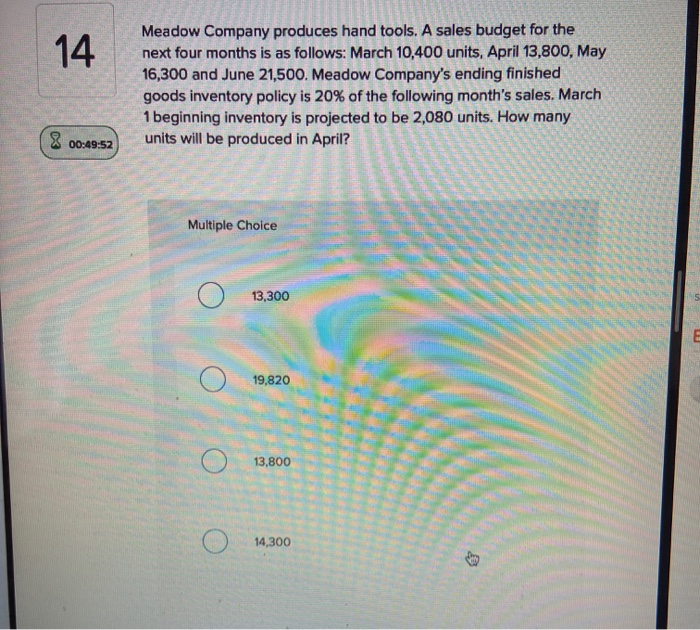

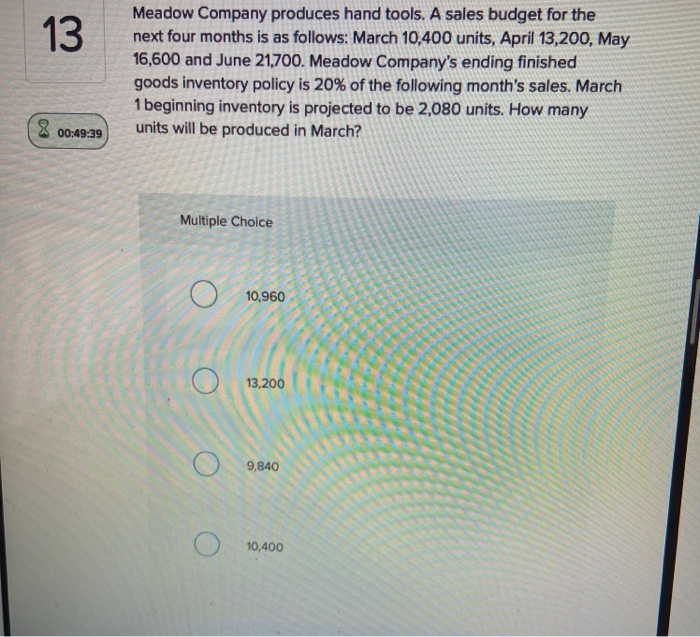

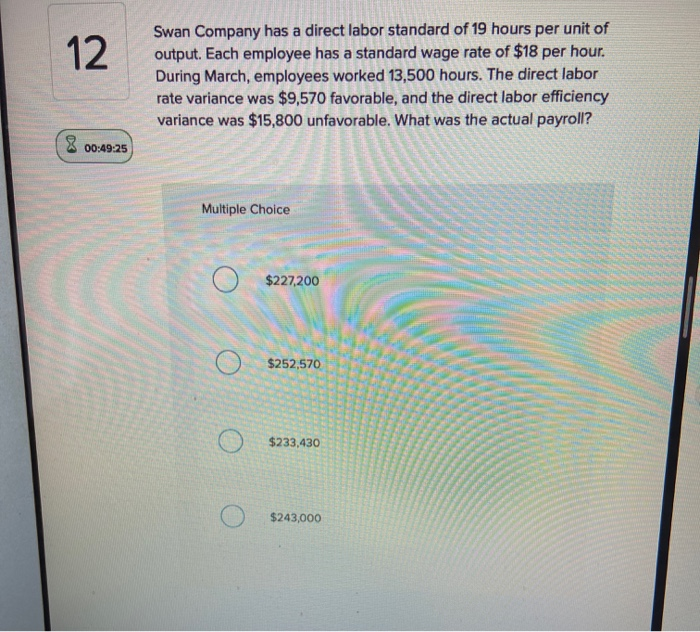

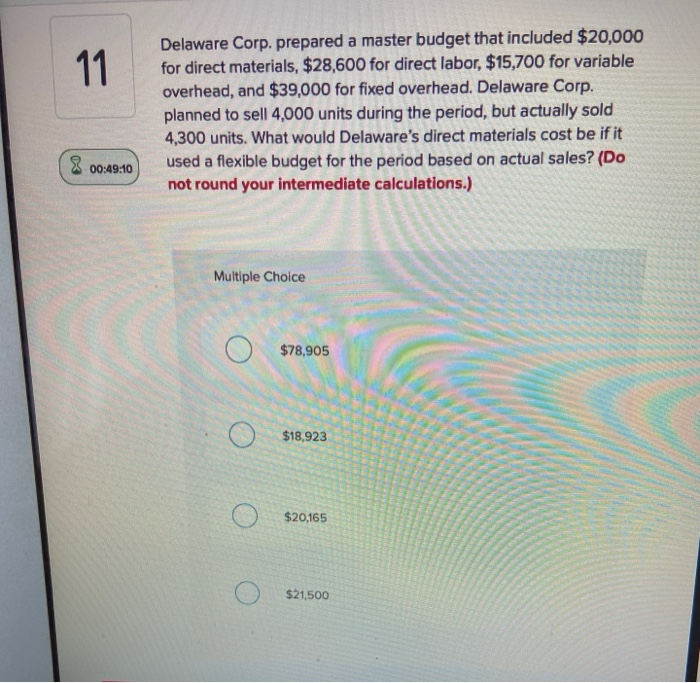

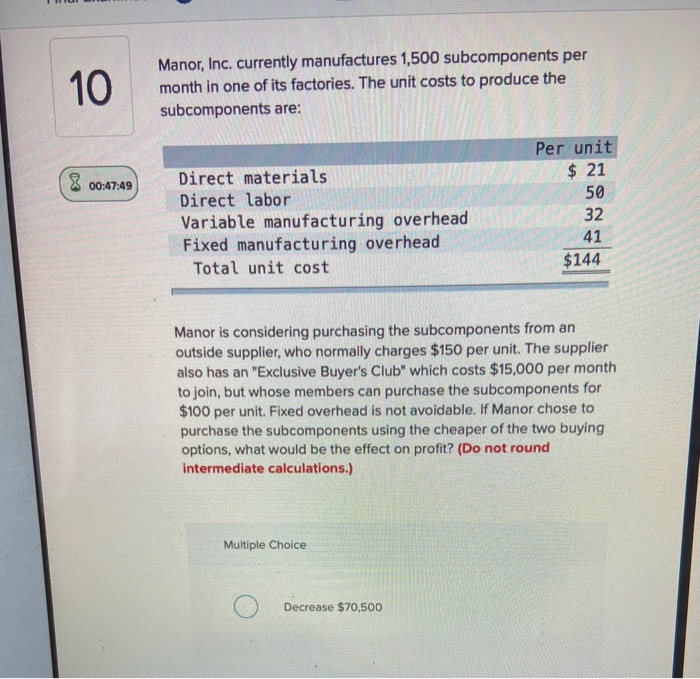

14 Meadow Company produces hand tools. A sales budget for the next four months is as follows: March 10,400 units, April 13,800, May 16,300 and June 21,500. Meadow Company's ending finished goods inventory policy is 20% of the following month's sales. March 1 beginning inventory is projected to be 2,080 units. How many units will be produced in April? 8 00:49:52 Multiple Choice 13,300 m 19,820 13,800 14,300 13 Meadow Company produces hand tools. A sales budget for the next four months is as follows: March 10,400 units, April 13,200, May 16,600 and June 21,700. Meadow Company's ending finished goods inventory policy is 20% of the following month's sales. March 1 beginning inventory is projected to be 2,080 units. How many units will be produced in March? 8 00:49:39 Multiple Choice 10,960 13,200 9,840 10,400 12 Swan Company has a direct labor standard of 19 hours per unit of output. Each employee has a standard wage rate of $18 per hour. During March, employees worked 13,500 hours. The direct labor rate variance was $9,570 favorable, and the direct labor efficiency variance was $15,800 unfavorable. What was the actual payroll? 8 00:49:25 Multiple Choice $227,200 $252,570 $233,430 $243,000 11 Delaware Corp. prepared a master budget that included $20,000 for direct materials, $28,600 for direct labor, $15,700 for variable overhead, and $39,000 for fixed overhead. Delaware Corp. planned to sell 4,000 units during the period, but actually sold 4,300 units. What would Delaware's direct materials cost be if it used a flexible budget for the period based on actual sales? (Do not round your intermediate calculations.) 8 00:49:10 Multiple Choice $78,905 $18,923 $20,165 $21,500 10 Manor, Inc. currently manufactures 1,500 subcomponents per month in one of its factories. The unit costs to produce the subcomponents are: Per unit $ 21 8 00:47:49 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total unit cost 50 32 41 $144 Manor is considering purchasing the subcomponents from an outside supplier, who normally charges $150 per unit. The supplier also has an "Exclusive Buyer's Club" which costs $15,000 per month to join, but whose members can purchase the subcomponents for $100 per unit. Fixed overhead is not avoidable. If Manor chose to purchase the subcomponents using the cheaper of the two buying options, what would be the effect on profit? (Do not round intermediate calculations.) Multiple Choice Decrease $70,500