Question

Consider the following alternatives: Alternative 1 Alternative 3 Alternative 2 First cost ($) 170,000 120,000 100,000 Net cash flow per year ($/year) 34,500 24,000

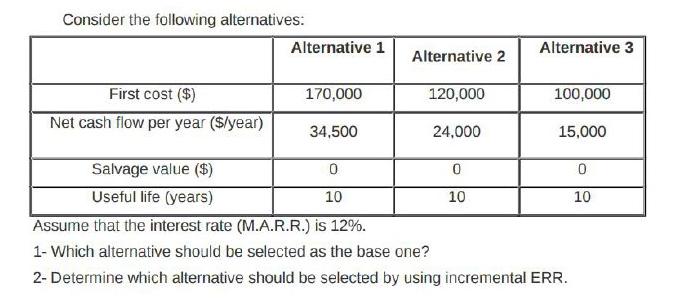

Consider the following alternatives: Alternative 1 Alternative 3 Alternative 2 First cost ($) 170,000 120,000 100,000 Net cash flow per year ($/year) 34,500 24,000 15,000 Salvage value ($) 0 0 0 Useful life (years) 10 10 10 Assume that the interest rate (M.A.R.R.) is 12%. 1- Which alternative should be selected as the base one? 2- Determine which alternative should be selected by using incremental ERR.

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 To determine which alternative should be selected as the base one we can use the Present Worth PW ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Matlab An Introduction with Applications

Authors: Amos Gilat

5th edition

1118629868, 978-1118801802, 1118801806, 978-1118629864

Students also viewed these Physics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App