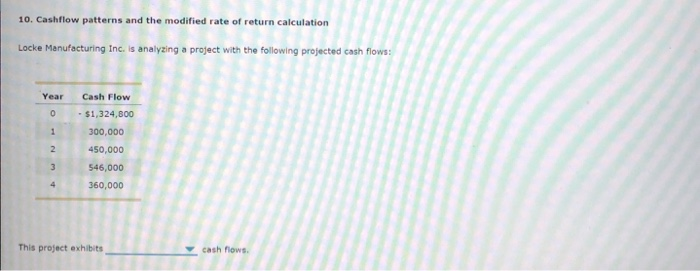

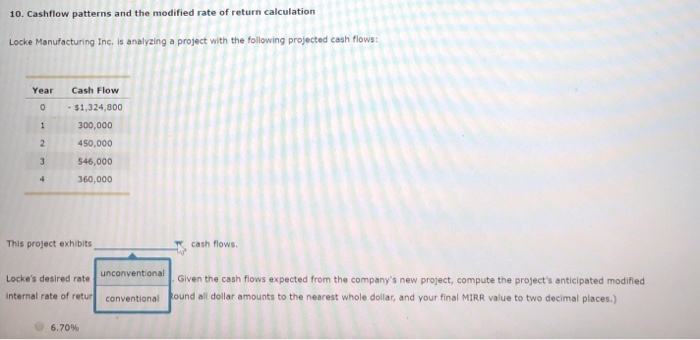

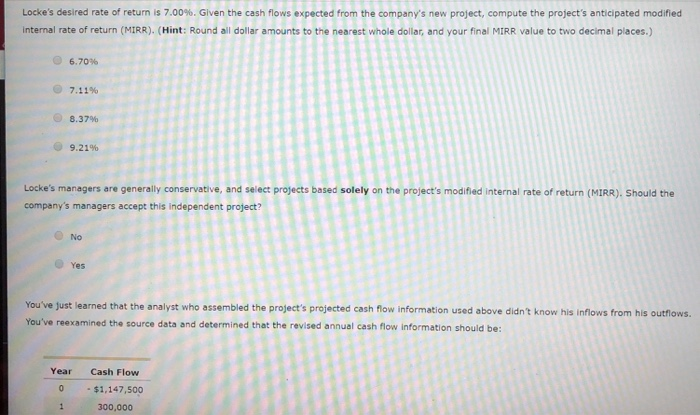

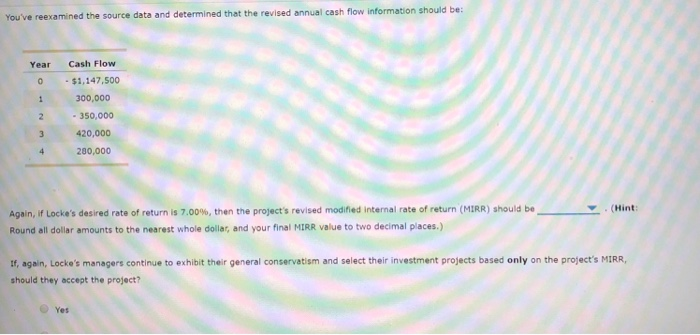

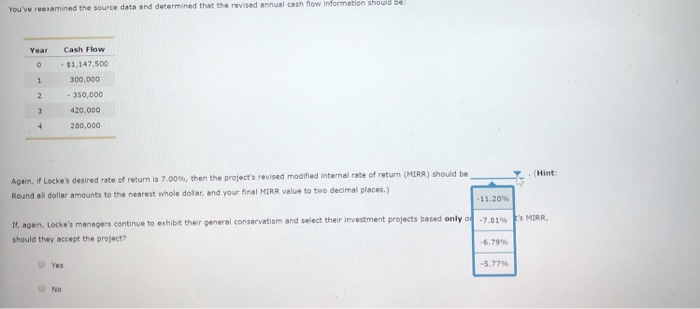

10. Cashflow patterns and the modified rate of return calculation Locke Manufacturing Inc. is analyzing a project with the following projected cash flows: Year Cash Flow 0$1,324,800 1300,000 2 450,000 546,000 4 360,000 This project exhibits w cash flows Locke's desired rate unconventional internal rate of retur conventional ound all dollar amounts to the nearest whole dollar, and your final MIRR value to two decimal places.) Given the cash flows expected from the company's new project, compute the project's anticipated modifled 6.70% Locke's desired rate of return is 7.00%. Given the cash flows expected from the company's new project, compute the project's anticipated modified internal rate of return (MIRR). (Hint: Round all dollar amounts to the nearest whole dollar, and your final MIRR value to two decimal places.) @ 6.70% 8.37% 9.21% Locke's managers are generally conservative, and select projects based solely on the project's modified internal rate of return (MIRR). Should the company's managers accept this independent project? O No Yes You've just learned that the analyst who assembled the project's projected cash flow information used above didn't know his inflows from his outflows. You've reexamined the source data and determined that the revised annual cash flow information should be: Year Cash Flow 0 $1,147,500 300,000 be You've reexamined the source data and determined that the revised annual cash flow information should Year Cash Flow 0$1,147.500 300,000 -350,000 3 420,000 4 280,000 Again, if Locke's desired rate of return is 7.00%, then the project's revised modified internal rate of return (MIRR) should be Round all dollar amounts to the nearest whole dollar, and your final MIRR value to two decimal places.) (Hint: If, again, Locke's managers continue to exhibit their general conservatism and select their investment projects based only on the project's MIRR should they accept the project? O Yes formetion should be You've reexamined the source data and determined that the revised annual cash flow i Year Cash Flow $1,147,500 300,000 2 350,000 20,000 4 280,000 s revised modified internal rate of return (MIRR) should be (Hint Again, if Locke's desired rate of return is 7.00% then the project Round all dollar amounts to the nearest whole dollar, and your final MIRR value to two decimal places) 11 .20% If, agein, Locke's managers continue to exhibit their general conservatism a should they accept the project? 6.79% Yes 5.77% No