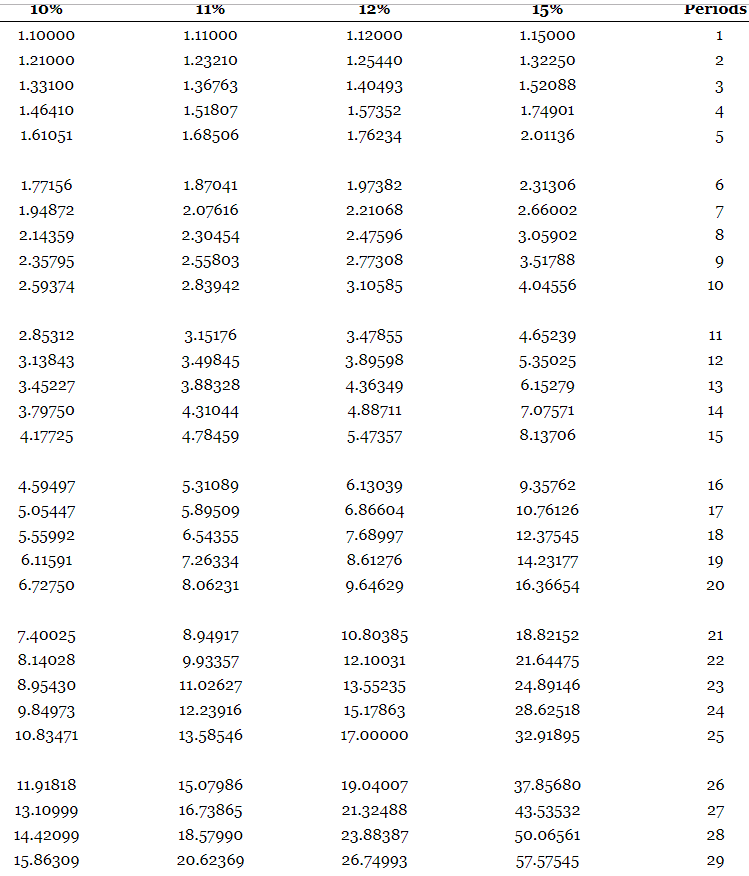

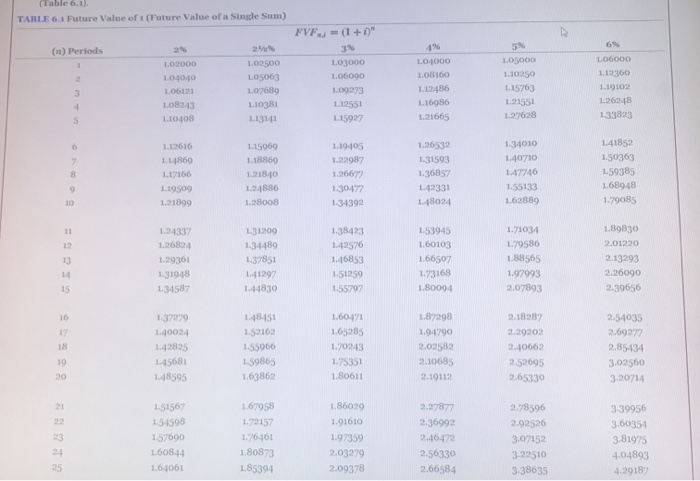

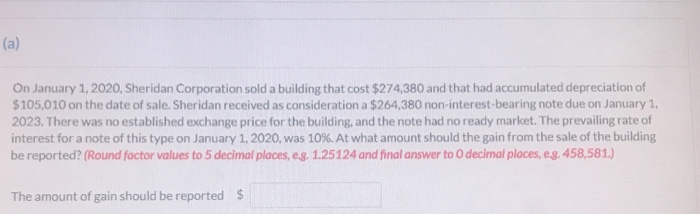

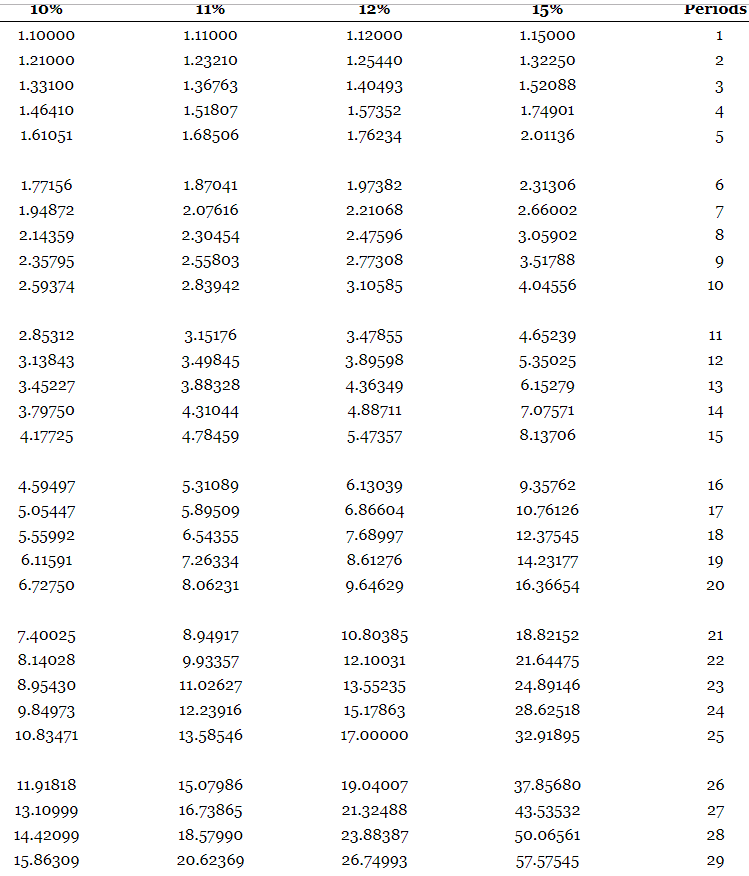

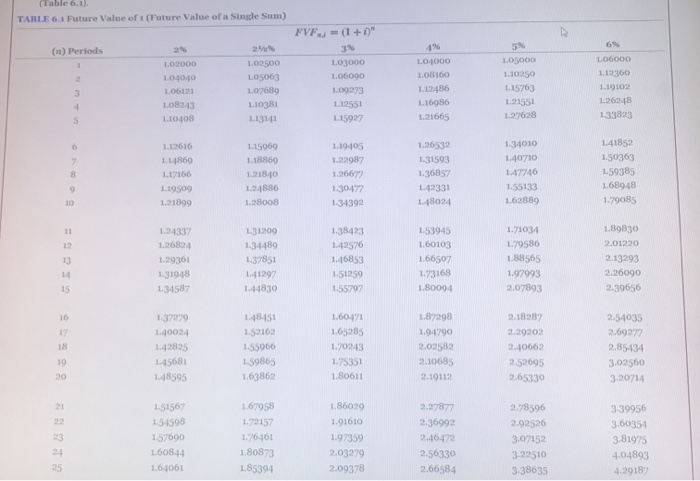

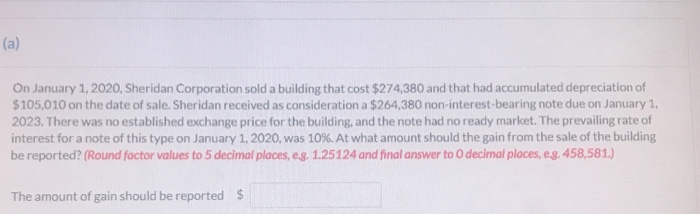

11% 12% Periods 1.12000 10% 1.10000 1.21000 1.33100 1.46410 1.61051 1.11000 1.23210 1.36763 1.51807 1.68506 1.25440 1.40493 1.57352 1.76234 15% 1.15000 1.32250 1.52088 1.74901 2.01136 1.77156 1.94872 2.14359 2.35795 2.59374 1.87041 2.07616 2.30454 2.55803 2.83942 1.97382 2.21068 2.47596 2.77308 3.10585 2.31306 2.66002 3.05902 3-51788 4.04556 2.85312 3.13843 3-45227 3.79750 4.17725 3.15176 3-49845 3.88328 4-31044 4.78459 3-47855 3.89598 4.36349 4.88711 5.47357 4.65239 5-35025 6.15279 7.07571 8.13706 4-59497 5.05447 5-55992 6.11591 6.72750 5.31089 5.89509 6.54355 7.26334 8.06231 6.13039 6.86604 7.68997 8.61276 9.64629 9.35762 10.76126 12.37545 14.23177 16.36654 7.40025 8.14028 8.95430 9.84973 10.83471 8.94917 9.93357 11.02627 12.23916 13-58546 10.80385 12.10031 13-55235 15.17863 17.00000 18.82152 21.64475 24.89146 28.62518 32.91895 11.91818 13.10999 1442099 15.86309 15.07986 16.73865 18.57990 20.62369 19.04007 21.32488 23.88387 26.74993 37.85680 43-53532 50.06561 57-57545 (Table 6.1). TAHLE 6.1 Future Value of 1 (Future Value of a Single Sum) FVF. =(1+1)" (1) Periods L02000 104040 106121 1.08243 1.10408 2 100500 105063 1.07689 110381 113141 1.03000 1.06090 1.09273 1.12551 1.15927 4% 104000 1.08160 1.12486 1.16986 1.21665 1.05000 1.10250 1.15763 1.21551 1.27628 1.00000 1.12360 1.10102 1.26248 133823 1.19405 1.22987 1.12616 114869 1.17166 1.19509 1.21899 1.15969 1.18869 1.21840 1.24886 1.28008 1.26532 1.31593 1.36857 142331 1.48024 1.34010 1.40710 1.47746 1.55133 1.62889 1.41852 1.50363 1.59385 1.68948 1.79085 1.30477 1.34392 1.24337 1.26824 1.29361 1.31948 1.34587 1.31209 1.34489 1.37851 1.41297 1.44830 1.38423 1.42576 1.46853 1.51259 1.55707 1.53945 1.60103 1.66507 1.73168 1.80094 1.71034 1.79586 1.88565 1.97993 2.07893 1.89830 2.01220 2.13293 2.26090 2.39656 137979 1.40024 1.42825 1.45681 1.48595 1.48451 1.52162 1.55966 1.59865 163862 1.60471 1.65285 1.70243 1.75351 1.80611 1.87298 1.94790 2.02582 2.10685 2.19112 2.18287 2.29202 2.40062 2.52695 2.65330 2.54035 2.69277 2.85434 3.02560 3.20714 1.51567 1.54598 1.57690 1.60844 1.64061 1.67958 1.72157 1.76461 1.80873 1.85394 1.86029 1.91610 1.97359 2.03279 2.09378 2.27877 2,36992 2.46472 2.56330 2.66584 2.78596 2.92526 3.07152 3.22510 3.38635 339956 3.00354 3.81975 4.04893 4.29187 (a) On January 1, 2020, Sheridan Corporation sold a building that cost $274,380 and that had accumulated depreciation of $105,010 on the date of sale. Sheridan received as consideration a $264,380 non-interest-bearing note due on January 1, 2023. There was no established exchange price for the building, and the note had no ready market. The prevailing rate of interest for a note of this type on January 1, 2020, was 10%. At what amount should the gain from the sale of the building be reported? (Round factor values to 5 decimal places, eg. 1.25124 and final answer to 0 decimal places, eg. 458,581.) The amount of gain should be reported $