10. Cowtown Cellular bonds mature in 2 1/2 years with a face value of $1,000. They pay a coupon rate of 10% distributed semi-annually. If the required rate of return on these bonds is 12% what is the bond's value?

11. Calculate the value of a bond that expects to mature in 14 years and has a $1,000 face value. The coupon interest rate is 7 percent, and the investors required rate of return is 10 percent?

12. The market price is $900 for a 10-year bond ($1,000 par value) that pays 8 percent interest annually. What is the bonds expected rate of return?

13. Zenith Co.s bonds mature in 12 years and pay 7 percent interest annually. If you purchase the bonds for $1,150, what is your expected rate of return?

14. National Steel 15-year, $1,000 par value bonds pay 8 percent interest annually. The market price of the bonds is $1,085, and your required rate of return is 10 percent.

a. Compute the bonds expected rate of return.

b. Determine the value of the bond to you, given your required rate of return.

c. Should you purchase the bond? Why or Why not?

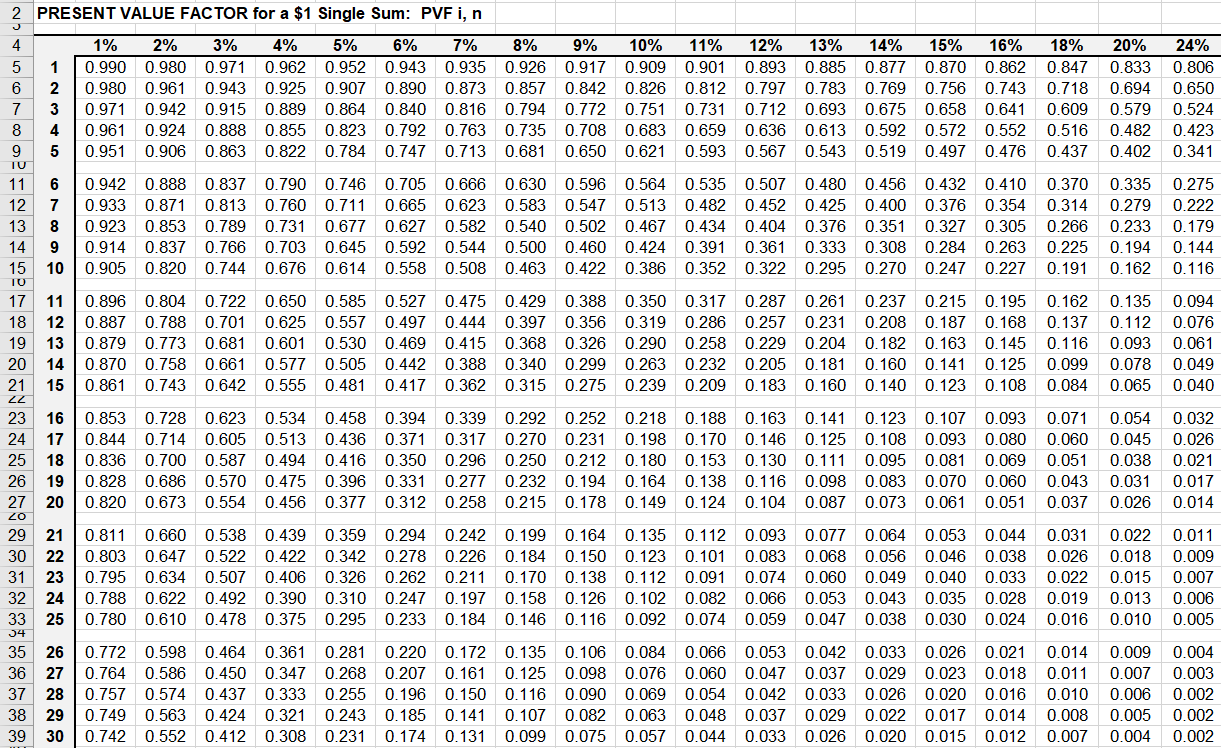

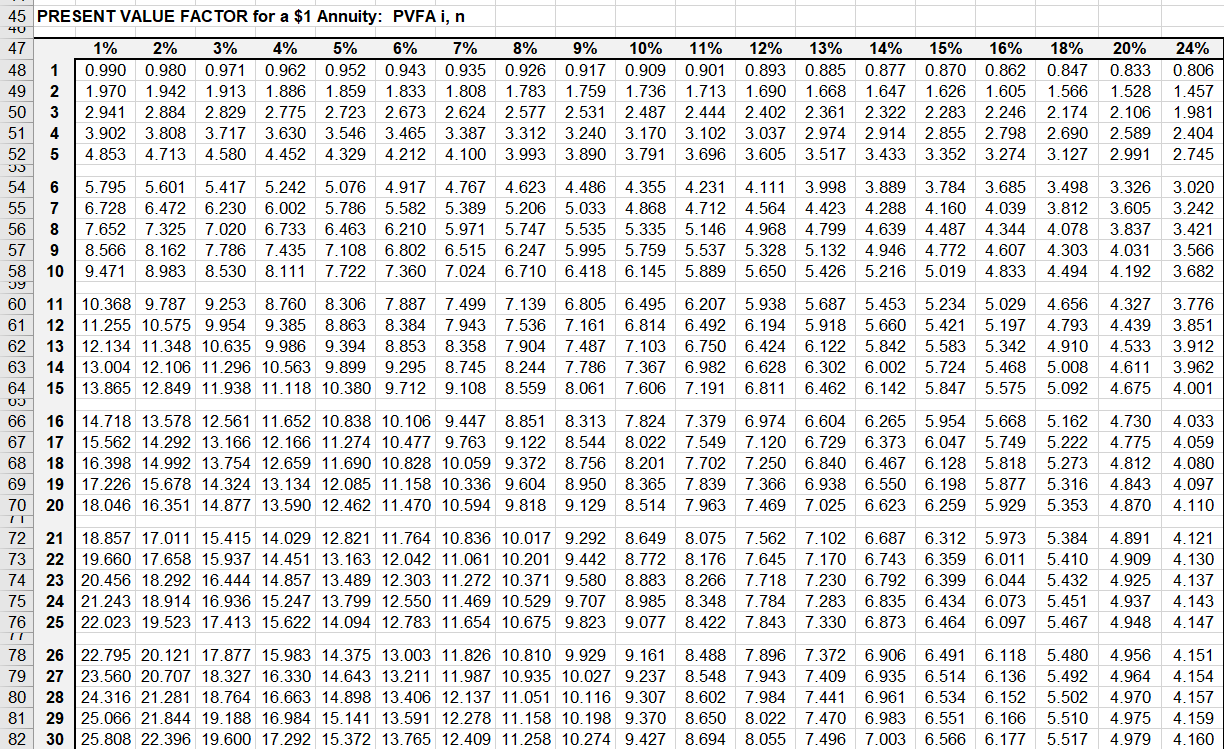

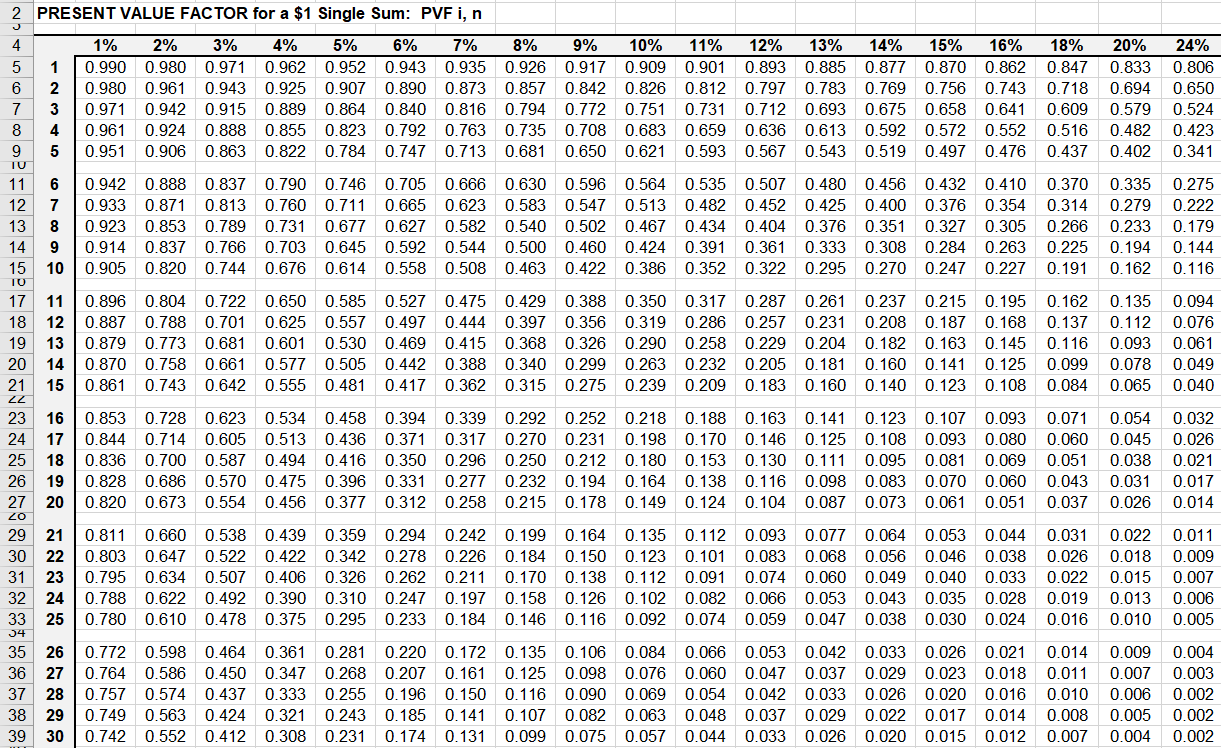

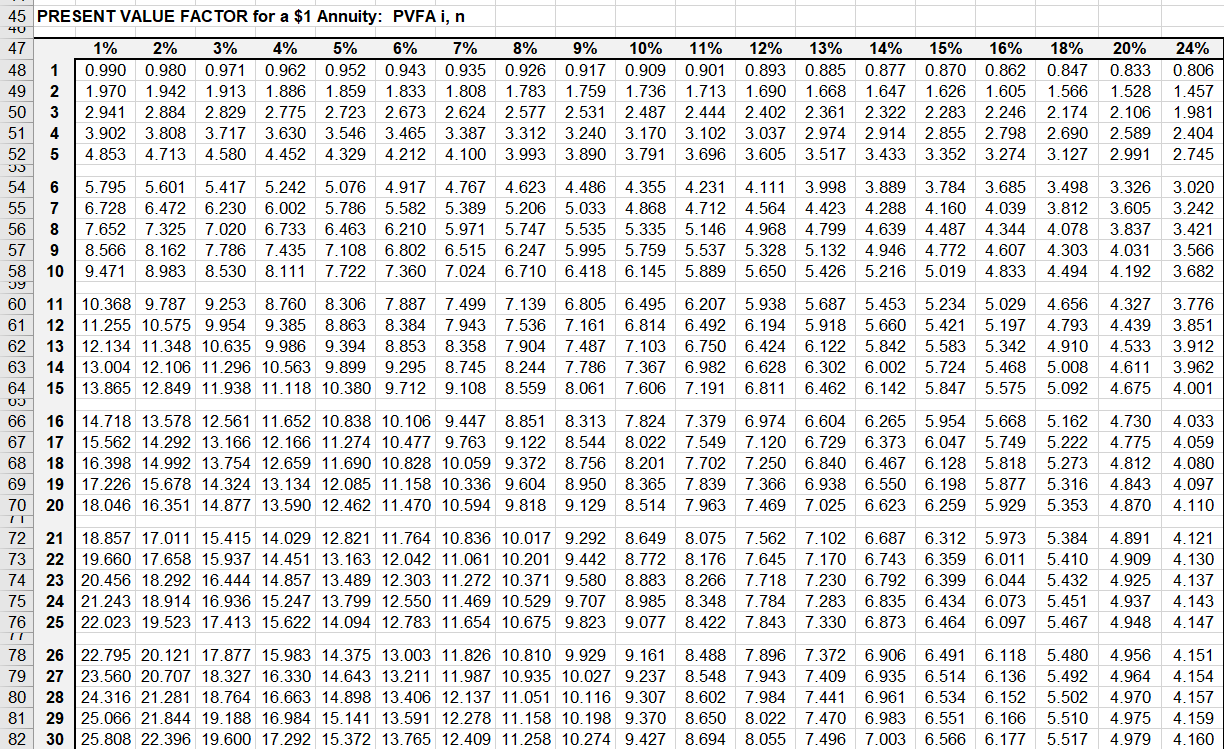

PRESENT VALUE FACTOR for a $1 Single Sum: PVF i, n 1 4 5 6 7 8 9 1% 0.990 0.980 0.971 0.961 0.951 2% 3% 0.980 0.971 0.961 0.943 0.942 0.915 0.924 0.888 0.906 0.863 4% 5% 6% 7% 8% 9% 10% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.822 0.784 0.747 0.713 0.681 0.650 0.621 11% 12% 0.901 0.893 0.812 0.797 0.731 0.712 0.659 0.636 0.593 0.567 13% 14% 15% 16% 18% 0.885 0.877 0.870 0.862 0.847 0.783 0.769 0.756 0.743 0.718 0.693 0.675 0.658 0.641 0.609 0.613 0.592 0.572 0.552 0.516 0.543 0.519 0.497 0.476 0.437 20% 0.833 0.694 0.579 0.482 0.402 24% 0.806 0.650 0.524 0.423 0.341 0.942 0.933 0.923 0.914 0.905 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.456 0.432 0.410 0.370 0.335 0.400 0.376 0.354 0.314 0.279 0.351 0.327 0.305 0.266 0.233 0.308 0.284 0.263 0.225 0.194 0.270 0.247 0.227 0.191 0.162 0.275 0.222 0.179 0.144 0.116 0.195 0.896 0.804 0.722 0.887 0.788 0.701 0.879 0.773 0.681 0.870 0.758 0.661 0.861 0.743 0.642 0.650 0.585 0.527 0.475 0.429 0.625 0.557 0.497 0.444 0.397 0.601 0.530 0.469 0.415 0.368 0.577 0.505 0.442 0.388 0.340 0.555 0.481 0.417 0.362 0.315 0.388 0.350 0.317 0.287 0.356 0.319 0.286 0.257 0.326 0.290 0.258 0.229 0.299 0.263 0.232 0.205 0.275 0.239 0.209 0.183 0.261 0.237 0.215 0.231 0.208 0.187 0.204 0.182 0.163 0.181 0.160 0.141 0.160 0.140 0.123 0.168 0.145 0.125 0.108 0.162 0.137 0.116 0.099 0.084 0.135 0.112 0.093 0.078 0.065 0.094 0.076 0.061 0.049 0.040 11 12 13 14 15 TU 17 18 19 20 21 ZZ 23 24 25 26 27 0 29 30 31 32 33 34 35 36 37 38 39 2345 678gm H26466HB9%n%84% 8899 16 17 18 19 20 0.853 0.844 0.836 0.828 0.820 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.141 0.123 0.107 0.125 0.108 0.093 0.111 0.095 0.081 0.098 0.083 0.070 0.087 0.073 0.061 0.093 0.080 0.069 0.060 0.051 0.071 0.060 0.051 0.043 0.037 0.054 0.045 0.038 0.031 0.026 0.032 0.026 0.021 0.017 0.014 21 0.811 0.660 0.538 22 0.803 0.647 0.522 23 0.795 0.634 0.507 24 0.788 0.622 0.492 25 0.780 0.610 0.478 0.439 0.359 0.294 0.242 0.199 0.422 0.342 0.278 0.226 0.184 0.406 0.326 0.262 0.211 0.170 0.390 0.310 0.247 0.197 0.158 0.375 0.295 0.233 0.184 0.146 0.164 0.135 0.112 0.150 0.123 0.101 0.138 0.112 0.091 0.126 0.102 0.082 0.116 0.092 0.074 0.093 0.083 0.074 0.066 0.059 0.077 0.064 0.053 0.044 0.068 0.056 0.046 0.038 0.060 0.049 0.040 0.033 0.053 0.043 0.035 0.028 0.047 0.038 0.030 0.024 0.031 0.026 0.022 0.019 0.016 0.022 0.018 0.015 0.013 0.010 0.011 0.009 0.007 0.006 0.005 26 27 28 29 30 0.772 0.598 0.464 0.764 0.586 0.450 0.757 0.574 0.437 0.749 0.563 0.424 0.742 0.552 0.412 0.361 0.347 0.333 0.321 0.308 0.281 0.268 0.255 0.243 0.231 0.220 0.172 0.135 0.207 0.161 0.125 0.196 0.150 0.116 0.185 0.141 0.107 0.174 0.131 0.099 0.106 0.084 0.098 0.076 0.090 0.069 0.082 0.063 0.075 0.057 0.066 0.060 0.054 0.048 0.044 0.053 0.047 0.042 0.037 0.033 0.042 0.033 0.026 0.021 0.037 0.029 0.023 0.018 0.033 0.026 0.020 0.016 0.029 0.022 0.017 0.014 0.026 0.020 0.015 0.012 0.014 0.011 0.010 0.008 0.007 0.009 0.007 0.006 0.005 0.004 0.004 0.003 0.002 0.002 0.002 6% 20% 0.833 1.528 2.106 2.589 2.991 24% 0.806 1.457 1.981 2.404 2.745 45 PRESENT VALUE FACTOR for a $1 Annuity: PVFA i, n HU 47 1% 2% 3% 4% 5% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 18% 48 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.847 49 2 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1.566 50 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.174 51 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.690 52 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.127 03 54 6 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.498 55 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.812 56 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4.078 57 9 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.303 58 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.494 09 60 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.656 61 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.793 62 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.122 5.842 5.583 5.342 4.910 63 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.008 64 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.092 Uy 66 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.162 67 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 6.729 6.373 6.047 5.749 5.222 68 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.273 69 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5.316 70 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469 7.025 6.623 6.259 5.929 5.353 3.326 3.605 3.837 4.031 4.192 3.020 3.242 3.421 3.566 3.682 4.327 4.439 4.533 4.611 4.675 3.776 3.851 3.912 3.962 4.001 4.730 4.775 4.812 4.843 4.870 4.033 4.059 4.080 4.097 4.110 72 73 74 75 76 21 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 8.075 7.562 22 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.201 9.442 8.7728.176 7.645 23 20.456 18.292 16.444 14.857 13.489 12.303 11.272 10.371 9.580 8.883 8.266 7.718 24 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 8.985 8.348 7.784 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 7.102 6.687 6.312 5.973 7.170 6.743 6.359 6.011 7.230 6.792 6.399 6.044 7.283 6.835 6.434 6.073 7.330 6.873 6.464 6.097 5.384 5.410 5.432 5.451 5.467 4.891 4.909 4.925 4.937 4.948 4.121 4.130 4.137 4.143 4.147 78 26 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.161 8.488 7.896 79 27 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 8.548 7.943 80 28 24.316 21.281 18.764 16.663 14.898 13.406 12.137 11.051 10.116 9.307 8.602 7.984 81 29 25.066 21.844 19.188 16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.650 8.022 82 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7.372 6.906 6.491 6.118 7.409 6.935 6.514 6.136 7.441 6.961 6.534 6.152 7.470 6.983 6.551 6.166 7.496 7.003 6.566 6.177 5.480 5.492 5.502 5.510 5.517 4.956 4.964 4.970 4.975 4.979 4.151 4.154 4.157 4.159 4.160