-Jan Paid the Chocolate Shop the amount due from the January 8 purchase in full

During January the following sales transactions occurred:

14-Jan Sold $950 (cost $500) of merchandise (inventory) on account to Maple Fair. Terms 3/15, n/45, FOB destination.

15-Jan Paid $75 freight charges to deliver goods to Maple Fair.

18-Jan Sold $650 (cost $350) of merchandise to cash customers.

24-Jan Maple Fair returned $175 (cost $100) of merchandise from the January 14 sale.

28-Jan Received payment in full from Maple Fair for the January 14 sale.

Adjusting entry:

31-Jan The Candy Store's inventory account shows a balance of $27,500, but the physical counts shows only $27,350 of inventory exists.

Required

Record the adjusting entry:

- Journalize the transactions

2.  Required

Required

1. Prepare the multiple step income statement for the period ending August 31 20xx

2. Prepare the statement of retained earnings for the month ending in 8/31/20xx

3. Prepare the classified balance sheet for the month ending in 8/21/20xx

4. Answer these questions:

-How are the income statement and the balance sheet different? Why are the dates recorded differently on the sheet?

-Explain how gross profit, operating profit, and net profit are different?

-What is the book value of the equipment?

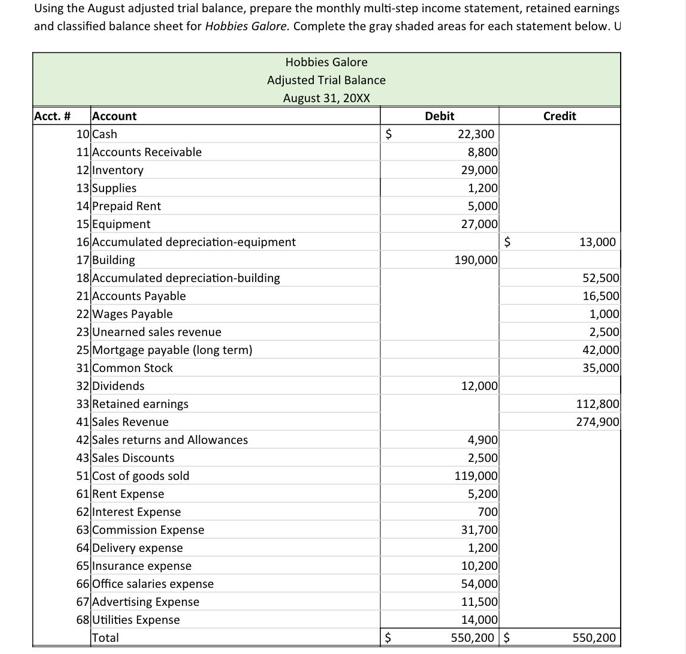

Using the August adjusted trial balance, prepare the monthly multi-step income statement, retained earnings and classified balance sheet for Hobbies Galore. Complete the gray shaded areas for each statement below. U Acct. # Account 10 Cash 11 Accounts Receivable 12 Inventory 13 Supplies 14 Prepaid Rent 15 Equipment 16 Accumulated depreciation-equipment 17 Building 18 Accumulated depreciation-building 21 Accounts Payable 22 Wages Payable 23 Unearned sales revenue 25 Mortgage payable (long term) 31 Common Stock 32 Dividends 33 Retained earnings 41 Sales Revenue 42 Sales returns and Allowances 43 Sales Discounts 51 Cost of goods sold 61 Rent Expense 62 Interest Expense Hobbies Galore Adjusted Trial Balance August 31, 20XX 63 Commission Expense 64 Delivery expense 65 Insurance expense 66 Office salaries expense 67 Advertising Expense 68 Utilities Expense Total $ $ Debit 22,300 8,800 29,000 1,200 5,000 27,000 190,000 12,000 4,900 2,500 119,000 5,200 700 $ 31,700 1,200 10,200 54,000 11,500 14,000 550,200 $ Credit 13,000 52,500 16,500 1,000 2,500 42,000 35,000 112,800 274,900 550,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution for Problem1 below During January the following purchase transactions occurred 8Jan Purchased 5900 of merchandise from The Chocolate Shop Terms 215 n45 FOB shipping point The Candy Store prep...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started