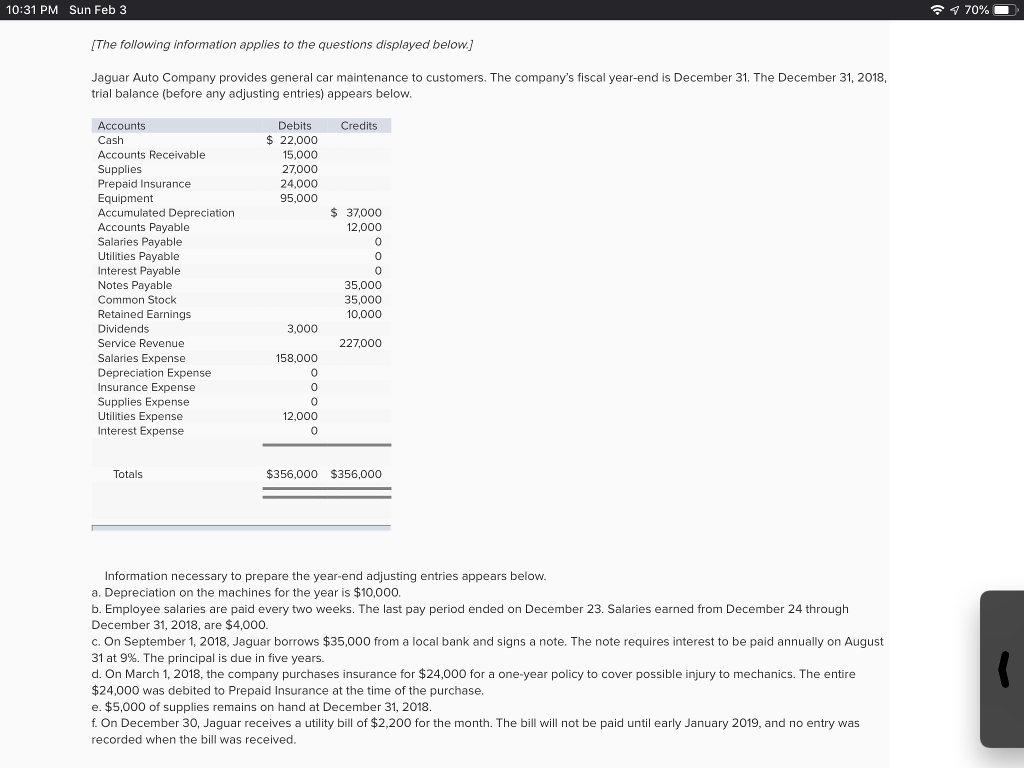

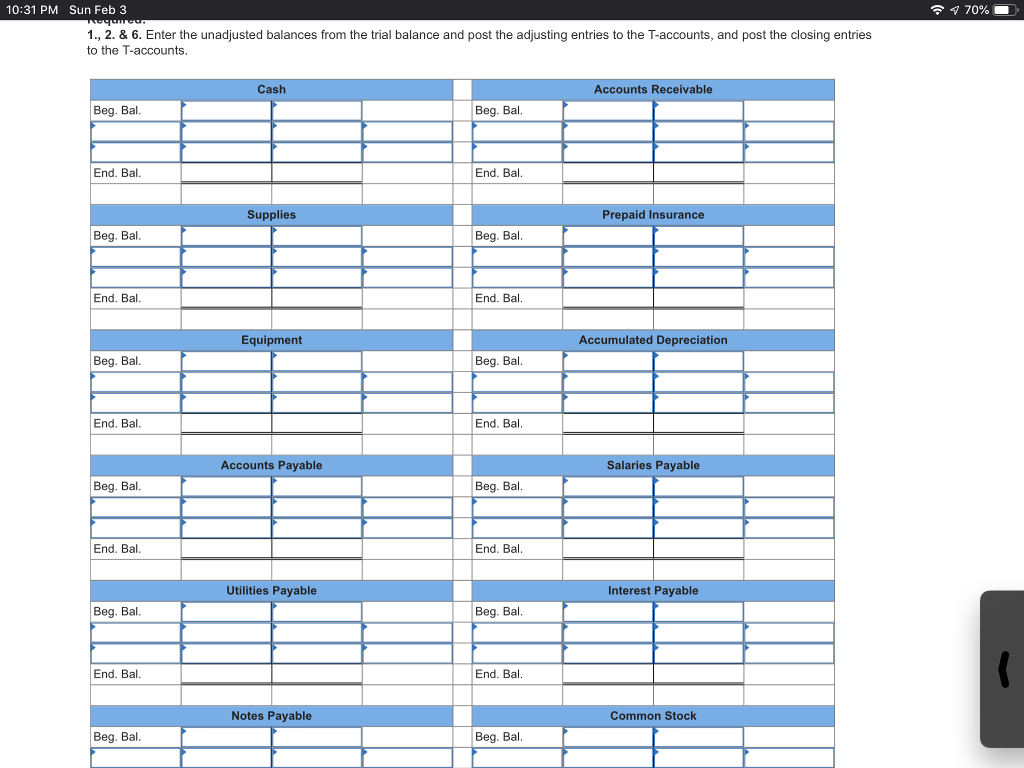

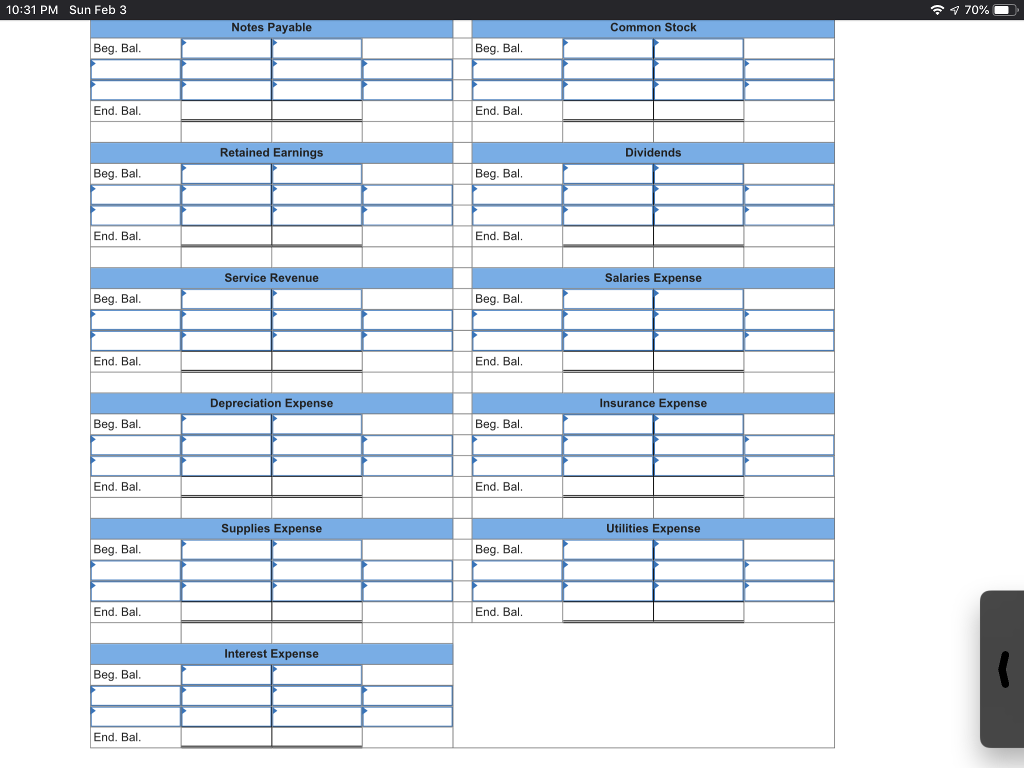

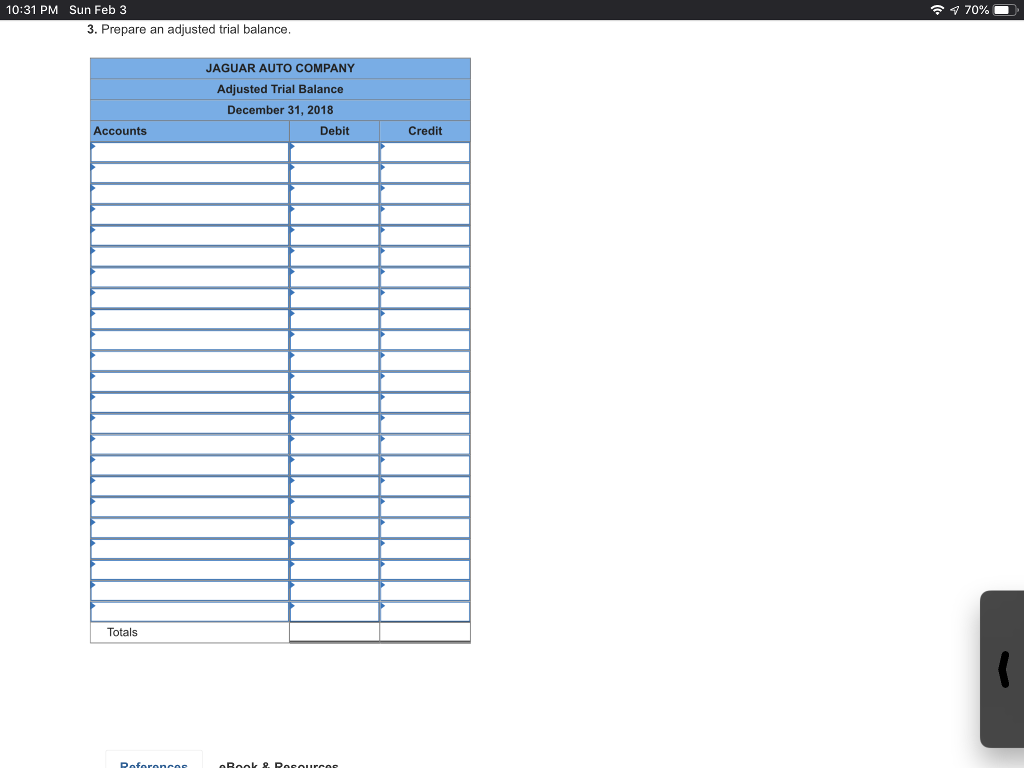

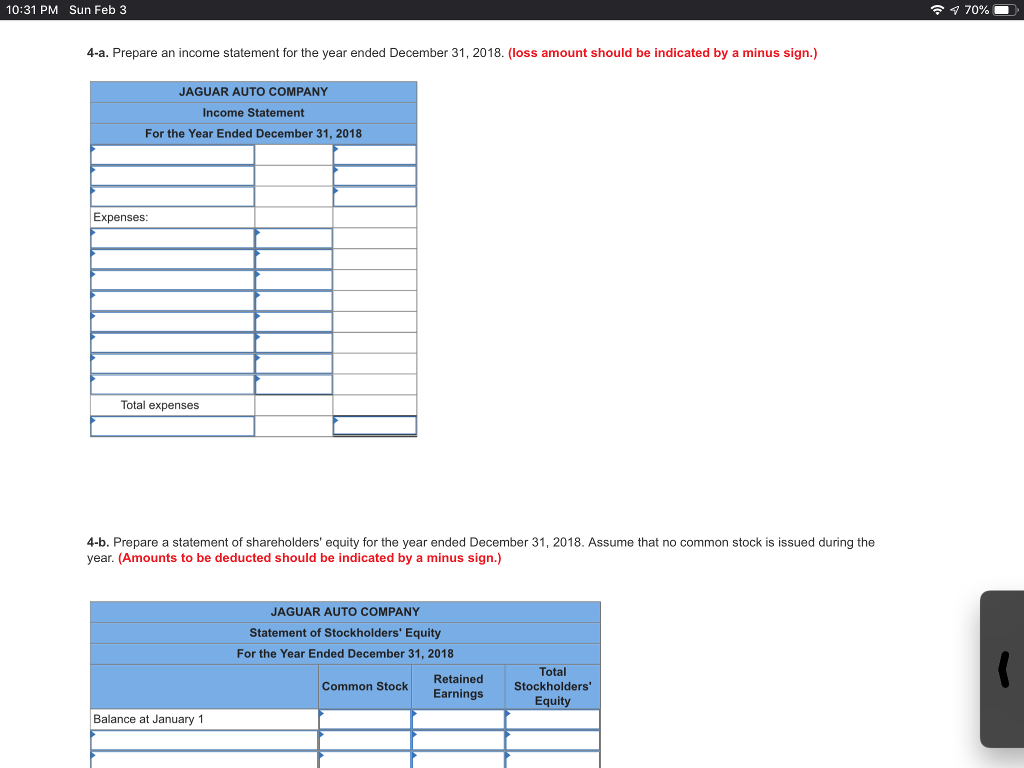

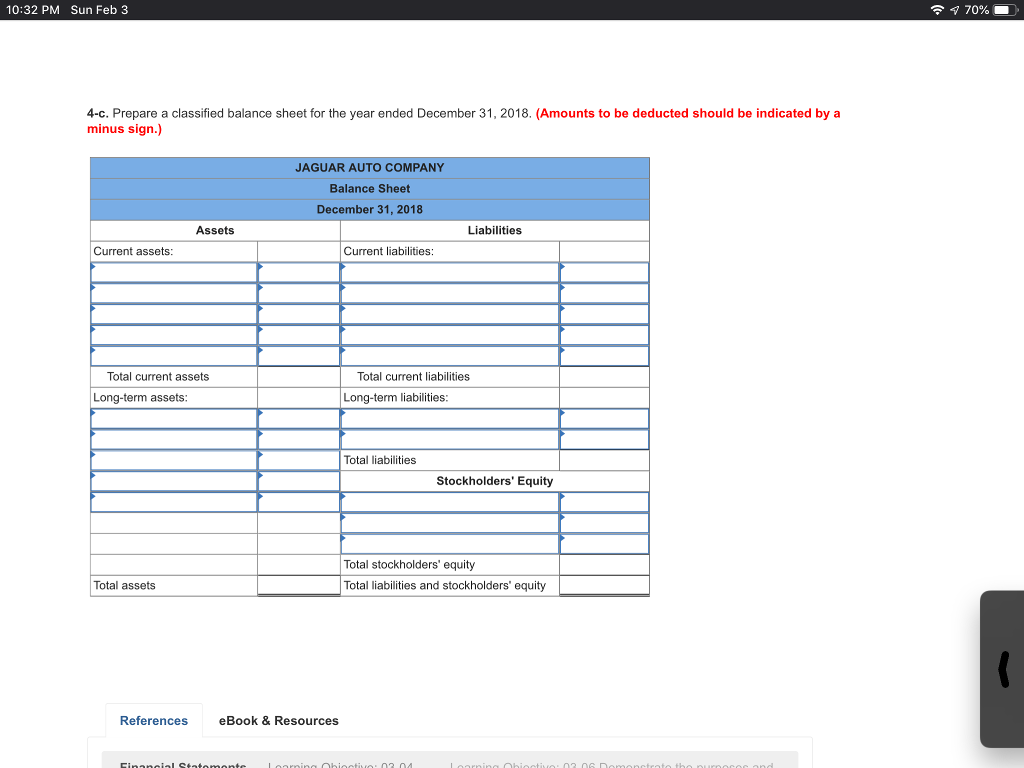

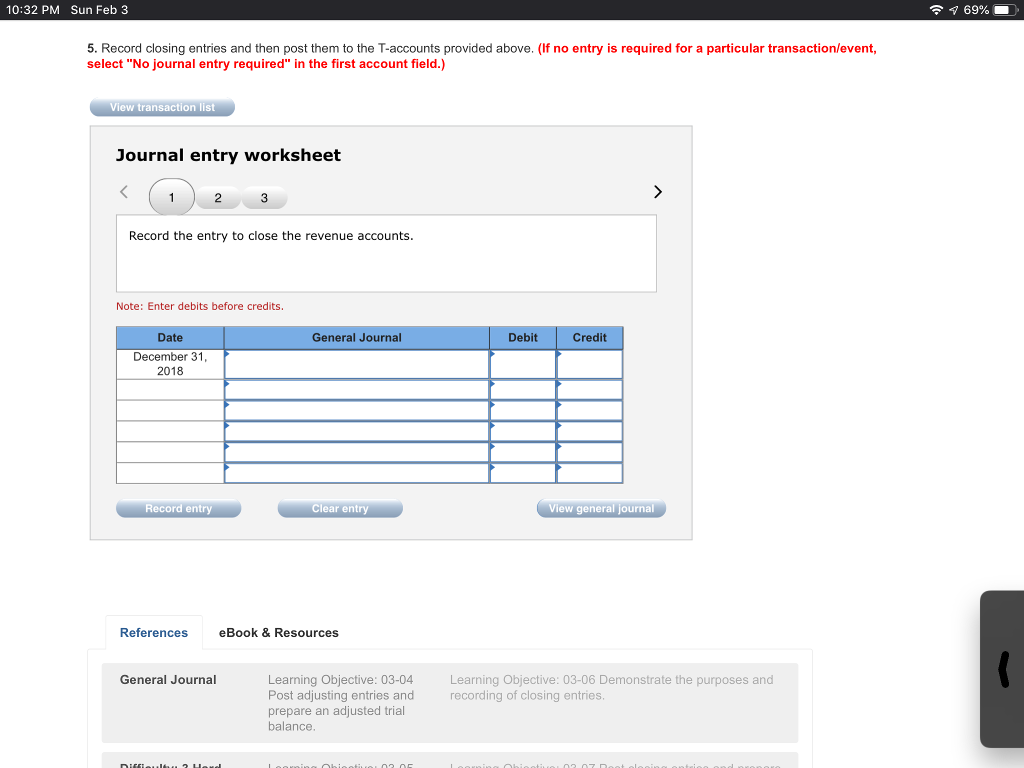

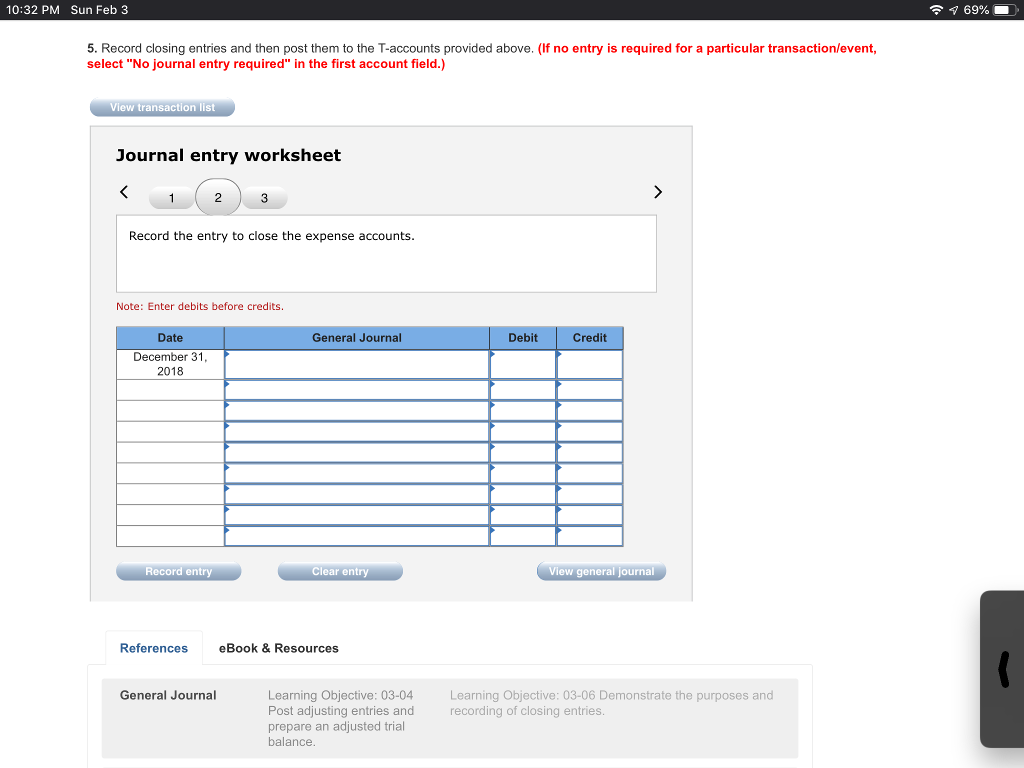

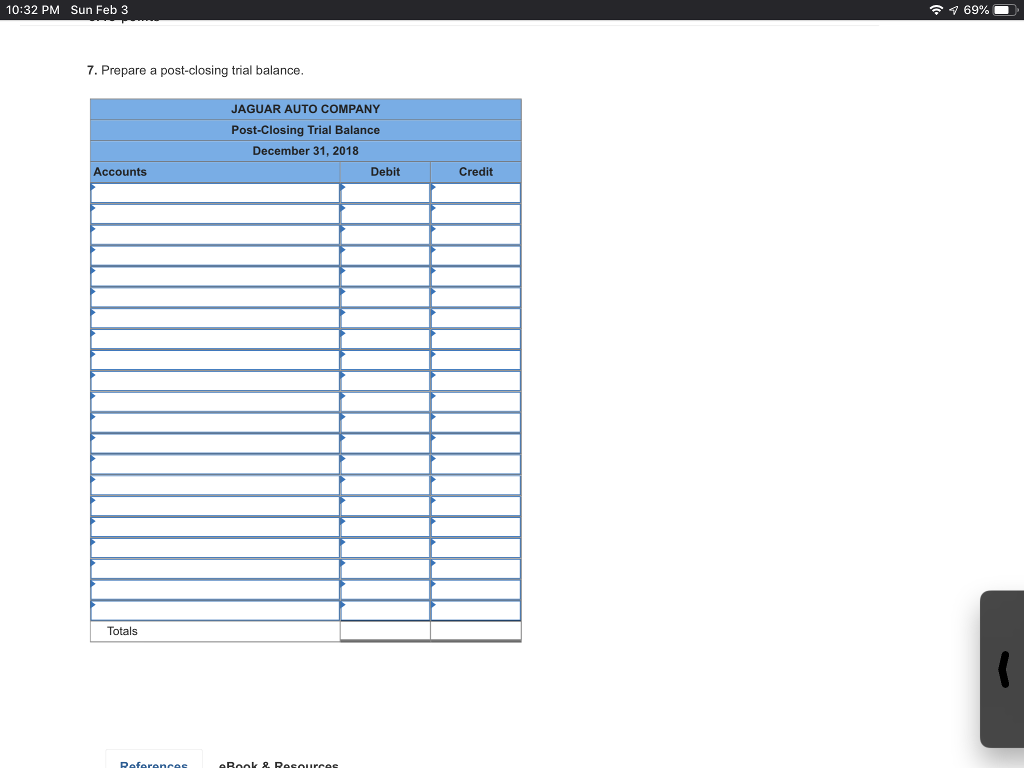

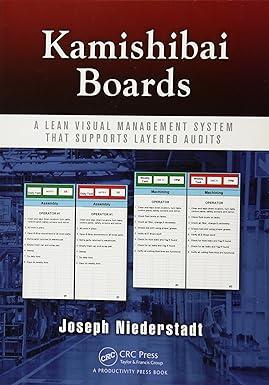

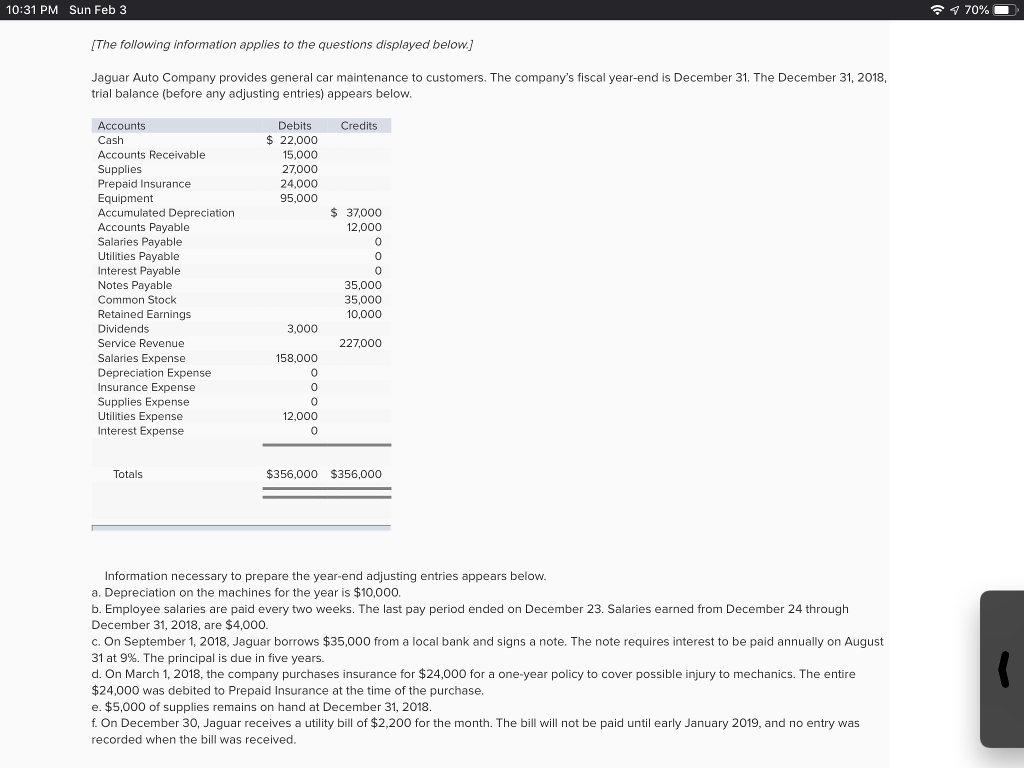

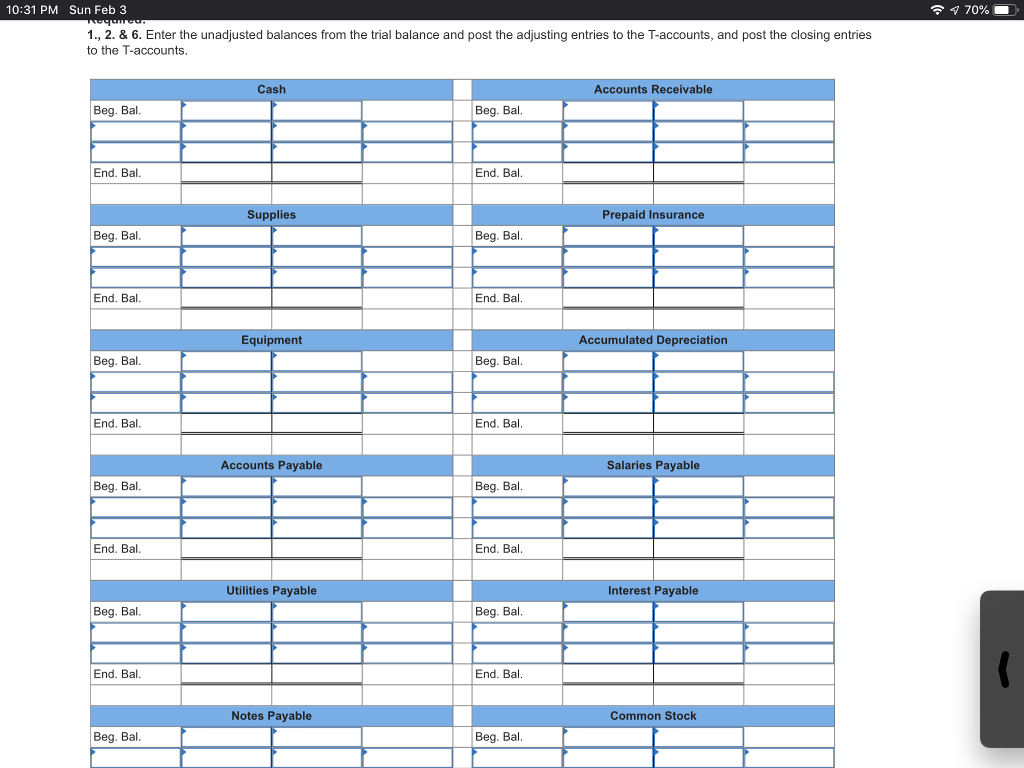

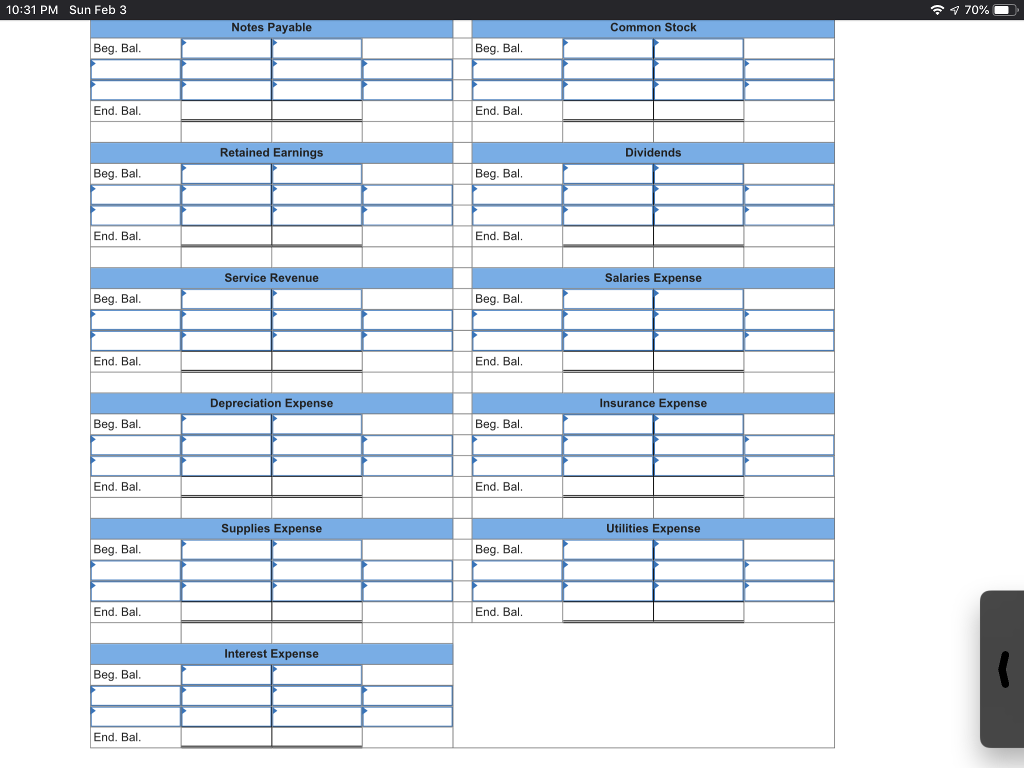

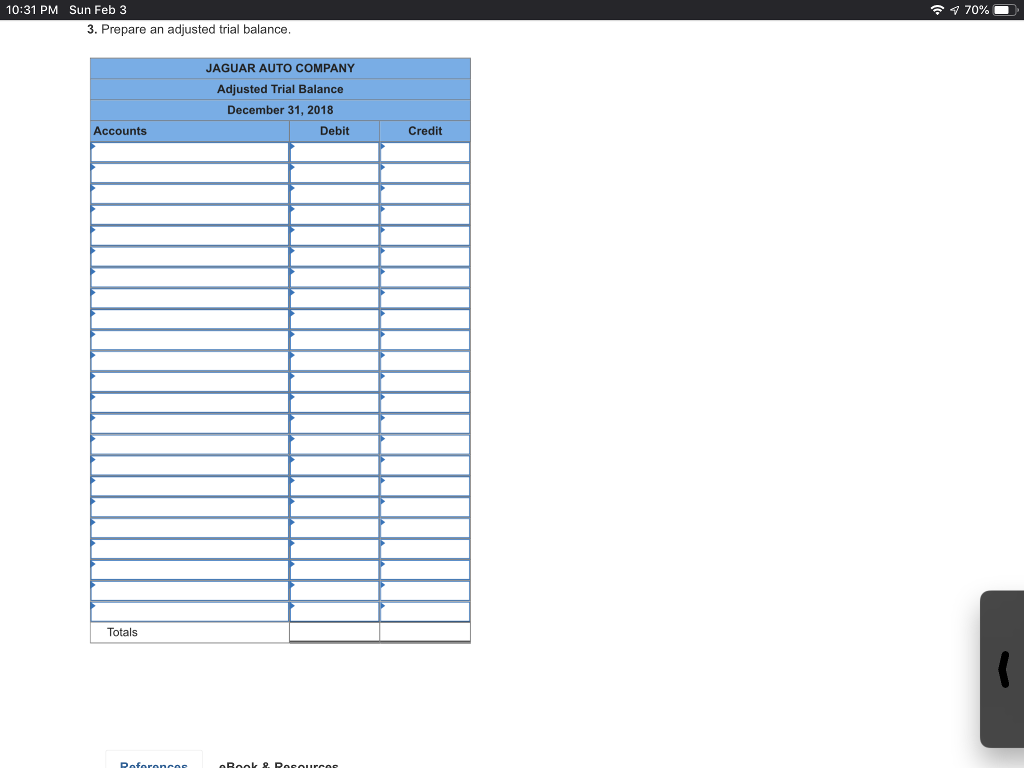

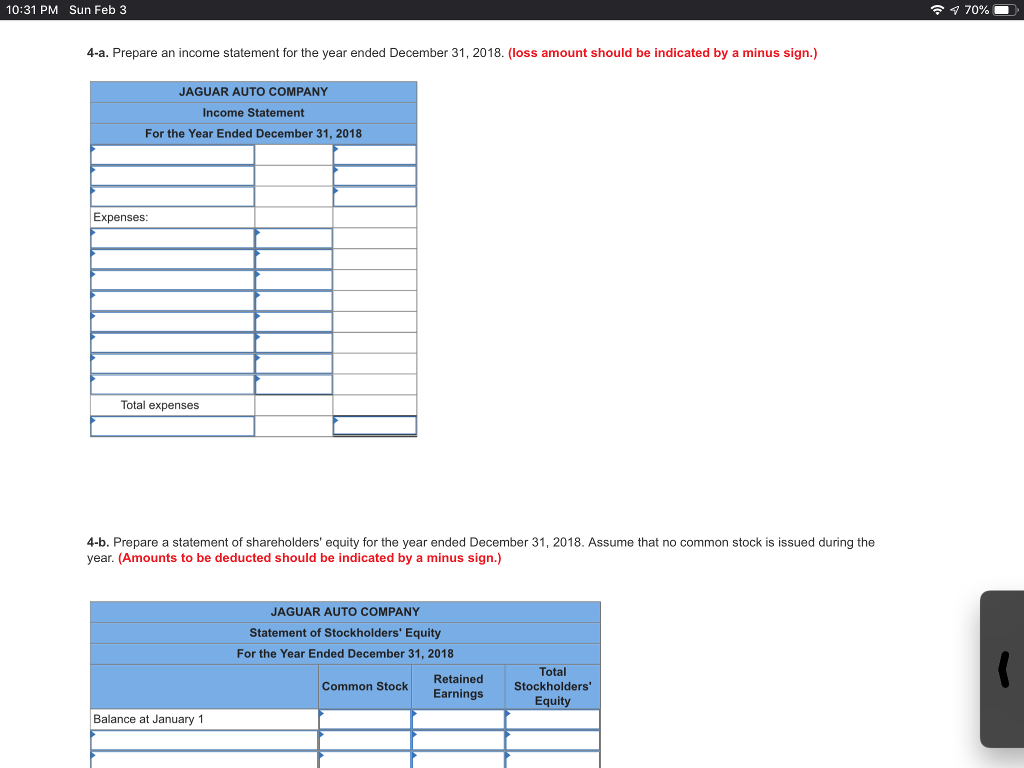

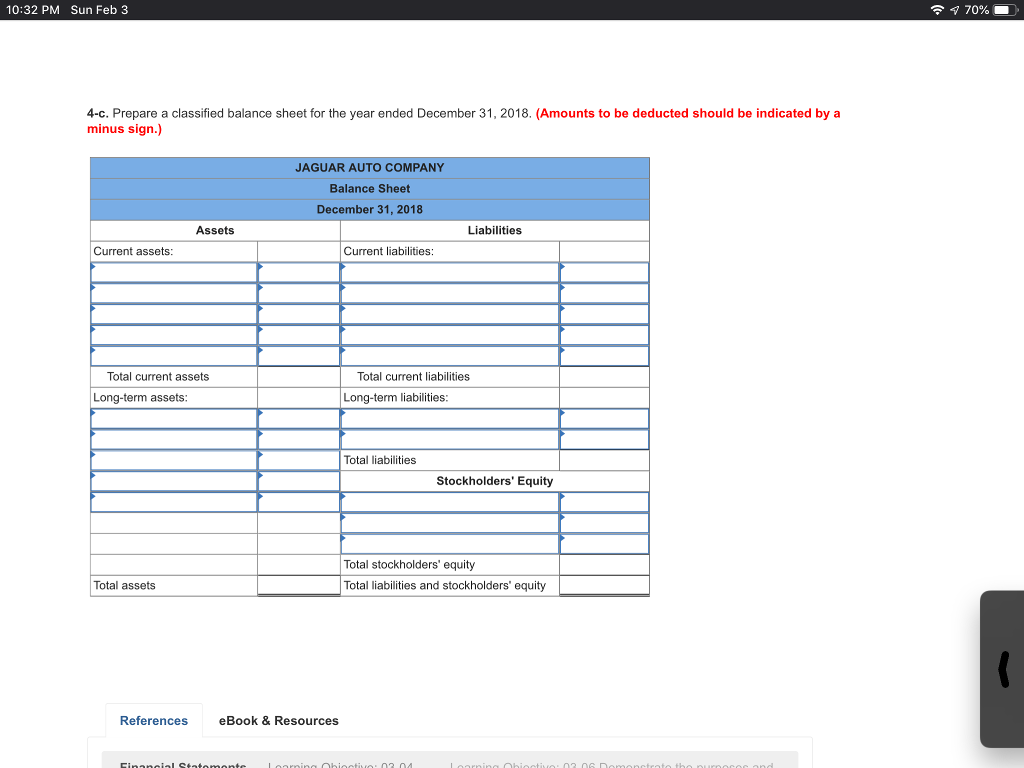

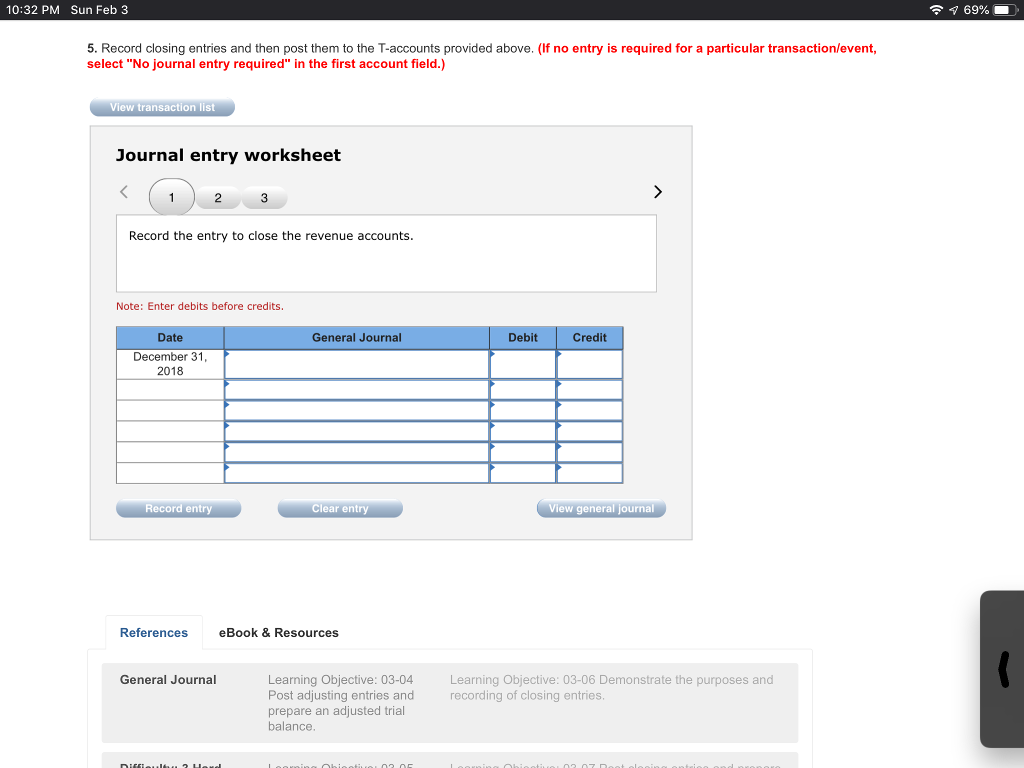

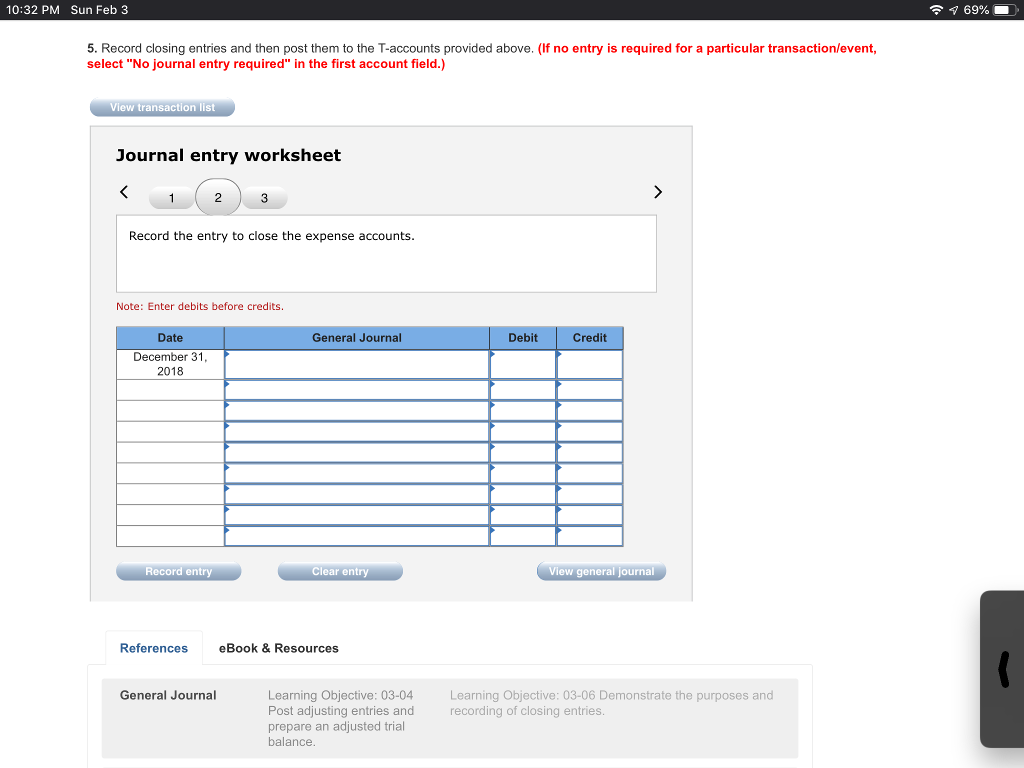

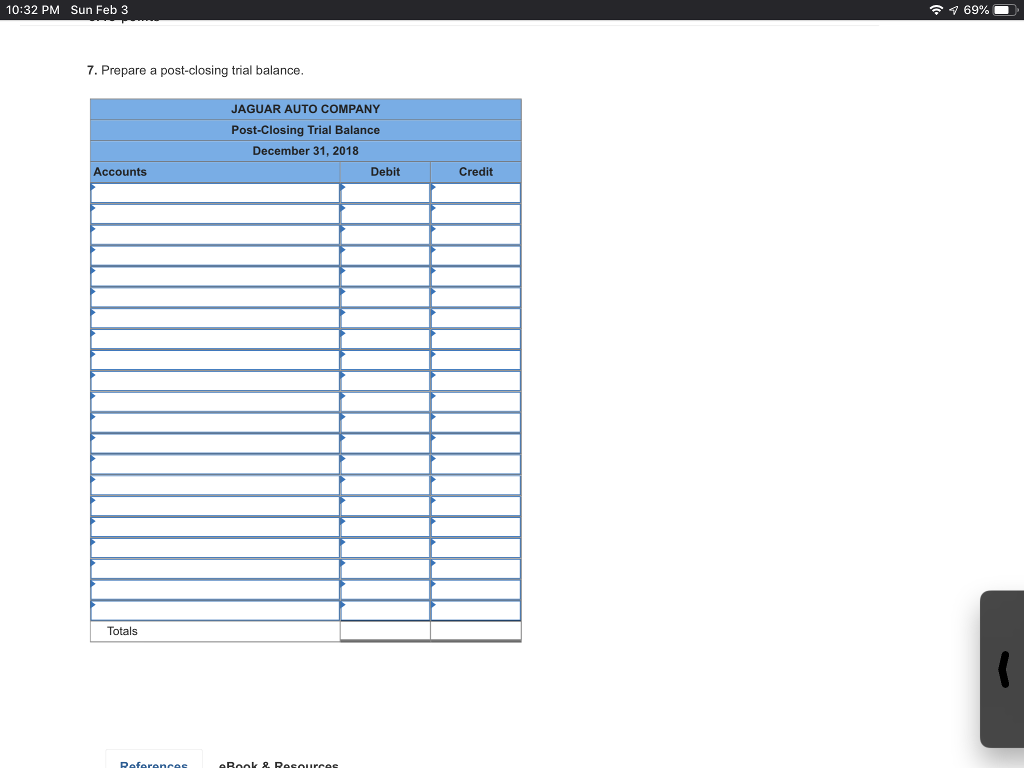

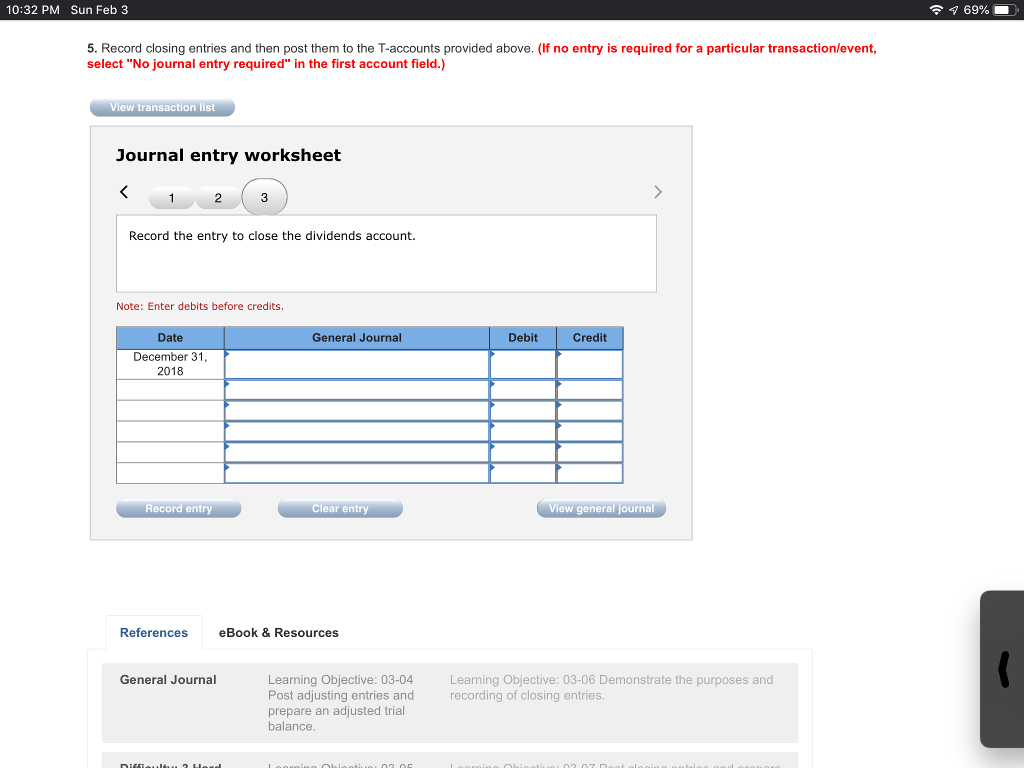

10:31 PM Sun Feb 3 The following information applies to the questions displayed below. Jaguar Auto Company provides general car maintenance to customers. The company's fiscal year-end is December 31. The December 31, 2018 trial balance (before any adjusting entries) appears below Debits Credits Accounts Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Salaries Payable Utilities Payable Interest Payable Notes Payable Common Stock Retained Earnings Dividends Service Revenue Salaries Expense Depreciation Expense Insurance Expensee Supplies Expense Utilities Expense Interest Expense 22,000 15,000 27,000 24,000 95,000 $ 37000 12,000 35,000 35,000 10,000 3,000 227,000 158,000 12,000 Totals $356,000 $356,000 Information necessary to prepare the year-end adjusting entries appears below a. Depreciation on the machines for the year is $10,000 b. Employee salaries are paid every two weeks. The last pay period ended on December 23. Salaries earned from December 24 througlh December 31, 2018, are $4,000 c. On September 1, 2018, Jaguar borrows $35,000 from a local bank and signs a note. The note requires interest to be paid annually on August 31 at 9%. The principal is due in five years. d. On March 1, 2018, the company purchases insurance for $24,000 for a one-year policy to cover possible injury to mechanics. The entire $24,000 was debited to Prepaid Insurance at the time of the purchase e. $5,000 of supplies remains on hand at December 31, 2018 f. On December 30, Jaguar receives a utility bill of $2,200 for the month. The bill will not be paid until early January 2019, and no entry was recorded when the bill was received 10:31 PM Sun Feb 3 1., 2. & 6. Enter the unadjusted balances from the trial balance and post the adjusting entries to the T-accounts, and post the closing entries to the T-accounts Cash Accounts Receivable Beg. Bal Beg. Bal End. Bal End. Bal Supplies Prepaid Insurance Beg. Bal Beg. Bal End. Bal End. Bal Equipment Accumulated Depreciation Beg. Bal Beg. Bal End. Bal End. Bal Accounts Payable Salaries Payable Beg. Bal Beg. Bal End. Bal End. Bal Utilities Payable Interest Payable Beg. Bal Beg. Bal End. Bal End. Bal Notes Payable Common Stock Beg. Bal Beg. Bal 10:31 PM Sun Feb 3 Notes Payable Common Stock Beg. Bal Beg. Bal End. Bal End. Bal Retained Earnings Dividends Beg. Bal Beg. Bal End. Bal End. Bal Service Revenue Salaries Expense Beg. Bal Beg. Bal End. Bal End. Bal Depreciation Expense Insurance Expense Beg. Bal Beg. Bal End. Bal End. Bal Supplies Expense Utilities Expense Beg. Bal Beg. Bal End. Bal End. Bal Interest Expense Beg. Bal End. Bal 10:31 PM Sun Feb 3 70% 3. Prepare an adjusted trial balance JAGUAR AUTO COMPANY Adjusted Trial Balance December 31, 2018 ccounts Debit Credit Totals 10:31 PM Sun Feb 3 70% 4-a. Prepare an income statement for the year ended December 31, 2018. (loss amount should be indicated by a minus sign.) JAGUAR AUTO COMPANY Income Statement For the Year Ended December 31, 2018 Expenses Total expenses 4-b. Prepare a statement of shareholders' equity for the year ended December 31, 2018. Assume that no common stock is issued during the year. (Amounts to be deducted should be indicated by a minus sign.) JAGUAR AUTO COMPANY Statement of Stockholders' Equity For the Year Ended December 31, 2018 Total Stockholders Equity Common Stock Retained Balance at January 1 10:32 PM Sun Feb 3 70% 4-c. Prepare a classified balance sheet for the year ended December 31, 2018. (Amounts to be deducted should be indicated by a minus sign.) JAGUAR AUTO COMPANY Balance Sheet December 31, 2018 Assets Liabilities Current assets Current liabilities Total current assets Total current liabilities Long-term assets Long-term liabilities: Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity Total assets References eBook & Resources 10:32 PM Sun Feb 3 69%- 5. Record closing entries and then post them to the T-accounts provided above. (If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry to close the revenue accounts Note: Enter debits before credits. Date General Journal Debit Credit December 31 2018 Record entry Clear entry view general journal References eBook & Resources General Journal Learning Objective: 03-04 Post adjusting entries and prepare an adjusted trial balance Learning Objective: 03-06 Demonstrate the purposes and recording of closing entries 10:32 PM Sun Feb 3 5. Record closing entries and then post them to the T-accounts provided above. (If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 Record the entry to close the expense accounts Note: Enter debits before credits Credit Date December 31 2018 General Journal Debit Record entry Clear entry view general journal References eBook & Resources General Journal Learning Objective: 03-04 Post adjusting entries and prepare an adjusted trial balance Learning Objective: 03-06 Demonstrate the purposes and recording of closing entries. 10:32 PM Sun Feb 3 69%- 7. Prepare a post-closing trial balance JAGUAR AUTO COMPANY Post-Closing Trial Balance December 31, 2018 ccounts Debit Credit Totals 10:32 PM Sun Feb 3 69%- 5. Record closing entries and then post them to the T-accounts provided above. (If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry to close the dividends account. Note: Enter debits before credits. Debit Credit Date December 31 2018 General Journal Record entry Clear entry View general journal References eBook & Resources General Journal Learning Objective: 03-04 Post adjusting entries and prepare an adjusted trial balance Learning Objective: 03-06 Demonstrate the purposes and recording of closing entries