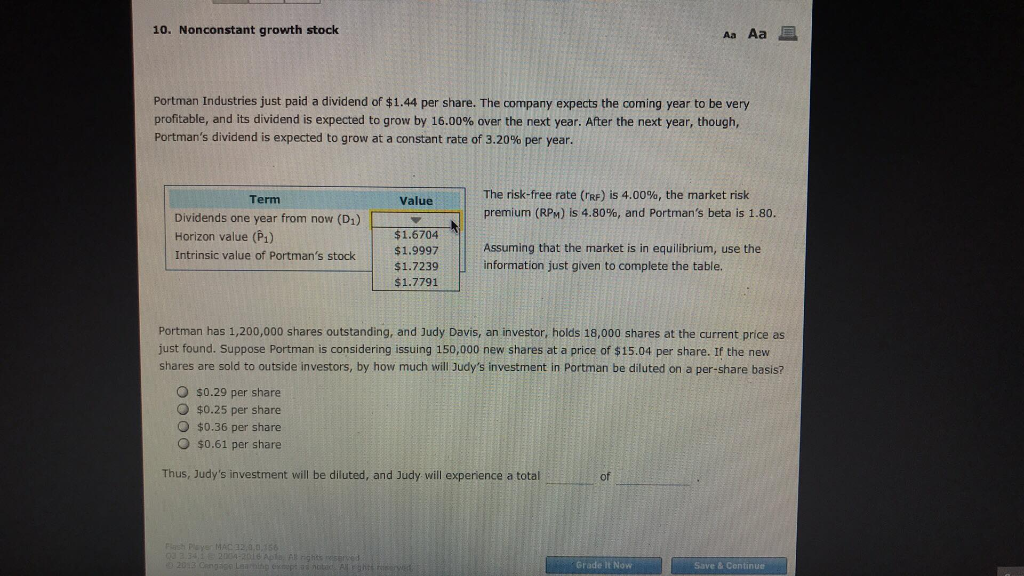

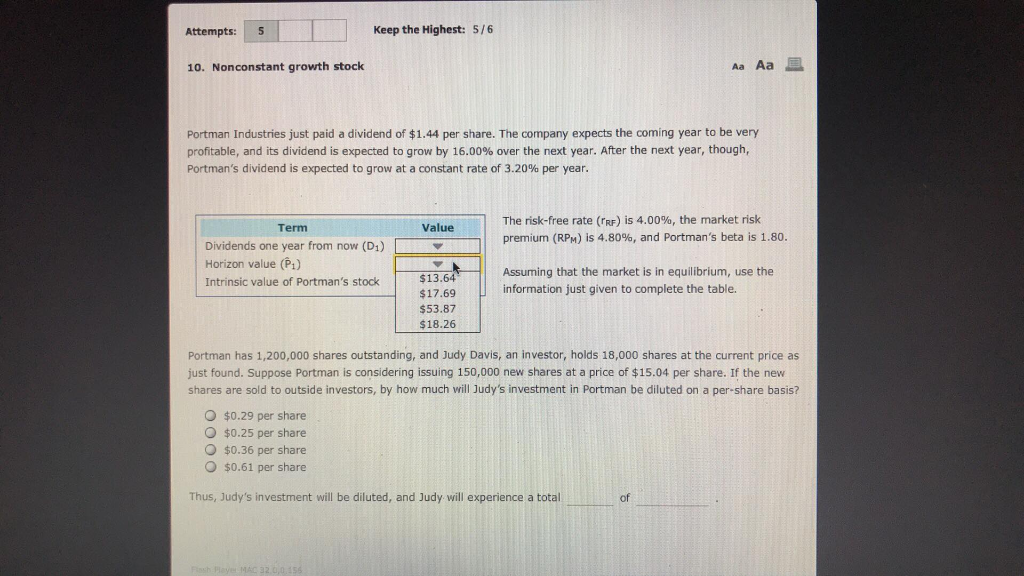

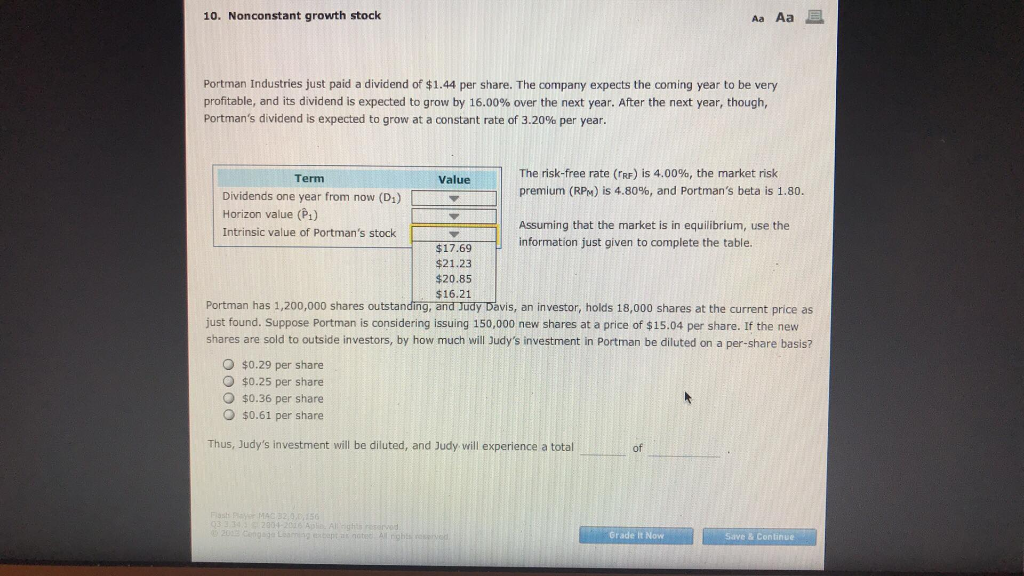

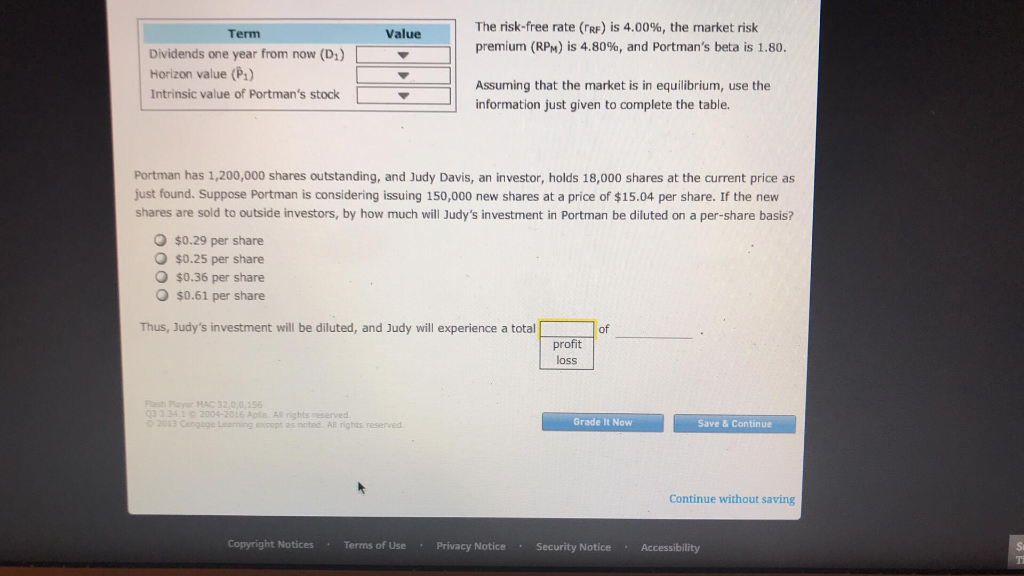

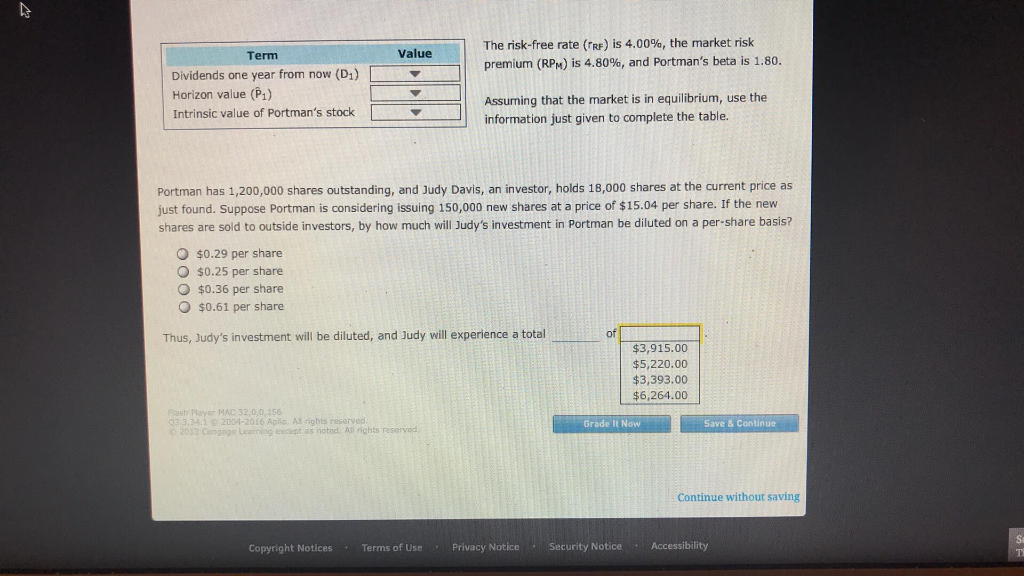

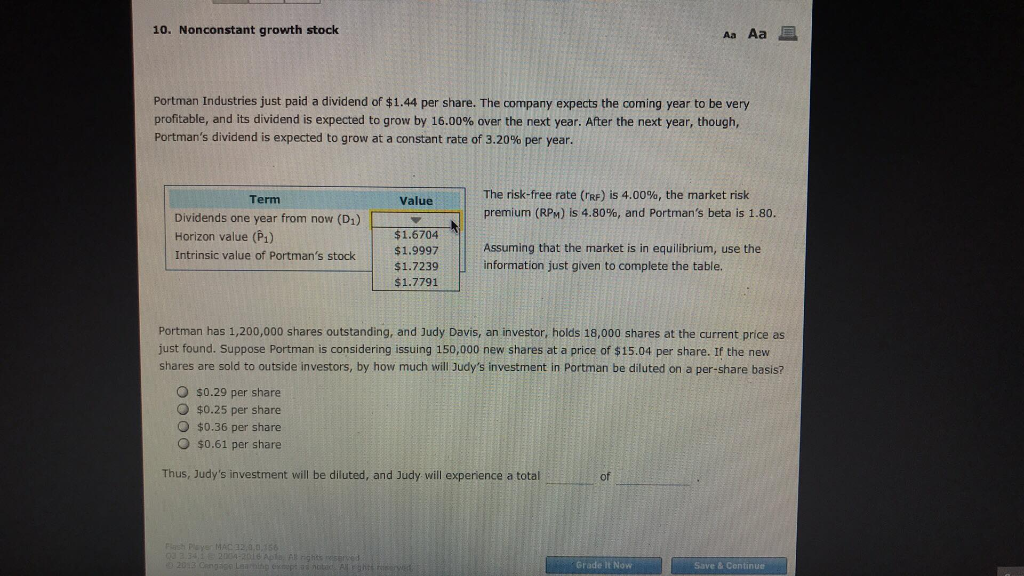

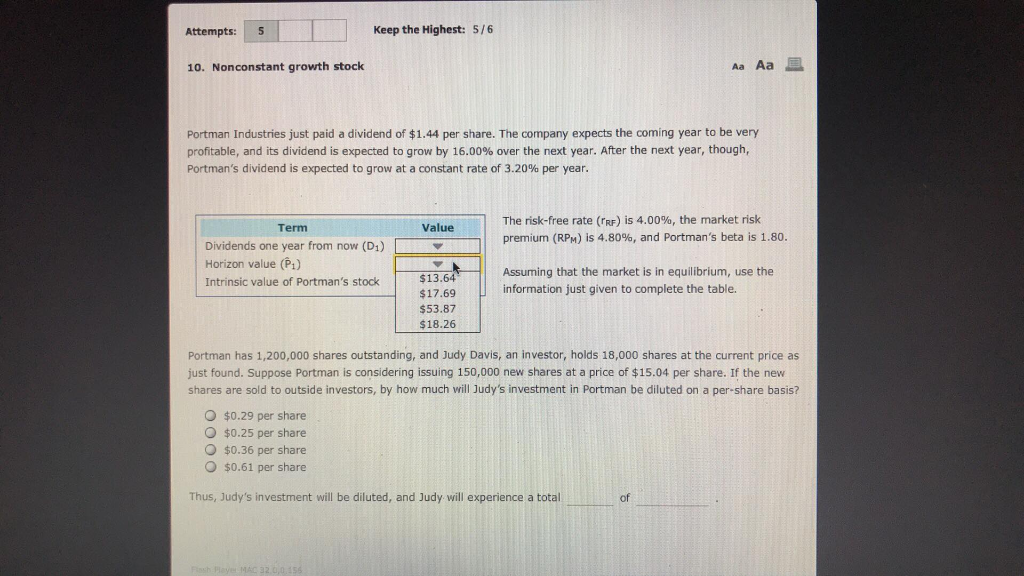

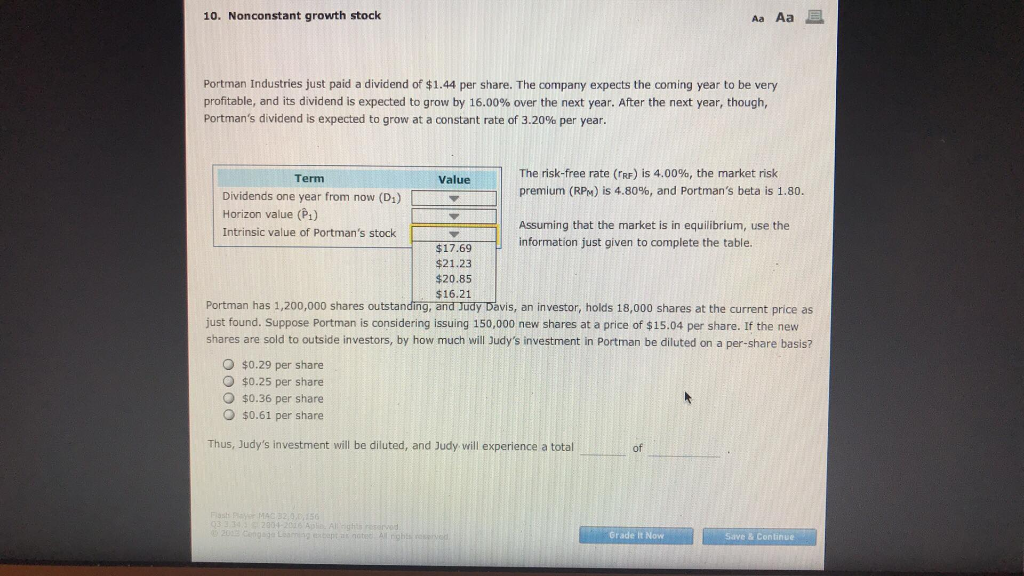

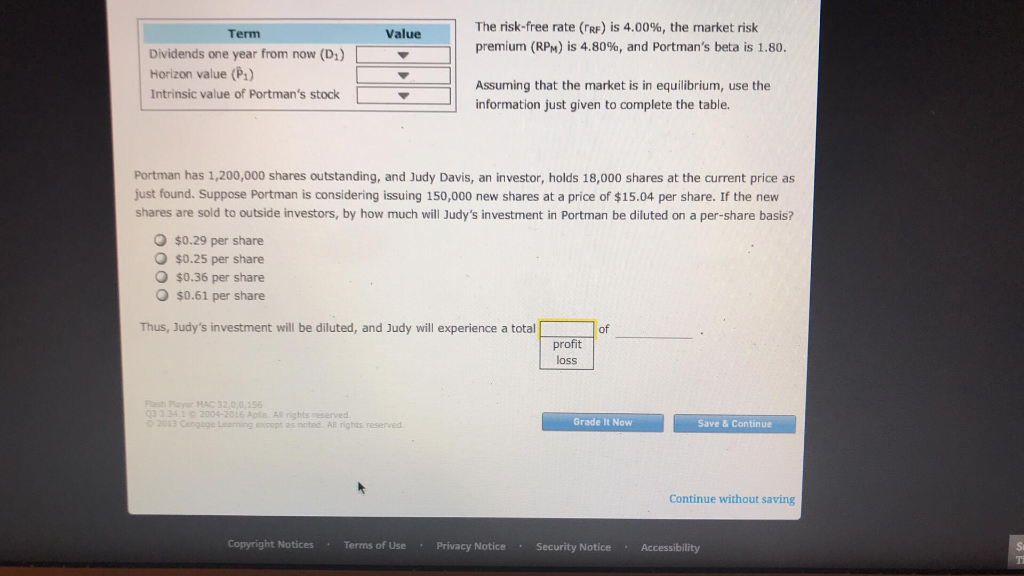

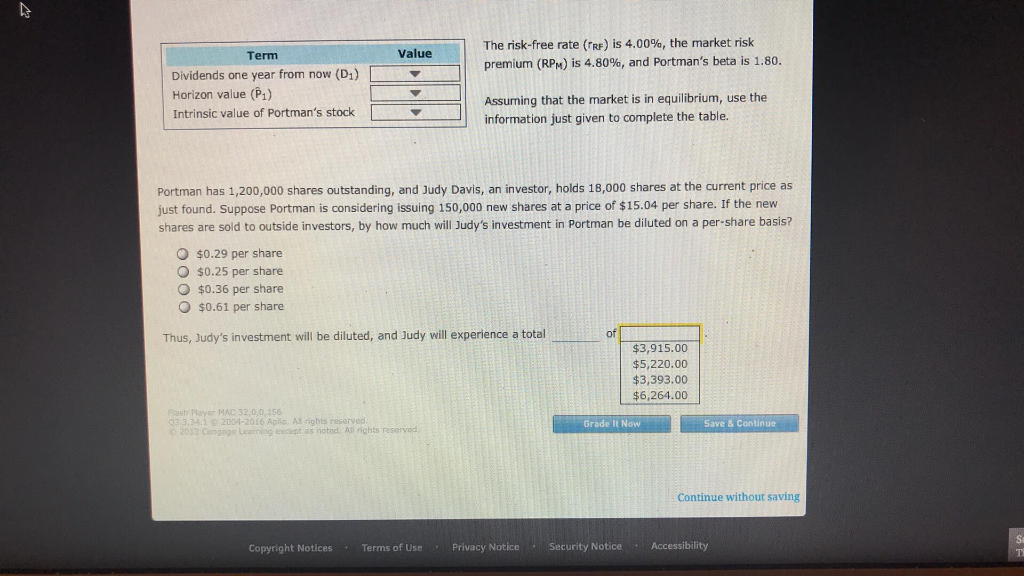

10. Nonconstant growth stock Aa Aa Portman Industries just paid a dividend of $1.44 per share. The company expects the coming year to be very profitable, and its dividend is expected to grow by 16.00% over the next year. After the next year, though, Portman's dividend is expected to grow at a constant rate of 3.20% per year. The risk-free rate (re) is 4.00%, the market risk premium (RPM) is 4.80%, and Portman's beta is 1.80 Term Value Dividends one year from now (D,) Horizon value (P1) Intrinsic value of Portman's stock $1.6704 $1.9997 $1.7239 $1.7791 Assuming that the market is in equilibrium, use the information just given to complete the table. Portman has 1,200,000 shares outstanding, and Judy Davis, an investor, holds 18,000 shares at the current price as just found. Suppose Portman is considering issuing 150,000 new shares at a price of $15.04 per share. If the new shares are sold to outside investors, by how much will Judy's investment in Portman be diluted on a per-share basis? O $0.29 per share O $0.25 per share O $0.36 per share O $0.61 per share Thus, Judy's investment will be diluted, and Judy will experience a total of Grade It Now Save & Centinue Attempts: 5 Keep the Highest: 5/6 10. Nonconstant growth stock Aa Aa Portman Industries just paid a dividend of $1.44 per share. The company expects the coming year to be very profitable, and its dividend is expected to grow by 16.00% over the next year. After the next year, though, Portman's dividend is expected to grow at a constant rate of 3.20% per year. The risk-free rate (re) is 4.00%, the market risk premium (RPM) is 4.80%, and Portman's beta is 1.80 Term Value Dividends one year from now (D1) Horizon value (P1) Intrinsic value of Portman's stock Assuming that the market is in equilibrium, use the information just given to complete the table. $13.64 $17.69 $53.87 $18.26 Portman has 1,200,000 shares outstanding, and Judy Davis, an investor, holds 18,000 shares at the current price as just found. Suppose Portman is considering issuing 150,000 new shares at a price of $15.04 per share. If the new shares are sold to outside investors, by how much will Judy's investment in Portman be diluted on a per-share basis? O $0.29 per share O $0.25 per share O $0.36 per share O $0.61 per share Thus, Judy's investment will be diluted, and Judy will experience a total of The risk-free rate (rer) is 4.00%, the market risk premium (RPH) is 4.80%, and Portman's beta is 1.80. Term Value Dividends one year from now (D) Horizon value (P1) Intrinsic value of Portman's stock Assuming that the market is in equilibrium, use the information just given to complete the table. Portman has 1,200,000 shares outstanding, and Judy Davis, an investor, holds 18,000 shares at the current price as just found. Suppose Portman is considering issuing 150,000 new shares at a price of $15.04 per share. If the new shares are sold to outside investors, by how much will Judy's investment in Portman be diluted on a per-share basis? O $0.29 per share O $0.25 per share $0.36 per share $0.61 per share of Thus, Judy's investment will be diluted, and Judy will experience a total $3,915.00 $5,220.00 $3,393.00 $6,264.00 Grade It Now Save & Continue ng excent as notnd, All rights reservod Continue without saving Copyright Notices Terms of Use Privacy Notice Security Notice Accessibility