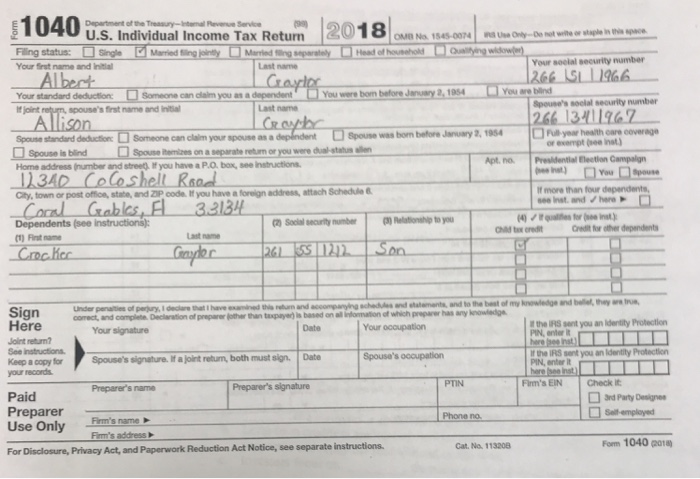

:1040 2018 on..an4 Rau-or 0e U.S. Individual Income Tax Return Fing status: sn* Your irst name and Initial P Married Your soctal security number 266 SL 11G Last name Albert Your standard deduction are blin Someone can claim you as a dependentYou were bon before Jenuary 2 1954You e Spouse's social seourity number spouse's first name and initial Last name 266 13411e 7 Pull year health care Someone can claim your spouse as Spouse was bom before January 2, 1954 Spouse standand deduction or exempt (e inat) Spouse ihemizes on a separate return or you were dual staus allen Spouse is blind Apt, ne. Presidential Eleetion Campaign Home address (number and streed It you hanve a P.O, box, see Instructions City, town or post oftion, state, and ap code. If you have a foreign address, attach Schedule Dependents (see instructions) If more than four dependents see Inst. and here Relationshp to you Social security number Credit for other dependents (1) First name Last return and accompanying chedules and aments, and to the best of my kowledge and bellel, they are r Under penaties of penury, I decdlare that I have examined this r oomect, and complete Declanation of preparer other than taxpayed) is based on all information of which preparer has any knowledge the IRS sent you an identity Profection PIN, enter Here Joint return See instructions Keep a copy for your records Date Your signature r the IRS sent you an Identity Protection Spouse's signature. If a joint returm, both must sign. Dat Firm's EIN Check it PTIN Preparer's signature Paid Preparer Use Only 3rd Party Dsie Salem ployed Phone no. Fm's name Finm's address Firm's name Form 1040 goi Cat. No. 113208 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. :1040 2018 on..an4 Rau-or 0e U.S. Individual Income Tax Return Fing status: sn* Your irst name and Initial P Married Your soctal security number 266 SL 11G Last name Albert Your standard deduction are blin Someone can claim you as a dependentYou were bon before Jenuary 2 1954You e Spouse's social seourity number spouse's first name and initial Last name 266 13411e 7 Pull year health care Someone can claim your spouse as Spouse was bom before January 2, 1954 Spouse standand deduction or exempt (e inat) Spouse ihemizes on a separate return or you were dual staus allen Spouse is blind Apt, ne. Presidential Eleetion Campaign Home address (number and streed It you hanve a P.O, box, see Instructions City, town or post oftion, state, and ap code. If you have a foreign address, attach Schedule Dependents (see instructions) If more than four dependents see Inst. and here Relationshp to you Social security number Credit for other dependents (1) First name Last return and accompanying chedules and aments, and to the best of my kowledge and bellel, they are r Under penaties of penury, I decdlare that I have examined this r oomect, and complete Declanation of preparer other than taxpayed) is based on all information of which preparer has any knowledge the IRS sent you an identity Profection PIN, enter Here Joint return See instructions Keep a copy for your records Date Your signature r the IRS sent you an Identity Protection Spouse's signature. If a joint returm, both must sign. Dat Firm's EIN Check it PTIN Preparer's signature Paid Preparer Use Only 3rd Party Dsie Salem ployed Phone no. Fm's name Finm's address Firm's name Form 1040 goi Cat. No. 113208 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions