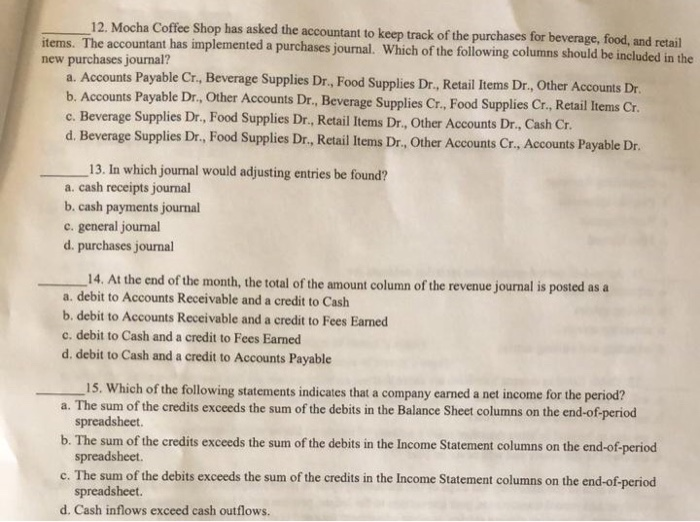

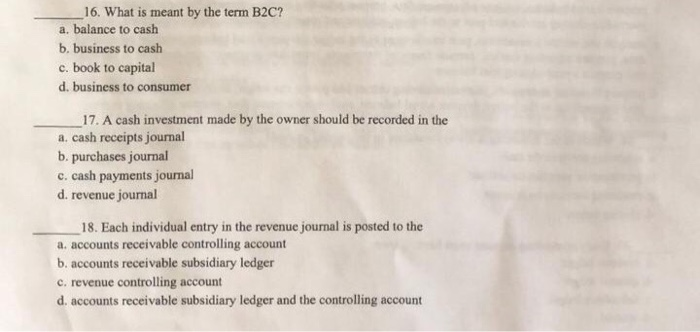

12. Mocha Coffee Shop has asked the accountant to keep track of the purchases for beverage, food, and retail items. The accountant has implemented a purchases journal. Which of the following columns should be included in the new purchases journal? a. Accounts Payable Cr., Beverage Supplies Dr., Food Supplies Dr., Retail Items Dr., Other Accounts Dr. b. Accounts Payable Dr., Other Accounts Dr., Beverage Supplies Cr., Food Supplies Cr., Retail Items Cr. c. Beverage Supplies Dr., Food Supplies Dr., Retail Items Dr. Other Accounts Dr., Cash Cr. d. Beverage Supplies Dr., Food Supplies Dr., Retail Items Dr., Other Accounts Cr., Accounts Payable Dr. 13. In which journal would adjusting entries be found? a. cash receipts journal b. cash payments journal c. general journal d. purchases journal _14. At the end of the month, the total of the amount column of the revenue journal is posted as a a. debit to Accounts Receivable and a credit to Cash b. debit to Accounts Receivable and a credit to Fees Eamed c. debit to Cash and a credit to Fees Eamed d. debit to Cash and a credit to Accounts Payable 15. Which of the following statements indicates that a company cared a net income for the period? a. The sum of the credits exceeds the sum of the debits in the Balance Sheet columns on the end-of-period spreadsheet. b. The sum of the credits exceeds the sum of the debits in the Income Statement columns on the end-of-period spreadsheet e. The sum of the debits exceeds the sum of the credits in the Income Statement columns on the end-of-period spreadsheet. d. Cash inflows exceed cash outflows. 16. What is meant by the term B2C? a. balance to cash b. business to cash c. book to capital d. business to consumer 17. A cash investment made by the owner should be recorded in the a. cash receipts journal b. purchases journal c. cash payments journal d. revenue journal 18. Each individual entry in the revenue journal is posted to the a. accounts receivable controlling account b. accounts receivable subsidiary ledger c. revenue controlling account d. accounts receivable subsidiary ledger and the controlling account