Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12. [0.75 pt.] Two companies, ABC and XYZ, have the following values on their annual tax returns: Company Sales revenue, $ ABC XYZ 1,500,000

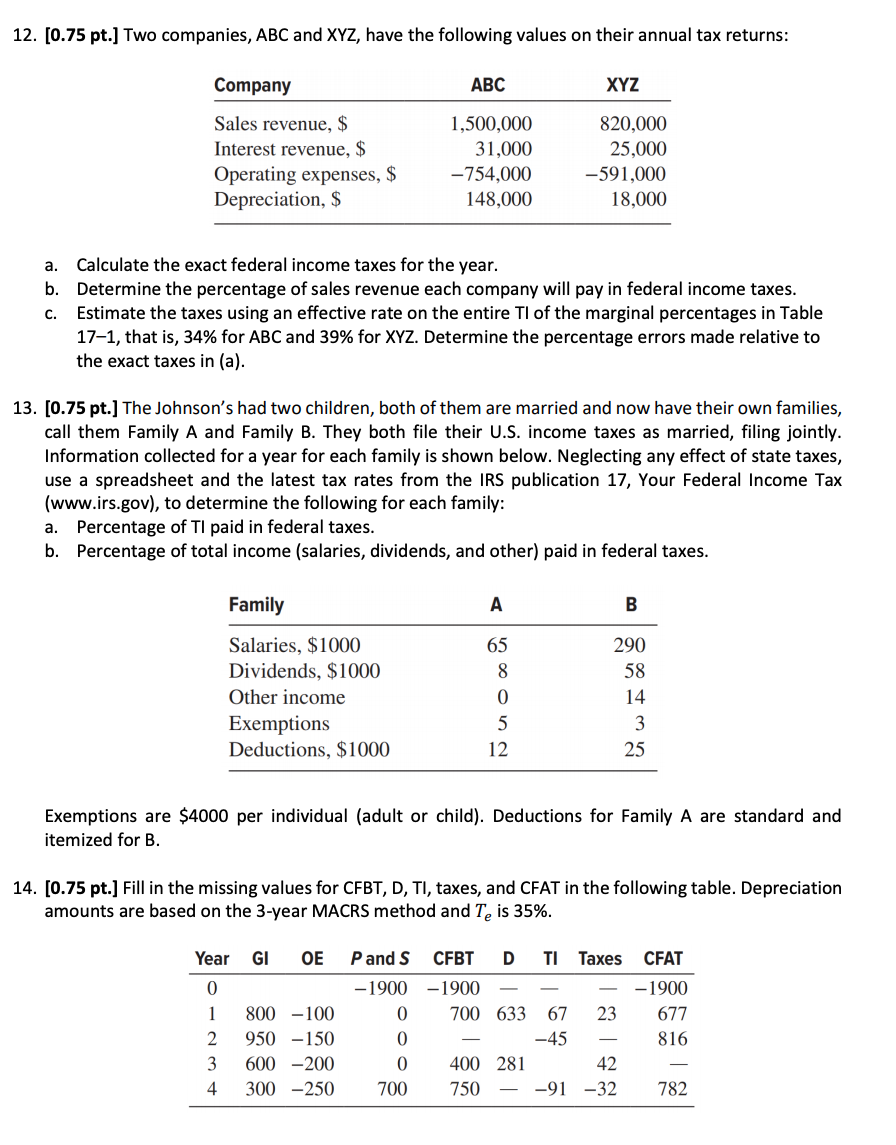

12. [0.75 pt.] Two companies, ABC and XYZ, have the following values on their annual tax returns: Company Sales revenue, $ ABC XYZ 1,500,000 820,000 Interest revenue, $ 31,000 25,000 Operating expenses, $ Depreciation, S -754,000 -591,000 148,000 18,000 a. Calculate the exact federal income taxes for the year. C. b. Determine the percentage of sales revenue each company will pay in federal income taxes. Estimate the taxes using an effective rate on the entire TI of the marginal percentages in Table 17-1, that is, 34% for ABC and 39% for XYZ. Determine the percentage errors made relative to the exact taxes in (a). 13. [0.75 pt.] The Johnson's had two children, both of them are married and now have their own families, call them Family A and Family B. They both file their U.S. income taxes as married, filing jointly. Information collected for a year for each family is shown below. Neglecting any effect of state taxes, use a spreadsheet and the latest tax rates from the IRS publication 17, Your Federal Income Tax (www.irs.gov), to determine the following for each family: a. Percentage of TI paid in federal taxes. b. Percentage of total income (salaries, dividends, and other) paid in federal taxes. Family A B Salaries, $1000 65 290 Dividends, $1000 8 58 Other income 0 14 Exemptions 5 3 Deductions, $1000 12 25 Exemptions are $4000 per individual (adult or child). Deductions for Family A are standard and itemized for B. 14. [0.75 pt.] Fill in the missing values for CFBT, D, TI, taxes, and CFAT in the following table. Depreciation amounts are based on the 3-year MACRS method and Te is 35%. Year Gl OE Pand S CFBT D TI Taxes CFAT 0 -1900-1900 - - -1900 1 800-100 0 700 633 67 23 677 2 950 -150 0 -45 - 816 3 600 -200 0 400 281 42 4 300-250 700 750 - -91-32 782

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started