Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13-1A PART B1 13-2-A QUESTION.. Problem 13-1A (Part Level Submission) Here are comparative statement data for Pharoah Company and Cullumber Company, two competitors. All balance

13-1A PART B1

13-2-A QUESTION..

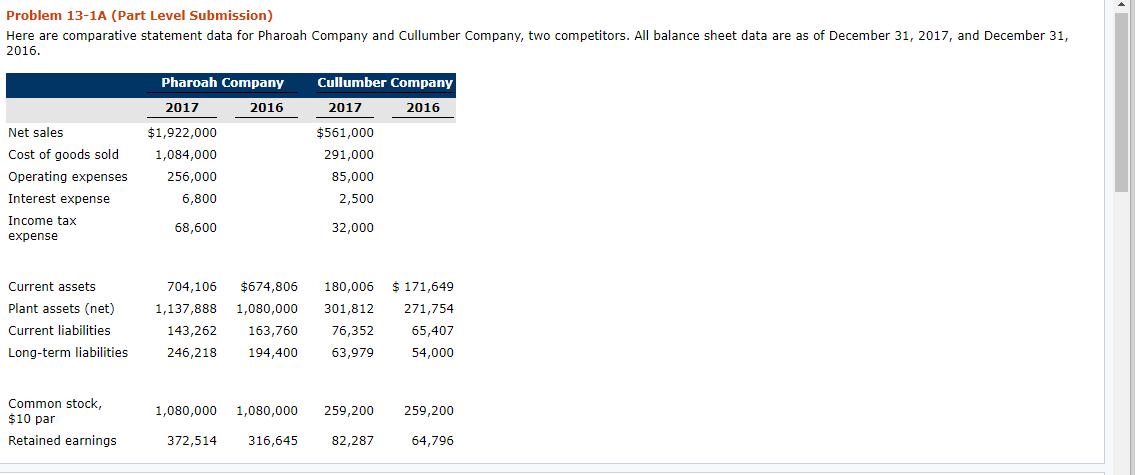

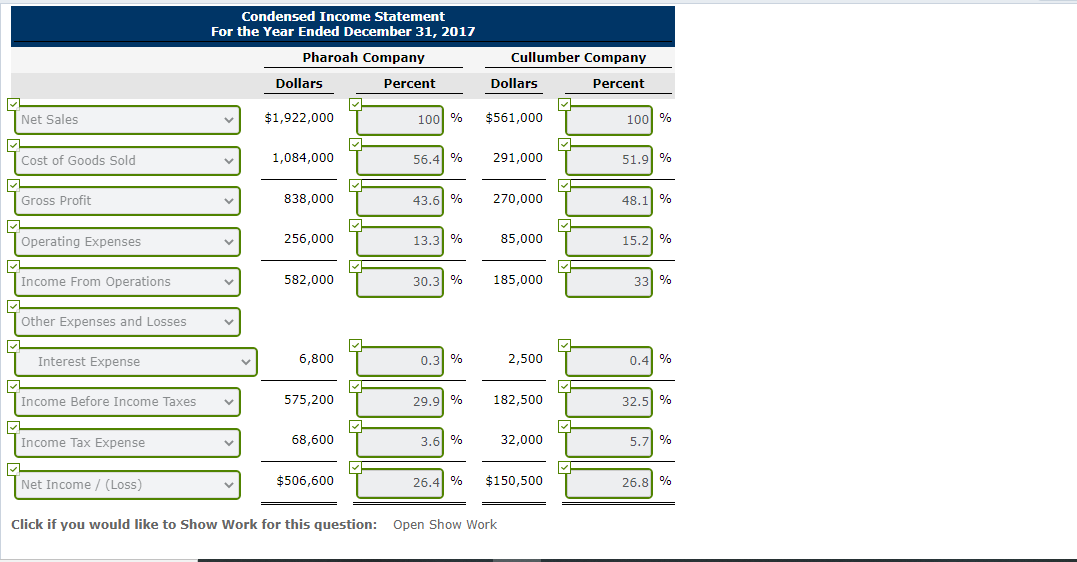

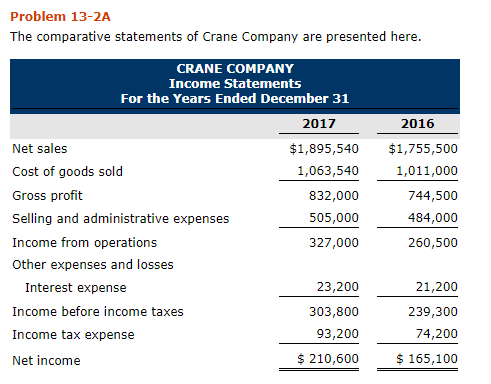

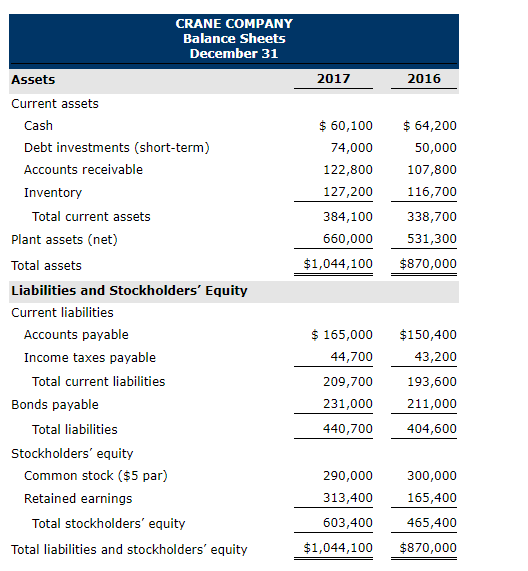

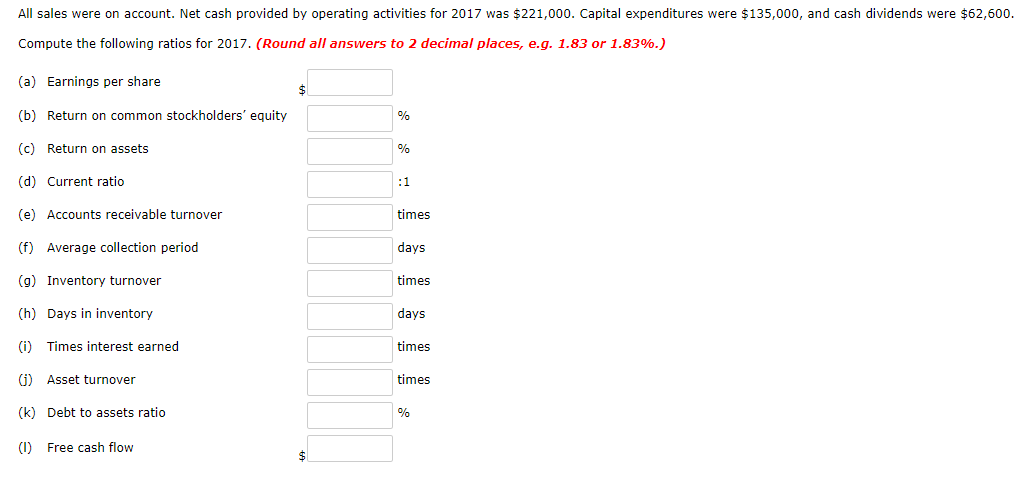

Problem 13-1A (Part Level Submission) Here are comparative statement data for Pharoah Company and Cullumber Company, two competitors. All balance sheet data are as of December 31, 2017, and December 31, 2016. Cullumber Company Pharoah Company 2017 2016 2017 2016 Net sales Cost of goods sold Operating expenses Interest expense Income tax expense $1,922,000 1,084,000 256,000 6,800 $561,000 291,000 85,000 2,500 68,600 32,000 Current assets Plant assets (net) Current liabilities Long-term liabilities 704,106 1,137,888 143,262 246,218 $674,806 1,080,000 163,760 194,400 180,006 301,812 76,352 63,979 $ 171,649 271,754 65,407 54,000 1,080,000 1,080,000 259,200 259,200 Common stock, $10 par Retained earnings 372,514 316,645 82,287 64,796 Condensed Income Statement For the Year Ended December 31, 2017 Pharoah Company Cullumber Company Dollars Percent Dollars Percent Net Sales $1,922,000 100 % $561,000 100 % Cost of Goods Sold 1,084,000 56.41 % 291,000 51.91 % Gross Profit 838,000 43.61% 270,000 48.1 % Operating Expenses 256,000 13.31 % 85,000 15.2 % Income From Operations 582,000 30.31% 185,000 331 % Other Expenses and Losses Interest Expense 6,800 0.3 % 2,500 0.41 % Income Before Income Taxes 575,200 29.90 % 182,500 32.5 % Income Tax Expense 68,600 3.6 % 32,000 5.71 % Net Income / (Loss) $506,600 26.4 % $150,500 26.8 % Click if you would like to Show Work for this question: Open Show Work (b1) Compute the 2017 return on assets and the return on common stockholders' equity for both companies. (Round all ratios to 1 decimal place, e.g. 2.5%.) Pharoah Company Cullumber Company Return on assets % % Return on common stockholders' equity % % Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT LINK TO TEXT Problem 13-2A The comparative statements of Crane Company are presented here. 2016 CRANE COMPANY Income Statements For the Years Ended December 31 2017 Net sales $1,895,540 Cost of goods sold 1,063,540 Gross profit 832,000 Selling and administrative expenses 505,000 Income from operations 327,000 Other expenses and losses Interest expense 23,200 Income before income taxes 303,800 Income tax expense 93,200 Net income $ 210,600 $1,755,500 1,011,000 744,500 484,000 260,500 21,200 239,300 74,200 $ 165,100 2017 2016 $ 60,100 74,000 122,800 127,200 384,100 660,000 $1,044,100 $ 64,200 50,000 107,800 116,700 338,700 531,300 $870,000 CRANE COMPANY Balance Sheets December 31 Assets Current assets Cash Debt investments (short-term) Accounts receivable Inventory Total current assets Plant assets (net) Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Income taxes payable Total current liabilities Bonds payable Total liabilities Stockholders' equity Common stock ($5 par) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 165,000 44,700 209,700 231,000 $150,400 43,200 193,600 211,000 404,600 440,700 290,000 313,400 603,400 $1,044,100 300,000 165,400 465,400 $870,000 All sales were on account. Net cash provided by operating activities for 2017 was $221,000. Capital expenditures were $135,000, and cash dividends were $62,600. Compute the following ratios for 2017. (Round all answers to 2 decimal places, e.g. 1.83 or 1.83%.) (a) Earnings per share $ (b) Return on common stockholders' equity % (c) Return on assets % (d) Current ratio :1 (e) Accounts receivable turnover times (f) Average collection period days (9) Inventory turnover times (h) Days in inventory days () Times interest earned times () Asset turnover times (k) Debt to assets ratio % (1) Free cash flow $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started