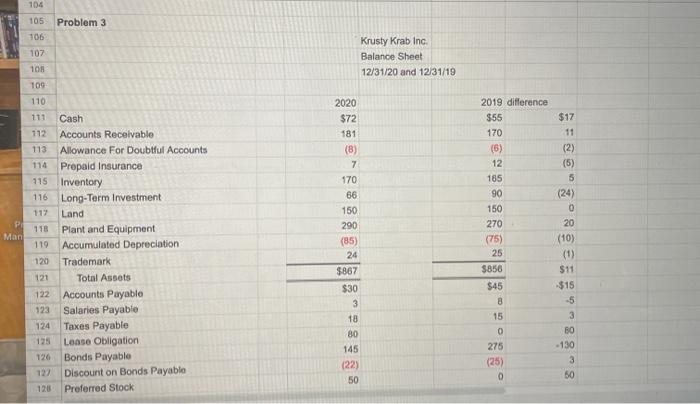

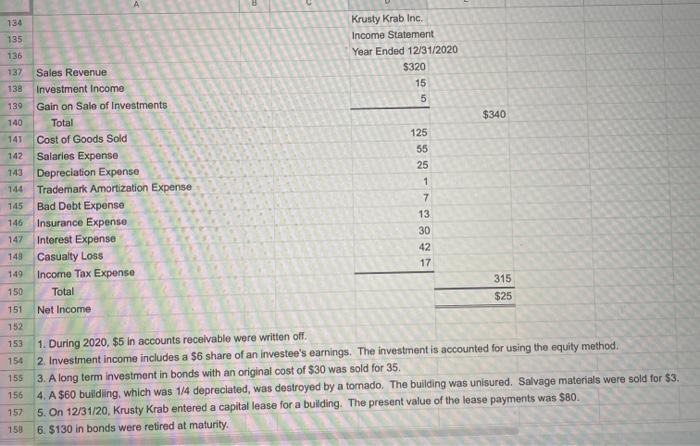

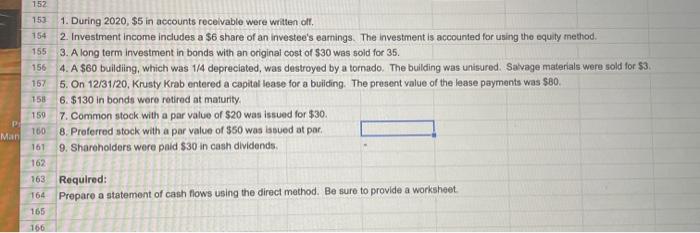

104 105 106 Problem 3 107 Krusty Krab Inc Balance Sheet 12/31/20 and 12/31/19 108 109 110 Man 111 Cash 112 Accounts Receivable 113 Allowance For Doubtful Accounts 114 Prepaid Insurance 115 Inventory 116 Long-Term Investment 117 Land 118 Plant and Equipment 119 Accumulated Depreciation 120 Trademark 121 Total Assets 122 Accounts Payable 123 Salaries Payable Taxes Payable Lease Obligation Bonds Payable 127 Discount on Bonds Payable 120 Preferred Stock 2020 $72 181 (8) 7 170 66 150 290 (85) 24 $867 $30 3 18 80 145 (22) 50 2019 difference $55 $17 170 11 (5) (2) 12 (5) 185 5 90 (24) 150 0 270 20 (75) (10) 25 (1) $856 $11 $45 $15 8 -5 15 3 0 B0 275 -130 (25) 3 50 124 134 135 136 137 Krusty Krab Inc. Income Statement Year Ended 12/31/2020 $320 15 5 138 139 $340 140 141 125 55 25 142 143 144 145 Sales Revenue Investment Income Gain on Sale of Investments Total Cost of Goods Sold Salaries Expense Depreciation Expense Trademark Amortization Expense Bad Debt Expense Insurance Expense Interest Expense Casualty Loss Income Tax Expense Total Net Income 1 7 13 146 147 30 42 17 148 149 315 $25 150 151 152 153 155 156 157 158 1. During 2020, $5 in accounts receivable were written off. 154 2. Investment income includes a $6 share of an investee's earnings. The investment is accounted for using the equity method. 3. A long term investment in bonds with an original cost of $30 was sold for 35. 4. A $60 building, which was 1/4 deprecated, was destroyed by a tomado. The building was unisured. Salvage materials were sold for $3. 5. On 12/31/20, Krusty Krab entered a capital lease for a building. The present value of the lease payments was $80. 6. $130 in bonds were retired at maturity. 152 153 154 155 156 157 1. During 2020, $5 in accounts receivable were written off, 2. Investment income includes a $6 share of an investee's earnings. The investment is accounted for using the equity method. 3. A long term investment in bonds with an original cost of $30 was sold for 35. 4. A $60 building, which was 1/4 depreciated, was destroyed by a tornado, The building was unsured. Salvage materials were sold for $3. 5. On 12/31/20, Krusty Krab entered a capital lease for a building. The present value of the lease payments was $80. 158 6. $130 in bonds were retired at maturity 159 7. Common stock with a par value of $20 was issued for $30. 160 8. Preferred stock with a par value of $50 was issued at par 161 9. Shareholders were paid $30 in cash dividends. 162 163 Required: 164 Prepare a statement of cash flows using the direct method. Be sure to provide a worksheet 165 P Man 166