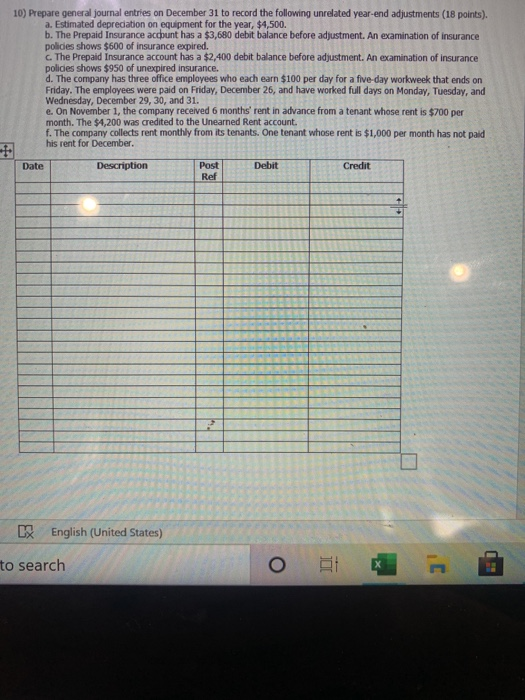

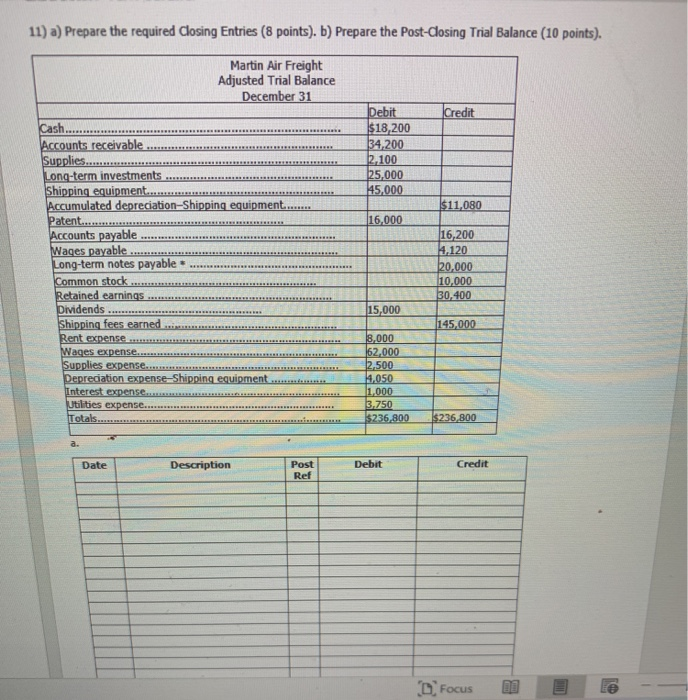

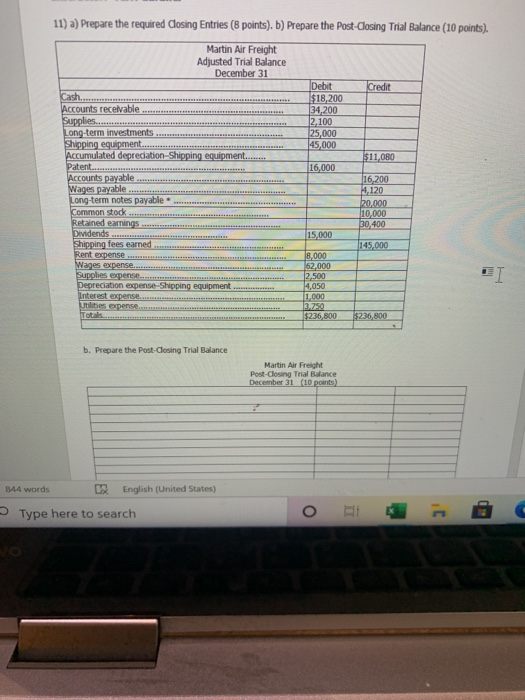

10) Prepare general journal entries on December 31 to record the following unrelated year-end adjustments (18 points). a. Estimated depreciation on equipment for the year, $4,500. b. The Prepaid Insurance account has a $3,680 debit balance before adjustment. An examination of insurance polides shows $600 of insurance expired. The Prepaid Insurance account has a $2,400 debit balance before adjustment. An examination of insurance policies shows $950 of unexpired insurance. d. The company has three office employees who each earn $100 per day for a five-day workweek that ends on Friday. The employees were paid on Friday, December 26, and have worked full days on Monday, Tuesday, and Wednesday, December 29, 30, and 31. e. On November 1, the company received 6 months' rent in advance from a tenant whose rent is $700 per month. The $4,200 was credited to the Unearned Rent account. f. The company collects rent monthly from its tenants. One tenant whose rent is $1,000 per month has not paid his rent for December. Date Description Post Debit Credit Ref EX English (United States) to search O JEL 11) a) Prepare the required Closing Entries (8 points). b) Prepare the Post-Closing Trial Balance (10 points). Martin Air Freight Adjusted Trial Balance December 31 Credit Cash.... Debit $18,200 34,200 2.100 125,000 45,000 $11,080 16,000 HERRER RE Accounts receivable Supplies........ Long-term investments Shipping equipment.... Accumulated depreciation-Shipping equipment. Patent... Accounts payable Wages payable Long-term notes payable Common stock Retained earnings .... Dividends Shipping fees earned Rent expense Wages expense..... Supplies expense.. Depreciation expense-Shipping equipment... Interest expense Utilities expense.... Totals 16,200 4,120 20,000 10.000 30,400 15,000 145,000 8,000 62,000 2,500 14.050 1,000 3.750 $236,800 $236,800 Date Description Post Ref Debit Credit D. Focus 11) a) Prepare the required Closing Entries (8 points). b) Prepare the Post-Closing Trial Balance (10 points). Martin Air Freight Adjusted Trial Balance December 31 Debit Credit Cash $18,200 Accounts receivable 34,200 Supplies...... 2,100 Long-term investments 25,000 Shipping equipment 45,000 Accumulated depreciation-Shipping equipment....... $11,080 Patent.. 16,000 Accounts payable 16,200 Wages payable 4.120 Long-term notes payable 20.000 Common stock... 10,000 Retained earnings 30,400 Dividends 15,000 Shipping fees earned 145,000 Rent expenses 18,000 Wages expense. 62,000 Supples expense 2,500 Depreciation expense-Shipping equipment 4,050 Interest expense... 1,000 Utilities expense 3.250 Totalis $236.800 $236,800 m b. Prepare the Post-Closing Trial Balance Martin Air Freight Post-Closing Trial Balance December 11 (10 points) 844 words DX English (United States) Type here to search . o