Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. Rocky Mountain Oil (RMO) is expanding its drilling operations. As a part of its expansion, the company recently contracted with a European firm to

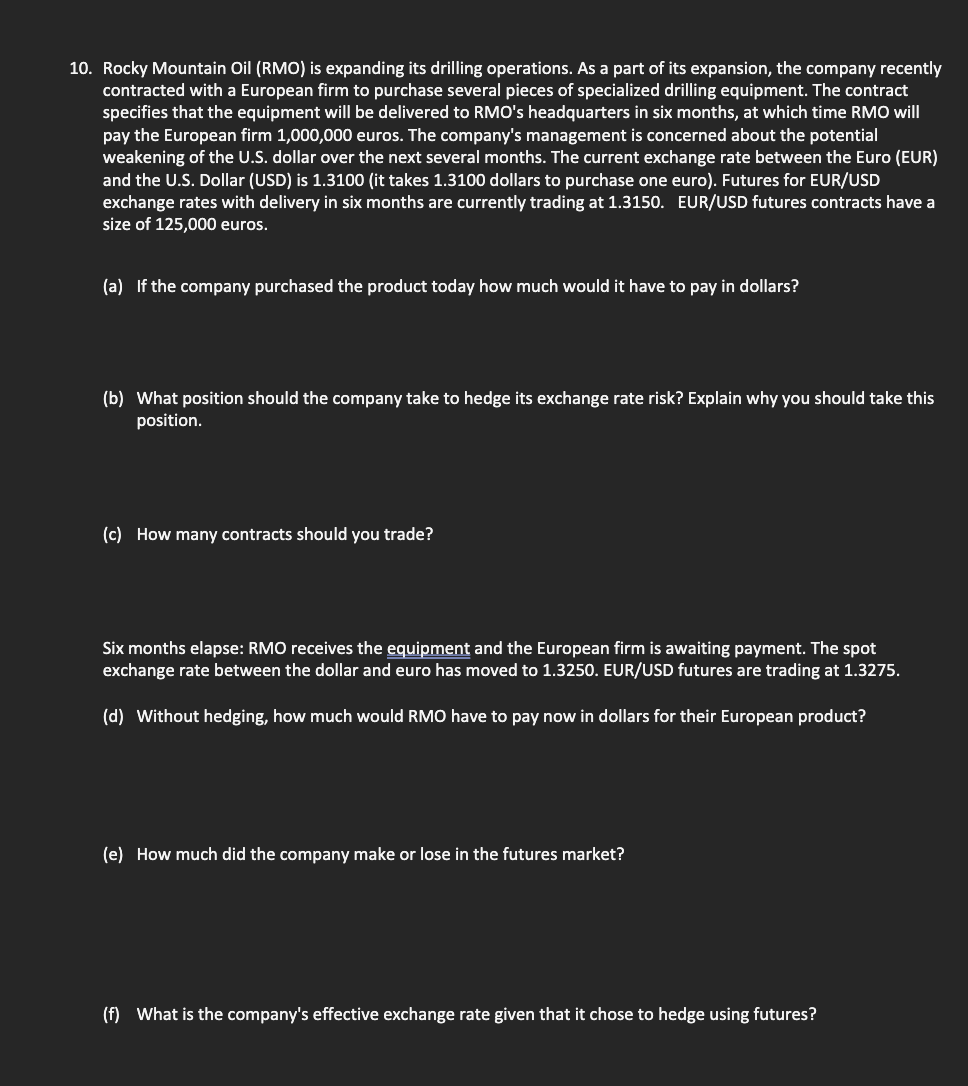

10. Rocky Mountain Oil (RMO) is expanding its drilling operations. As a part of its expansion, the company recently contracted with a European firm to purchase several pieces of specialized drilling equipment. The contract specifies that the equipment will be delivered to RMO's headquarters in six months, at which time RMO will pay the European firm 1,000,000 euros. The company's management is concerned about the potential weakening of the U.S. dollar over the next several months. The current exchange rate between the Euro (EUR) and the U.S. Dollar (USD) is 1.3100 (it takes 1.3100 dollars to purchase one euro). Futures for EUR/USD exchange rates with delivery in six months are currently trading at 1.3150. EUR/USD futures contracts have a size of 125,000 euros. (a) If the company purchased the product today how much would it have to pay in dollars? (b) What position should the company take to hedge its exchange rate risk? Explain why you should take this position. (c) How many contracts should you trade? Six months elapse: RMO receives the equipment and the European firm is awaiting payment. The spot exchange rate between the dollar and euro has moved to 1.3250. EUR/USD futures are trading at 1.3275. (d) Without hedging, how much would RMO have to pay now in dollars for their European product? (e) How much did the company make or lose in the futures market? (f) What is the company's effective exchange rate given that it chose to hedge using futures

10. Rocky Mountain Oil (RMO) is expanding its drilling operations. As a part of its expansion, the company recently contracted with a European firm to purchase several pieces of specialized drilling equipment. The contract specifies that the equipment will be delivered to RMO's headquarters in six months, at which time RMO will pay the European firm 1,000,000 euros. The company's management is concerned about the potential weakening of the U.S. dollar over the next several months. The current exchange rate between the Euro (EUR) and the U.S. Dollar (USD) is 1.3100 (it takes 1.3100 dollars to purchase one euro). Futures for EUR/USD exchange rates with delivery in six months are currently trading at 1.3150. EUR/USD futures contracts have a size of 125,000 euros. (a) If the company purchased the product today how much would it have to pay in dollars? (b) What position should the company take to hedge its exchange rate risk? Explain why you should take this position. (c) How many contracts should you trade? Six months elapse: RMO receives the equipment and the European firm is awaiting payment. The spot exchange rate between the dollar and euro has moved to 1.3250. EUR/USD futures are trading at 1.3275. (d) Without hedging, how much would RMO have to pay now in dollars for their European product? (e) How much did the company make or lose in the futures market? (f) What is the company's effective exchange rate given that it chose to hedge using futures Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started