Answered step by step

Verified Expert Solution

Question

1 Approved Answer

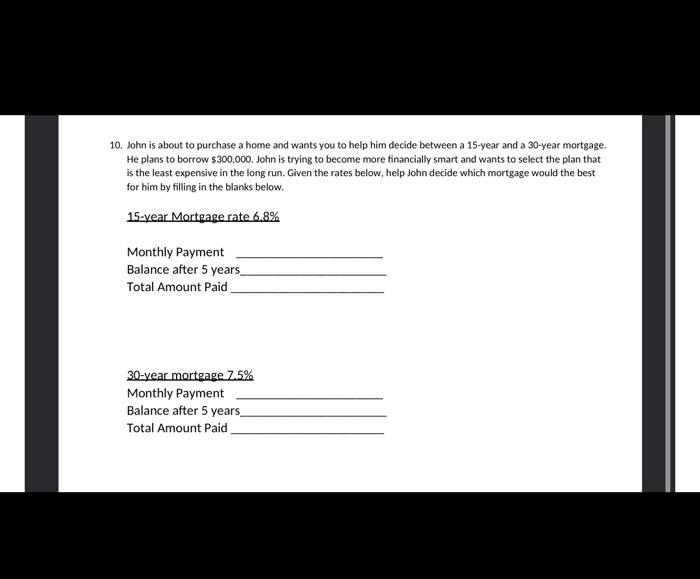

10. John is about to purchase a home and wants you to help him decide between a 15-year and a 30-year mortgage. He plans to

10. John is about to purchase a home and wants you to help him decide between a 15-year and a 30-year mortgage. He plans to borrow $300,000. John is trying to become more financially smart and wants to select the plan that is the least expensive in the long run. Given the rates below, help John decide which mortgage would the best for him by filling in the blanks below. 15-year Mortgage rate 6.8% Monthly Payment Balance after 5 years_ Total Amount Paid 30-year mortgage 7.5% Monthly Payment Balance after 5 years_ Total Amount Paid

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started