14. Project Evaluation [LO1] Your firm is contemplating the purchase of a new $425,000 compputer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $30,000 at the end of that time. You will save $130,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $60,000 (this is a one-time reduction) If the tax rate is 35 percent, what is the 1RR for this project?

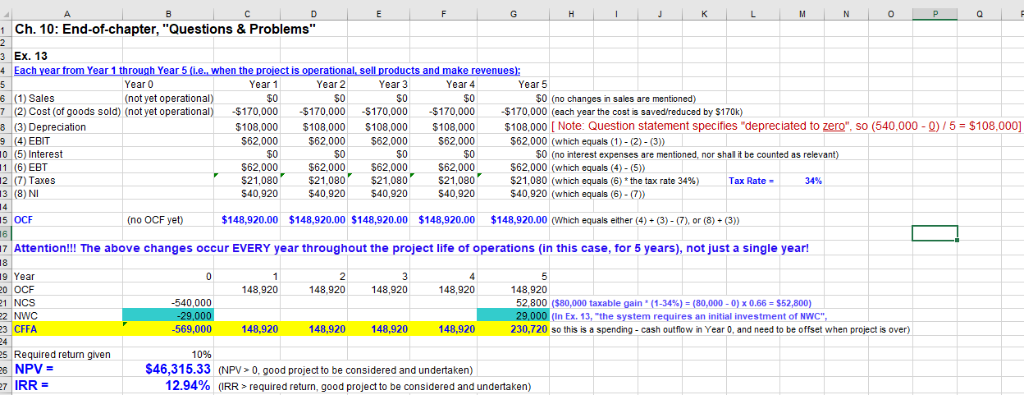

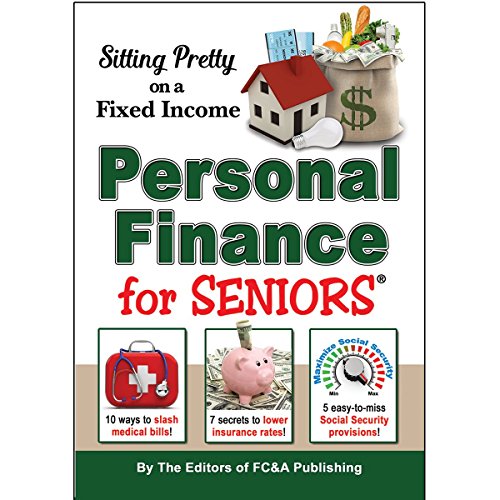

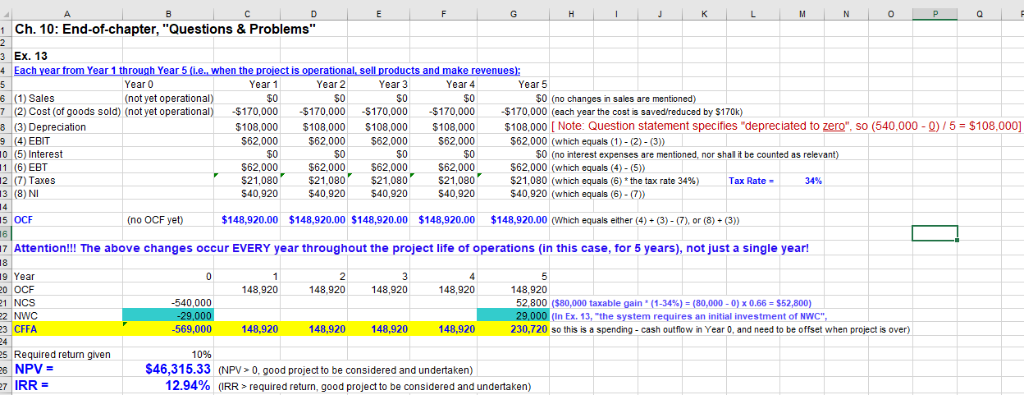

c) For hints about Ex. 14, please see my Excel example of Ex. 13 as attached (updated with Textbook 11 ed. data). But please note that the situation about "the change in net working capital (NWC)" is different between the Ex. 13 example and your Ex. 14 HW.

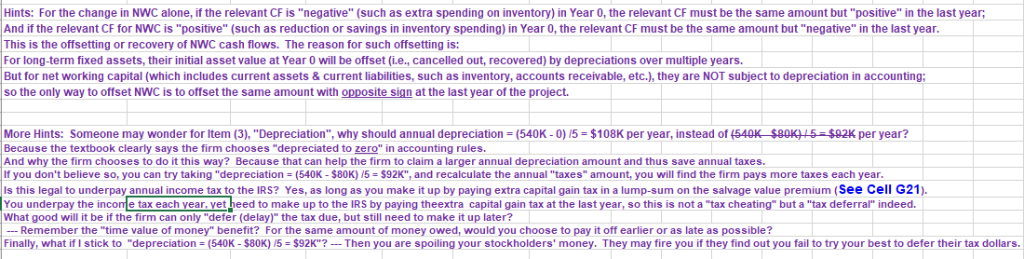

In Ex. 13 example, the investing company needs to spend some money to invest on NWC (such as purchasing extra inventory) at the beginning, and thus recover (offset, write off) those NWC investment in the end. The results would be a cash outflow of -$zzz in the initial "Year 0", and also an offsetting cash inflow with opposite sign pf +$zzz in the final year of project.

In Ex. 14 HW, the situation about NWC is just the other way around. By undertaking this investment project, you are able to reduce some net working capital (be careful, reduce capital investment = save expenditure money = cash inflow, should be positive money amount +$zzz instead of negative; do NOT be misled simply by the word "reduce") as a one-time savings at the initial "Year 0". However, do NOT forget to also offset this change (of +$zzz) in the initial year with the opposite sign (of -$zzz) in the ending year.

B Ch. 10: End-of-chapter, "Questions & Problems" D n A E G Ex. 13 Each year from Year 1 through Year 5 (i.e. when the projectis operational, sell products and make revenues) Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 s (1) Sales 7 (2) Cost 8 (3) Depreciation 50 S0 (not yet operational) fgoods sold) (not yet operational) S0 $0 $0 (no changes in sales are mentioned) -$170,000 $170.000 -$170,000 -$170,000 -$170,000 (each year the cost is saved/reduced by $170k) $108,000 [ Note: Question statement specifies "depreciated to zero", so (540,000 -0)/ 5 $108,000] $108,000 $108,000 $62.0 SO $108,000 $108,000 $62,00 $62.0 $62.0 50 $62,0 ich equals (1)-(2)-(3)) (5Unterest so SO mentioned, nor shall it be counted as relevant) 1 (6) EBT 2 (7) Taxes 3 (8) NI $62,000 $21,080 $62,000 $62,000 $21,080 $62,000 $21,080 $62,000 (which equals (4)-(5) $21,080 (which equals (6) the tax rate 34 % ) $40.920 (which equals (6)- (7) $21.080 Tax Rate- 34% $40.920 $40,920 $40,920 $40,920 4 OCF (no OCF yet) $148,920.00 $148,920.00 $148,920.00 $148,920.00 $148,920.00 (Which equals either (4)+ (3)-(7), or (8)+(3) 7 Attention!!! The above changes occur EVERY year throughout the project life of operations (in this case, for 5 years), not just a single year! 8 9 Year 0 OCF 1 NCS 2 NWC 0 2 5 1 4 148.920 148.920 148.920 148,920 148.920 52,800 ($80,000 taxable gain (1-34 % ) - ( 80,000-0) x 0.66 $52,800) -540.000 29,000 (In Ex. 13, "the system requires an initial investment NWC" -29,000 230.720 so this is a spending- cash outflow n Year 0, and need to b 148.920 148,920 CFFA -569.000 148.920 148,920 offset when project is over) s Required return given 6 NPV 10% $46,315.33 (NPV 0, good project to be considered and undertaken) (RR> required return, good project to IRR= 12.94% considered and undertaken) Hints: For the change in NWC alone, if the relevant CF is "negative" (such as extra spending on inventory) in Year 0, the relevant CF must be the same amount but "positive" in the last year; And if the relevant CF for NWC is "positive" (such as reduction or savings This is the offsetting or recovery of NWC cash flows. The reason for such offsetting is: For long-term fixed assets, their initial asset value at Year 0 will be offset (i.e., cancelled out, recovered) by depreciations over multiple years. But for net working capital (which includes current assets & current liabilities, such as inventory, accounts receivable, etc.), they are NOT subject to depreciation in accounting: so the only way to offset NWC is to offset the same amount with opposite sign at the last year of the project. inventory spending) in Year 0, the relevant CF must be the same amount but "negative" in the last year. More Hints: Someone may wonder for Item (3), "Depreciation", why should annual depreciation = (540K -0) /5 $108K per year, instead of (540K $80KH5=$92K per year? Because the textbook clearly says the firm chooses "depreciated And why the firm chooses to do it this Way? BecausSe that can neip the zero" in accounting rules Claim a larger annual depreciation amount and thus save annual taxes s92K" more taxes each year. Is this legal to underpay annual income tax to the IRS? Yes, as long as you make it up by paying extra capital gain tax in a lump-sum on the salvage value premium (See Cell G21) You underpay the income tax each year, yet heed to make up to the IRS by paying theextra capital gain tax at the last year, so this is not a "tax cheating" but a "tax deferral" indeed. What good will it be if the firm can only "defer (delay)" the tax due, but still need to make it up later? Remember the "time value of money" benefit? For the same amount of money owed, wou ld you choose to pay it off earlier or as late as possible? Finally, what if I stick to "depreciation = (540K - $8OK) 15 = $92K" ? -Then you are spoiling your stockholders' money. They may fire you if they find out you fail to try your best defer their tax dollars