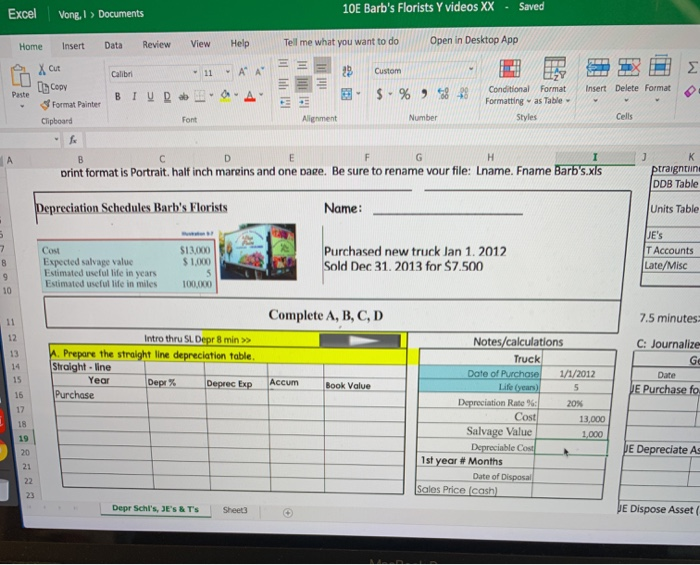

10E Barb's Florists Y videos XX Saved Excel Vong,I> Documents Open in Desktop App Tell me what you want to do Help Review View Data Insert Home A A Custom 11 Calibri Copy Paste Conditional Format Formatting as Table Insert Delete Format $-% I V Format Painter Cells Number Styles Alignment Font Clipboard G H I E C A ptraigntin DDB Table print format is Portrait. half inch mareins and one page. Be sure to rename vour file: Lname. Fname Barbs.xls Depreciation Schedules Barb's Florists Name: Units Table JE's T Accounts Late/Misc Purchased new truck Jan 1. 2012 Sold Dec 31. 2013 for $7.500 Cost Expected salvage value Estimated useful life in years Estimated useful life in miles $13,000 $1,000 8 100,000 10 Complete A, B, C, D 7.5 minutes: 11 12 Intro thru SL Depr 8 min Notes/calculations Truck Date of Purchasel Life (years) C: Journalize A. Prepare the straight line depreciation table. Straight-line 13 Ge 14 1/1/2012 Date 15 Year Accum Depr % Deprec Exp Book Value E Purchase fo. Purchase 16 Depreciation Rate % Cost 20% 17 13,000 18 Salvage Value Depreciable Cost 1,000 19 E Depreciate A 20 1st year # Months 21 Date of Disposal 22 Sales Price (cash) 23 E Dispose Asset ( Depr Schl's, JE's & Ts Sheet3 W 10E Barb's Florists Y videos XX Saved Excel Vong,I> Documents Open in Desktop App Tell me what you want to do Help Review View Data Insert Home A A Custom 11 Calibri Copy Paste Conditional Format Formatting as Table Insert Delete Format $-% I V Format Painter Cells Number Styles Alignment Font Clipboard G H I E C A ptraigntin DDB Table print format is Portrait. half inch mareins and one page. Be sure to rename vour file: Lname. Fname Barbs.xls Depreciation Schedules Barb's Florists Name: Units Table JE's T Accounts Late/Misc Purchased new truck Jan 1. 2012 Sold Dec 31. 2013 for $7.500 Cost Expected salvage value Estimated useful life in years Estimated useful life in miles $13,000 $1,000 8 100,000 10 Complete A, B, C, D 7.5 minutes: 11 12 Intro thru SL Depr 8 min Notes/calculations Truck Date of Purchasel Life (years) C: Journalize A. Prepare the straight line depreciation table. Straight-line 13 Ge 14 1/1/2012 Date 15 Year Accum Depr % Deprec Exp Book Value E Purchase fo. Purchase 16 Depreciation Rate % Cost 20% 17 13,000 18 Salvage Value Depreciable Cost 1,000 19 E Depreciate A 20 1st year # Months 21 Date of Disposal 22 Sales Price (cash) 23 E Dispose Asset ( Depr Schl's, JE's & Ts Sheet3 W