Answered step by step

Verified Expert Solution

Question

1 Approved Answer

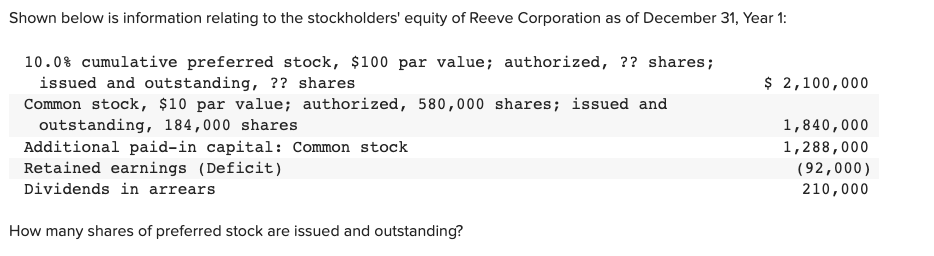

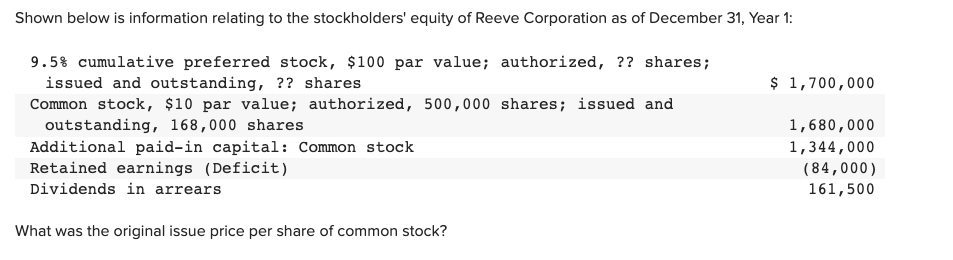

10.0%cumulativepreferredstock,$100parvalue;authorized,??shares;issuedandoutstanding,??sharesCommonstock,$10parvalue;authorized,580,000shares;issuedandoutstanding,184,000sharesAdditionalpaid-incapital:CommonstockRetainedearnings(Deficit)Dividendsinarrears$2,100,0001,840,0001,288,000(92,000)210,000 9.5%cumulativepreferredstock,$100parvalue;authorized,??shares;issuedandoutstanding,??sharesCommonstock,$10parvalue;authorized,500,000shares;issuedandoutstanding,168,000sharesAdditionalpaid-incapital:CommonstockRetainedearnings(Deficit)Dividendsinarrears$1,700,0001,680,0001,344,000(84,000)161,500 What was the original issue price per share of common stock? Shown below is information relating to the stockholders' equity of Reeve Corporation

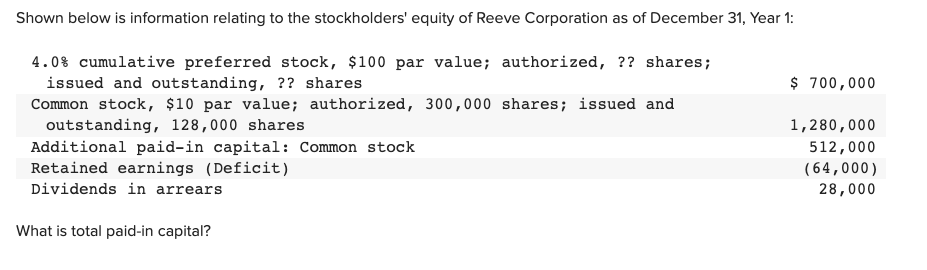

10.0%cumulativepreferredstock,$100parvalue;authorized,??shares;issuedandoutstanding,??sharesCommonstock,$10parvalue;authorized,580,000shares;issuedandoutstanding,184,000sharesAdditionalpaid-incapital:CommonstockRetainedearnings(Deficit)Dividendsinarrears$2,100,0001,840,0001,288,000(92,000)210,000 9.5%cumulativepreferredstock,$100parvalue;authorized,??shares;issuedandoutstanding,??sharesCommonstock,$10parvalue;authorized,500,000shares;issuedandoutstanding,168,000sharesAdditionalpaid-incapital:CommonstockRetainedearnings(Deficit)Dividendsinarrears$1,700,0001,680,0001,344,000(84,000)161,500 What was the original issue price per share of common stock? Shown below is information relating to the stockholders' equity of Reeve Corporation as of December 31, Year 1: 4.0%cumulativepreferredstock,$100parvalue;authorized,??shares;issuedandoutstanding,??sharesCommonstock,$10parvalue;authorized,300,000shares;issuedandoutstanding,128,000sharesAdditionalpaid-incapital:CommonstockRetainedearnings(Deficit)Dividendsinarrears$700,0001,280,000512,000(64,000)28,000 What is total paid-in capital

10.0%cumulativepreferredstock,$100parvalue;authorized,??shares;issuedandoutstanding,??sharesCommonstock,$10parvalue;authorized,580,000shares;issuedandoutstanding,184,000sharesAdditionalpaid-incapital:CommonstockRetainedearnings(Deficit)Dividendsinarrears$2,100,0001,840,0001,288,000(92,000)210,000 9.5%cumulativepreferredstock,$100parvalue;authorized,??shares;issuedandoutstanding,??sharesCommonstock,$10parvalue;authorized,500,000shares;issuedandoutstanding,168,000sharesAdditionalpaid-incapital:CommonstockRetainedearnings(Deficit)Dividendsinarrears$1,700,0001,680,0001,344,000(84,000)161,500 What was the original issue price per share of common stock? Shown below is information relating to the stockholders' equity of Reeve Corporation as of December 31, Year 1: 4.0%cumulativepreferredstock,$100parvalue;authorized,??shares;issuedandoutstanding,??sharesCommonstock,$10parvalue;authorized,300,000shares;issuedandoutstanding,128,000sharesAdditionalpaid-incapital:CommonstockRetainedearnings(Deficit)Dividendsinarrears$700,0001,280,000512,000(64,000)28,000 What is total paid-in capital Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started