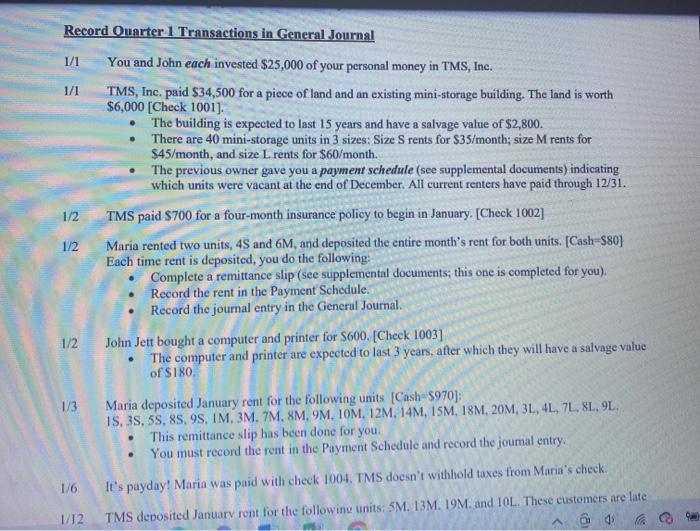

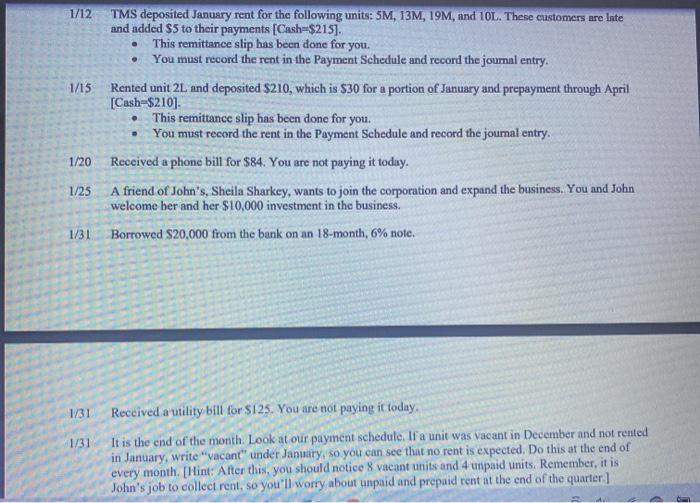

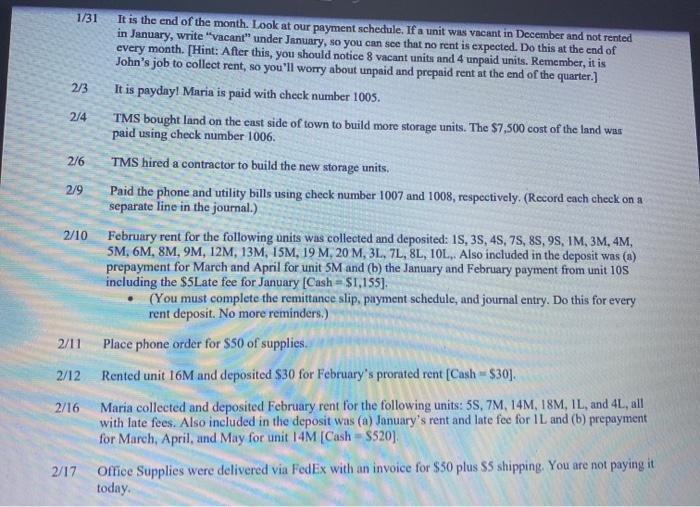

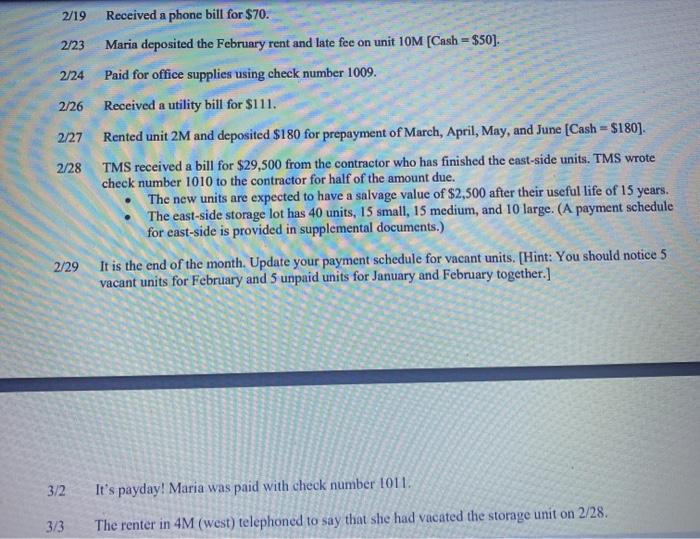

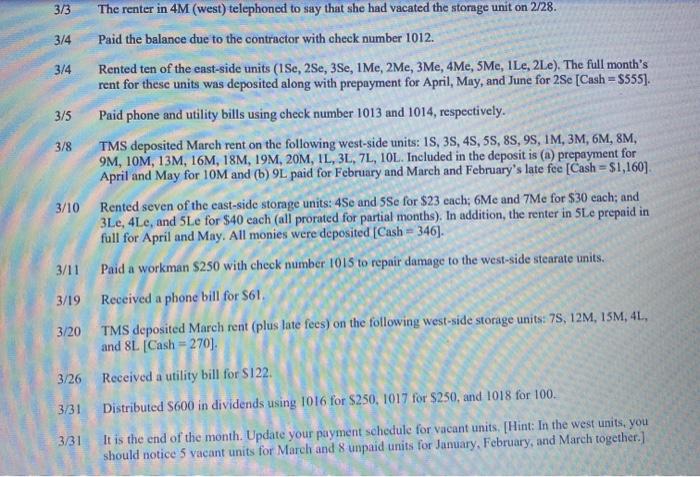

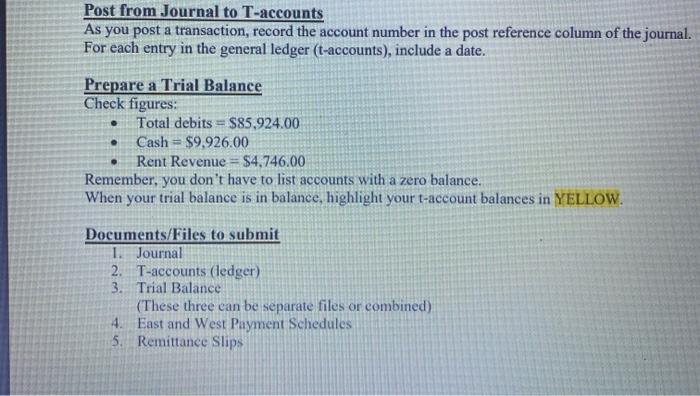

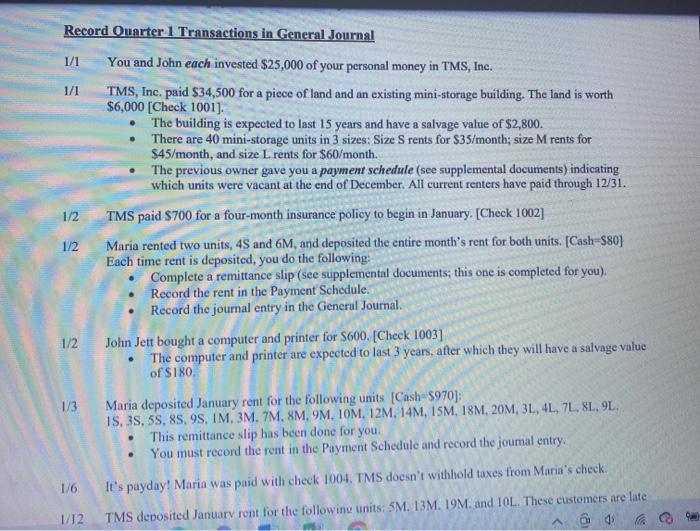

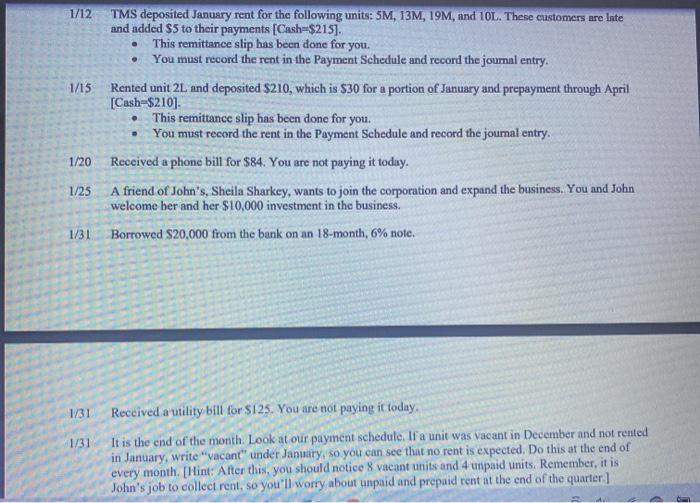

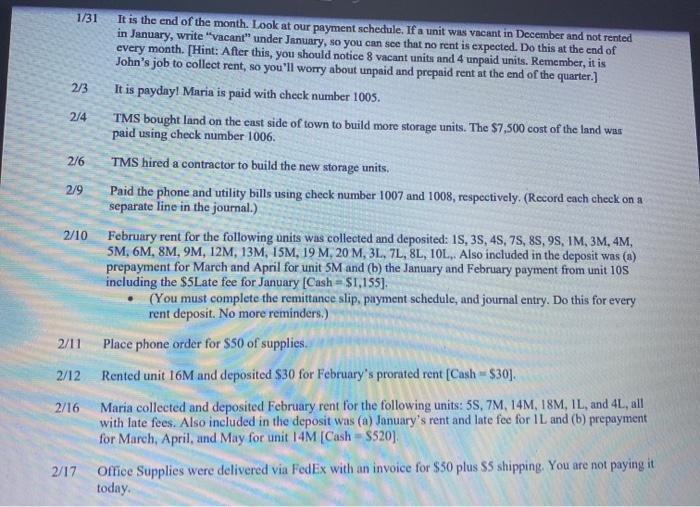

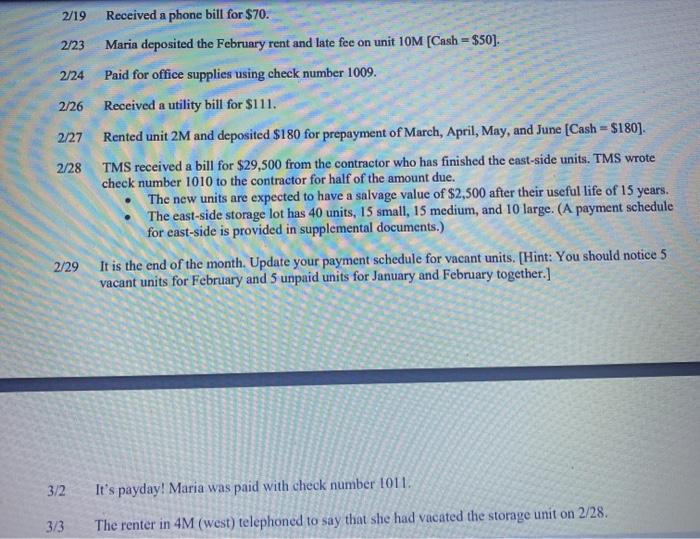

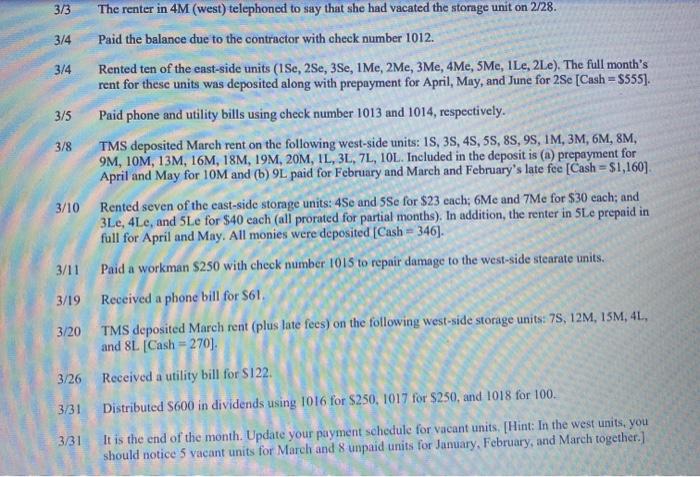

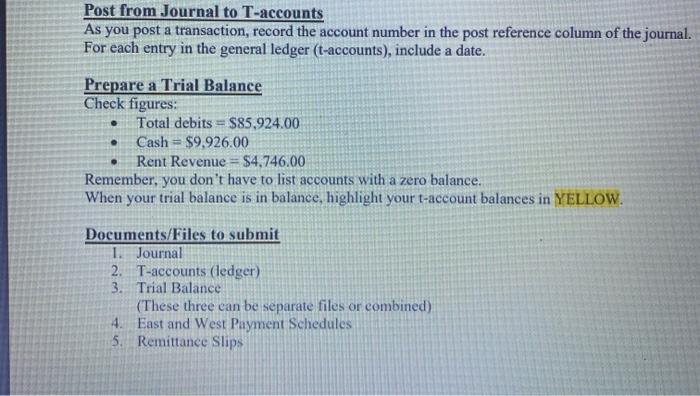

1/1 1/1 . Record Ouarter 1 Transactions in General Journal You and John each invested $25,000 of your personal money in TMS, Inc. TMS, Inc. paid $34,500 for a piece of land and an existing mini-storage building. The land is worth $6,000 (Check 1001]. The building is expected to last 15 years and have a salvage value of $2,800. There are 40 mini-storage units in 3 sizes: Size Srents for $35/month; size M rents for $45/month, and size L rents for $60/month. The previous owner gave you a payment schedule (see supplemental documents) indicating which units were vacant at the end of December. All current renters have paid through 12/31. TMS paid $700 for a four-month insurance policy to begin in January. (Check 1002] 1/2 Maria rented two units, 45 and 6M, and deposited the entire month's rent for both units. (Cash-580) Each time rent is deposited, you do the following: Complete a remittance slip (see supplemental documents, this one is completed for you). Record the rent in the Payment Schedule Record the journal entry in the General Journal 1/2 John Jett bought a computer and printer for S600. (Check 1003] The computer and printer are expected to last 3 years, after which they will have a salvage value of $180 1/2 1/3 Maria deposited January rent for the following units (Cash-S970): 15, 35, 5S, 85, 9S, IM, 3M. 7M, 8M, 9M, 10M, 12M. 14M, 15M, 18M. 20M, 3L, 4L, 7L. 8L. 9L. This remittance slip has been done for you. You must record the rent in the Payment Schedule and record the joumal entry It's payday! Maria was paid with check 1004. TMS doesn't withhold taxes from Maria's check. TMS deposited Januarv rent for the following units: 5M. 13M. 19M. and 10L. These customers are late 1 1/6 1/12 1/12 . 1/15 TMS deposited January rent for the following units: SM, 13M, 19M, and 10L. These customers are inte and added $5 to their payments [Cash=$215]. This remittance slip has been done for you. You must record the rent in the Payment Schedule and record the journal entry. Rented unit 2L and deposited $210, which is $30 for a portion of January and prepayment through April [Cash-$210) This remittance slip has been done for you. You must record the rent in the Payment Schedule and record the journal entry. Received a phone bill for $84. You are not paying it today. A friend of John's, Sheila Sharkey, wants to join the corporation and expand the business. You and John welcome her and her $10,000 investment in the business. Borrowed $20,000 from the bank on an 18-month, 6% note. 1/20 1/25 1/31 1/31 Received a utility bill for $125. You are not paying it today, 1/31 It is the end of the month. Look at our payment schedule. If a unit was vacant in December and not rented in January, write "vacant" under January, so you can see that no rent is expected. Do this at the end of every month. (Hint: After this, you should notice 8 vacant units and 4 unpaid units. Remember, it is John's job to collect rent, so you'll worry about unpaid and prepaid rent at the end of the quarter.] 1/31 It is the end of the month. Look at our payment schedule. If a unit was vocant in December and not rented in January, write "vacant" under January, so you can see that no rent is expected. Do this at the end of every month. (Hint: After this, you should notice 8 vacant units and 4 unpaid units. Remember, it is John's job to collect rent, so you'll worry about unpaid and prepaid rent at the end of the quarter.] 2/3 It is paydayl Maria is paid with check number 1005. 2/4 TMS bought land on the east side of town to build more storage units. The $7,500 cost of the land was paid using check number 1006. 2/6 TMS hired a contractor to build the new storage units. 2/9 Paid the phone and utility bills using check number 1007 and 1008, respectively. (Record cach check on a separate line in the journal.) 2/10 February rent for the following units was collected and deposited: 18, 38, 48, 7, 8, 98, IM, 3M, 4M, 5M, 6M, 8M, 9M, 12M, 13M, 15M, 19 M. 20 M, 3L, 7L, 8L, 10L.. Also included in the deposit was (a) prepayment for March and April for unit SM and (b) the January and February payment from unit 105 including the $5Late fee for January (Cash = $1,155]. (You must complete the remittance slip, payment schedule, and journal entry. Do this for every rent deposit. No more reminders.) 2/11 Place phone order for $50 of supplies 2/12 Rented unit 16M and deposited $30 for February's prorated rent (Cash = $30]. 2/16 Maria collected and deposited February rent for the following units: 58, 7M. 14M, 18M, IL, and 4L, all with late fees. Also included in the deposit was (a) January's rent and late fee for IL and (b) prepayment for March, April, and May for unit 14M (Cash - $520). 2/17 Office Supplies were delivered via FedEx with an invoice for $50 plus 55 shipping. You are not paying it today 2/19 2/26 Received a phone bill for $70. 2/23 Maria deposited the February rent and late fee on unit 10M (Cash = $50]. 2/24 Paid for office supplies using check number 1009. Received a utility bill for $111. 2/27 Rented unit 2M and deposited $180 for prepayment of March, April, May, and June (Cash = $180). 2/28 TMS received a bill for $29,500 from the contractor who has finished the east-side units. TMS wrote check number 1010 to the contractor for half of the amount due. The new units are expected to have a salvage value of $2,500 after their useful life of 15 years. The east-side storage lot has 40 units, 15 small, 15 medium, and 10 large. (A payment schedule for east-side is provided in supplemental documents.) 2/29 It is the end of the month. Update your payment schedule for vacant units. (Hint: You should notice 5 vacant units for February and 5 unpaid units for January and February together.] 3/2 It's payday! Maria was paid with check number 1011 3/3 The renter in 4M (west) telephoned to say that she had vacated the storage unit on 2/28. 3/4 3/5 3/3 The renter in 4M (west) telephoned to say that she had vacated the storage unit on 2/28. Paid the balance due to the contractor with check number 1012. 3/4 Rented ten of the east-side units (1 Se, 2S, 3Se, 1 Me, 2Me, 3Me, 4Me, 5Me, ILe, 2Le). The full month's rent for these units was deposited along with prepayment for April, May, and June for 2Se [Cash = $555). Paid phone and utility bills using check number 1013 and 1014, respectively. 3/8 TMS deposited March rent on the following west-side units: 18, 35, 48, 55, 88, 98, IM, 3M, 6M, 8M, 9M, 10M, 13M, 16M, 18M, 19M, 20M, IL, 3L, 7L, 10L. Included in the deposit is (a) prepayment for April and May for 10M and (b) 9L paid for February and March and February's late fee [Cash = $1,160) 3/10 Rented seven of the east-side storage units: 4Se and 5Se for $23 cach; 6Me and 7Me for $30 each; and 3Le, 4Le, and 5Le for $40 cach (all prorated for partial months). In addition, the renter in Le prepaid in full for April and May. All monies were deposited (Cash = 346). 3/11 Paid a workman S250 with check number 1015 to repair damage to the west-side stearate units. 3/19 Received a phone bill for $61. 3/20 TMS deposited March rent (plus late fees) on the following west-side storage units: 75, 12M, 15M, 4L, and 8L (Cash=2701 3/26 Received a utility bill for S122. 3/31 Distributed S600 in dividends using 1016 for $250, 1017 for $250, and 1018 for 100. 3/31 It is the end of the month. Update your payment schedule for vacant units. (Hint: In the west units, you should notice 5 vacant units for March and 8 unpaid units for January, February, and March together.] Post from Journal to T-accounts As you post a transaction, record the account number in the post reference column of the journal. For each entry in the general ledger (t-accounts), include a date. . Prepare a Trial Balance Check figures: Total debits $85,924.00 Cash = $9.926.00 Rent Revenue = $4,746.00 Remember, you don't have to list accounts with a zero balance. When your trial balance is in balance, highlight your t-account balances in YELLOW. . . Documents/Files to submit 1. Journal 2. T-accounts (ledger) 3. Trial Balance (These three can be separate files or combined) 4. East and West Payment Schedules 5. Remittance Slips 1/1 1/1 . Record Ouarter 1 Transactions in General Journal You and John each invested $25,000 of your personal money in TMS, Inc. TMS, Inc. paid $34,500 for a piece of land and an existing mini-storage building. The land is worth $6,000 (Check 1001]. The building is expected to last 15 years and have a salvage value of $2,800. There are 40 mini-storage units in 3 sizes: Size Srents for $35/month; size M rents for $45/month, and size L rents for $60/month. The previous owner gave you a payment schedule (see supplemental documents) indicating which units were vacant at the end of December. All current renters have paid through 12/31. TMS paid $700 for a four-month insurance policy to begin in January. (Check 1002] 1/2 Maria rented two units, 45 and 6M, and deposited the entire month's rent for both units. (Cash-580) Each time rent is deposited, you do the following: Complete a remittance slip (see supplemental documents, this one is completed for you). Record the rent in the Payment Schedule Record the journal entry in the General Journal 1/2 John Jett bought a computer and printer for S600. (Check 1003] The computer and printer are expected to last 3 years, after which they will have a salvage value of $180 1/2 1/3 Maria deposited January rent for the following units (Cash-S970): 15, 35, 5S, 85, 9S, IM, 3M. 7M, 8M, 9M, 10M, 12M. 14M, 15M, 18M. 20M, 3L, 4L, 7L. 8L. 9L. This remittance slip has been done for you. You must record the rent in the Payment Schedule and record the joumal entry It's payday! Maria was paid with check 1004. TMS doesn't withhold taxes from Maria's check. TMS deposited Januarv rent for the following units: 5M. 13M. 19M. and 10L. These customers are late 1 1/6 1/12 1/12 . 1/15 TMS deposited January rent for the following units: SM, 13M, 19M, and 10L. These customers are inte and added $5 to their payments [Cash=$215]. This remittance slip has been done for you. You must record the rent in the Payment Schedule and record the journal entry. Rented unit 2L and deposited $210, which is $30 for a portion of January and prepayment through April [Cash-$210) This remittance slip has been done for you. You must record the rent in the Payment Schedule and record the journal entry. Received a phone bill for $84. You are not paying it today. A friend of John's, Sheila Sharkey, wants to join the corporation and expand the business. You and John welcome her and her $10,000 investment in the business. Borrowed $20,000 from the bank on an 18-month, 6% note. 1/20 1/25 1/31 1/31 Received a utility bill for $125. You are not paying it today, 1/31 It is the end of the month. Look at our payment schedule. If a unit was vacant in December and not rented in January, write "vacant" under January, so you can see that no rent is expected. Do this at the end of every month. (Hint: After this, you should notice 8 vacant units and 4 unpaid units. Remember, it is John's job to collect rent, so you'll worry about unpaid and prepaid rent at the end of the quarter.] 1/31 It is the end of the month. Look at our payment schedule. If a unit was vocant in December and not rented in January, write "vacant" under January, so you can see that no rent is expected. Do this at the end of every month. (Hint: After this, you should notice 8 vacant units and 4 unpaid units. Remember, it is John's job to collect rent, so you'll worry about unpaid and prepaid rent at the end of the quarter.] 2/3 It is paydayl Maria is paid with check number 1005. 2/4 TMS bought land on the east side of town to build more storage units. The $7,500 cost of the land was paid using check number 1006. 2/6 TMS hired a contractor to build the new storage units. 2/9 Paid the phone and utility bills using check number 1007 and 1008, respectively. (Record cach check on a separate line in the journal.) 2/10 February rent for the following units was collected and deposited: 18, 38, 48, 7, 8, 98, IM, 3M, 4M, 5M, 6M, 8M, 9M, 12M, 13M, 15M, 19 M. 20 M, 3L, 7L, 8L, 10L.. Also included in the deposit was (a) prepayment for March and April for unit SM and (b) the January and February payment from unit 105 including the $5Late fee for January (Cash = $1,155]. (You must complete the remittance slip, payment schedule, and journal entry. Do this for every rent deposit. No more reminders.) 2/11 Place phone order for $50 of supplies 2/12 Rented unit 16M and deposited $30 for February's prorated rent (Cash = $30]. 2/16 Maria collected and deposited February rent for the following units: 58, 7M. 14M, 18M, IL, and 4L, all with late fees. Also included in the deposit was (a) January's rent and late fee for IL and (b) prepayment for March, April, and May for unit 14M (Cash - $520). 2/17 Office Supplies were delivered via FedEx with an invoice for $50 plus 55 shipping. You are not paying it today 2/19 2/26 Received a phone bill for $70. 2/23 Maria deposited the February rent and late fee on unit 10M (Cash = $50]. 2/24 Paid for office supplies using check number 1009. Received a utility bill for $111. 2/27 Rented unit 2M and deposited $180 for prepayment of March, April, May, and June (Cash = $180). 2/28 TMS received a bill for $29,500 from the contractor who has finished the east-side units. TMS wrote check number 1010 to the contractor for half of the amount due. The new units are expected to have a salvage value of $2,500 after their useful life of 15 years. The east-side storage lot has 40 units, 15 small, 15 medium, and 10 large. (A payment schedule for east-side is provided in supplemental documents.) 2/29 It is the end of the month. Update your payment schedule for vacant units. (Hint: You should notice 5 vacant units for February and 5 unpaid units for January and February together.] 3/2 It's payday! Maria was paid with check number 1011 3/3 The renter in 4M (west) telephoned to say that she had vacated the storage unit on 2/28. 3/4 3/5 3/3 The renter in 4M (west) telephoned to say that she had vacated the storage unit on 2/28. Paid the balance due to the contractor with check number 1012. 3/4 Rented ten of the east-side units (1 Se, 2S, 3Se, 1 Me, 2Me, 3Me, 4Me, 5Me, ILe, 2Le). The full month's rent for these units was deposited along with prepayment for April, May, and June for 2Se [Cash = $555). Paid phone and utility bills using check number 1013 and 1014, respectively. 3/8 TMS deposited March rent on the following west-side units: 18, 35, 48, 55, 88, 98, IM, 3M, 6M, 8M, 9M, 10M, 13M, 16M, 18M, 19M, 20M, IL, 3L, 7L, 10L. Included in the deposit is (a) prepayment for April and May for 10M and (b) 9L paid for February and March and February's late fee [Cash = $1,160) 3/10 Rented seven of the east-side storage units: 4Se and 5Se for $23 cach; 6Me and 7Me for $30 each; and 3Le, 4Le, and 5Le for $40 cach (all prorated for partial months). In addition, the renter in Le prepaid in full for April and May. All monies were deposited (Cash = 346). 3/11 Paid a workman S250 with check number 1015 to repair damage to the west-side stearate units. 3/19 Received a phone bill for $61. 3/20 TMS deposited March rent (plus late fees) on the following west-side storage units: 75, 12M, 15M, 4L, and 8L (Cash=2701 3/26 Received a utility bill for S122. 3/31 Distributed S600 in dividends using 1016 for $250, 1017 for $250, and 1018 for 100. 3/31 It is the end of the month. Update your payment schedule for vacant units. (Hint: In the west units, you should notice 5 vacant units for March and 8 unpaid units for January, February, and March together.] Post from Journal to T-accounts As you post a transaction, record the account number in the post reference column of the journal. For each entry in the general ledger (t-accounts), include a date. . Prepare a Trial Balance Check figures: Total debits $85,924.00 Cash = $9.926.00 Rent Revenue = $4,746.00 Remember, you don't have to list accounts with a zero balance. When your trial balance is in balance, highlight your t-account balances in YELLOW. . . Documents/Files to submit 1. Journal 2. T-accounts (ledger) 3. Trial Balance (These three can be separate files or combined) 4. East and West Payment Schedules 5. Remittance Slips