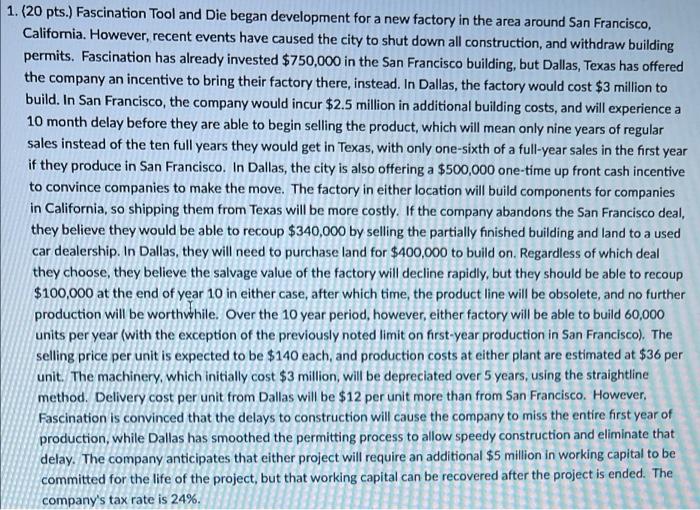

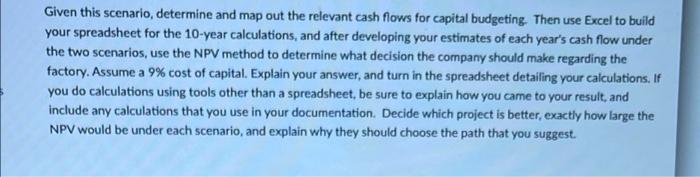

1.(20 pts.) Fascination Tool and Die began development for a new factory in the area around San Francisco, California. However, recent events have caused the city to shut down all construction, and withdraw building permits. Fascination has already invested $750,000 in the San Francisco building, but Dallas, Texas has offered the company an incentive to bring their factory there, instead. In Dallas, the factory would cost $3 million to build. In San Francisco, the company would incur $2.5 million in additional building costs, and will experience a 10 month delay before they are able to begin selling the product, which will mean only nine years of regular sales instead of the ten full years they would get in Texas, with only one-sixth of a full-year sales in the first year if they produce in San Francisco. In Dallas, the city is also offering a $500,000 one-time up front cash incentive to convince companies to make the move. The factory in either location will build components for companies in California, so shipping them from Texas will be more costly. If the company abandons the San Francisco deal, they believe they would be able recoup $340,000 by selling the partially finished building and land to a used car dealership. In Dallas, they will need to purchase land for $400,000 to build on. Regardless of which deal they choose, they believe the salvage value of the factory will decline rapidly, but they should be able to recoup $100,000 at the end of year 10 in either case, after which time, the product line will be obsolete, and no further production will be worthwhile. Over the 10 year period, however, either factory will be able to build 60,000 units per year (with the exception of the previously noted limit on first-year production in San Francisco). The selling price per unit is expected to be $140 each, and production costs at either plant are estimated at $36 per unit. The machinery, which initially cost $3 million, will be depreciated over 5 years, using the straightline method. Delivery cost per unit from Dallas will be $12 per unit more than from San Francisco. However, Fascination is convinced that the delays to construction will cause the company to miss the entire first year of production, while Dallas has smoothed the permitting process to allow speedy construction and eliminate that delay. The company anticipates that either project will require an additional $5 million in working capital to be committed for the life of the project, but that working capital can be recovered after the project is ended. The company's tax rate is 24%. Given this scenario, determine and map out the relevant cash flows for capital budgeting. Then use Excel to build your spreadsheet for the 10-year calculations, and after developing your estimates of each year's cash flow under the two scenarios, use the NPV method to determine what decision the company should make regarding the factory. Assume a 9% cost of capital. Explain your answer, and turn in the spreadsheet detailing your calculations. If you do calculations using tools other than a spreadsheet, be sure to explain how you came to your result, and include any calculations that you use in your documentation. Decide which project is better, exactly how large the NPV would be under each scenario, and explain why they should choose the path that you suggest. 1.(20 pts.) Fascination Tool and Die began development for a new factory in the area around San Francisco, California. However, recent events have caused the city to shut down all construction, and withdraw building permits. Fascination has already invested $750,000 in the San Francisco building, but Dallas, Texas has offered the company an incentive to bring their factory there, instead. In Dallas, the factory would cost $3 million to build. In San Francisco, the company would incur $2.5 million in additional building costs, and will experience a 10 month delay before they are able to begin selling the product, which will mean only nine years of regular sales instead of the ten full years they would get in Texas, with only one-sixth of a full-year sales in the first year if they produce in San Francisco. In Dallas, the city is also offering a $500,000 one-time up front cash incentive to convince companies to make the move. The factory in either location will build components for companies in California, so shipping them from Texas will be more costly. If the company abandons the San Francisco deal, they believe they would be able recoup $340,000 by selling the partially finished building and land to a used car dealership. In Dallas, they will need to purchase land for $400,000 to build on. Regardless of which deal they choose, they believe the salvage value of the factory will decline rapidly, but they should be able to recoup $100,000 at the end of year 10 in either case, after which time, the product line will be obsolete, and no further production will be worthwhile. Over the 10 year period, however, either factory will be able to build 60,000 units per year (with the exception of the previously noted limit on first-year production in San Francisco). The selling price per unit is expected to be $140 each, and production costs at either plant are estimated at $36 per unit. The machinery, which initially cost $3 million, will be depreciated over 5 years, using the straightline method. Delivery cost per unit from Dallas will be $12 per unit more than from San Francisco. However, Fascination is convinced that the delays to construction will cause the company to miss the entire first year of production, while Dallas has smoothed the permitting process to allow speedy construction and eliminate that delay. The company anticipates that either project will require an additional $5 million in working capital to be committed for the life of the project, but that working capital can be recovered after the project is ended. The company's tax rate is 24%. Given this scenario, determine and map out the relevant cash flows for capital budgeting. Then use Excel to build your spreadsheet for the 10-year calculations, and after developing your estimates of each year's cash flow under the two scenarios, use the NPV method to determine what decision the company should make regarding the factory. Assume a 9% cost of capital. Explain your answer, and turn in the spreadsheet detailing your calculations. If you do calculations using tools other than a spreadsheet, be sure to explain how you came to your result, and include any calculations that you use in your documentation. Decide which project is better, exactly how large the NPV would be under each scenario, and explain why they should choose the path that you suggest