Answered step by step

Verified Expert Solution

Question

1 Approved Answer

12. Indirect business taxes and capital consump- tion allowance are not income, yet they are. included in order to find GDP as income received.

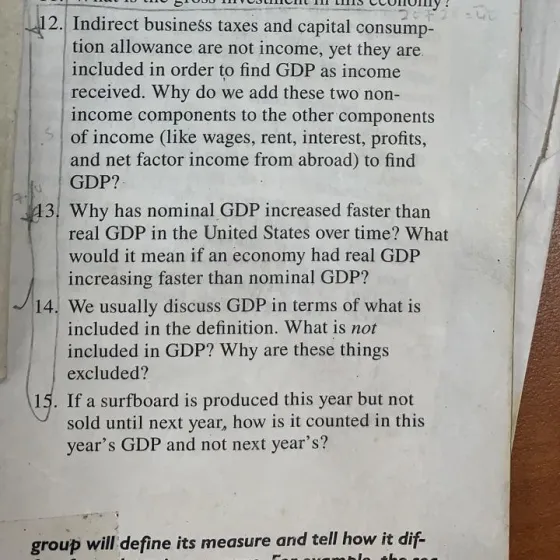

12. Indirect business taxes and capital consump- tion allowance are not income, yet they are. included in order to find GDP as income received. Why do we add these two non- income components to the other components of income (like wages, rent, interest, profits, and net factor income from abroad) to find GDP? 13. Why has nominal GDP increased faster than real GDP in the United States over time? What would it mean if an economy had real GDP increasing faster than nominal GDP? 14. We usually discuss GDP in terms of what is included in the definition. What is not included in GDP? Why are these things excluded? 15. If a surfboard is produced this year but not sold until next year, how is it counted in this year's GDP and not next year's? group will define its measure and tell how it dif-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Understanding GDP and its components Ill address your questions about Gross Domestic Product GDP 12 Indirect Business Taxes and Capital Consumption Allowance in GDP While youre right that indirect bus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started