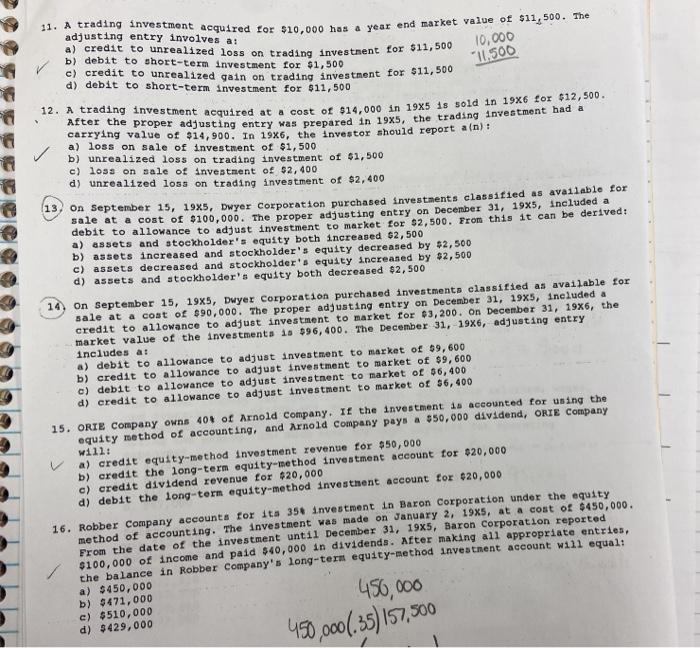

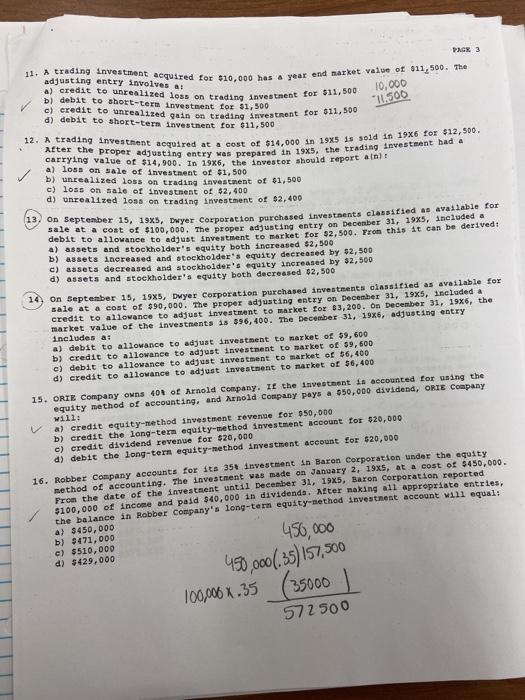

10,000 11.500 11. A trading investment acquired for $10,000 has a year end market value of $11,500. The adjusting entry involves a: a) credit to unrealized loss on trading Investment for $11,500 b) debit to short-term investment for $1,500 c) credit to unrealized gain on trading investment for $11,500 d) debit to short-term investment for $11,500 12. A trading investment acquired at a cost of $14,000 in 19X5 is sold in 19X6 for $12,500. after the proper adjusting entry was prepared in 1985, the trading investment had a carrying value of $14,900. In 19x6, the investor should report a(n) : a) loss on sale of investment of $1,500 b) unrealized loss on trading investment of $1,500 c) loss on sale of investment of $2,400 d) unrealized loss on trading investment of $2,400 13, on September 15, 1935, Dwyer Corporation purchased investments classified as available for sale at a cost of $100,000. The proper adjusting entry on December 31, 1935, included a debit to allowance to adjust investment to market for $2,500. From this it can be derived: a) assets and stockholder's equity both increased $2,500 b) assets increased and stockholder's equity decreased by $2,500 c) assets decreased and stockholder's equity increased by $2,500 d) assets and stockholder's equity both decreased $2,500 14 On September 15, 1985, Dwyer Corporation purchased investments classified as available for sale at a cost of $90,000. The proper adjusting entry on December 31, 1935, included a credit to allowance to adjust investment to market for $3,200. On December 31, 1986, the market value of the investments is $96,400. The December 31, -1986, adjusting entry includes a: a) debit to allowance to adjust investment to market of 69,600 b) credit to allowance to adjust investment to market of $9,600 c) debit to allowance to adjust investment to market of $6,400 d) credit to allowance to adjust investment to market of $6,400 15. ORIE Company owns 40% of Arnold company. If the investment is accounted for using the equity method of accounting, and Arnold Company pays a $50,000 dividend, ORIE Company will: a) credit equity-method investment revenue for $50,000 b) credit the long-term equity-method investment account for $20,000 c) credit dividend revenue for $20,000 d) debit the long-term equity-method investment account for $20,000 16. Robber Company accounts for its 35 investment in Baron Corporation under the equity method of accounting. The investment was made on January 2, 1935, at a cost of $450,000. From the date of the investment until December 31, 1935, Baron Corporation reported $100,000 of income and paid $40,000 in dividends. After making all appropriate entries, the balance in Robber Company's long-term equity-method investment account will equali a) $450,000 b) 9471,000 c) $510,000 d) $429,000 450,000 450.000(-35) 157,500