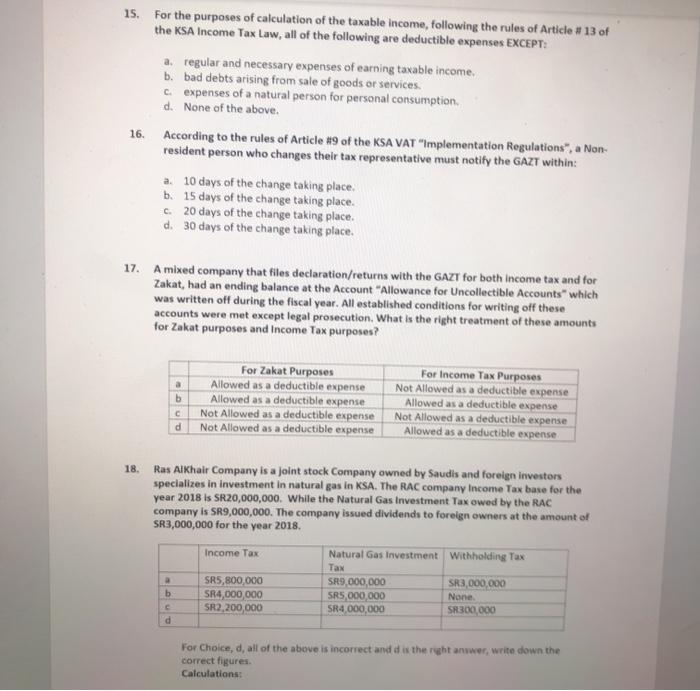

15. For the purposes of calculation of the taxable income, following the rules of Article # 13 of the KSA Income Tax Law, all of the following are deductible expenses EXCEPT: a. regular and necessary expenses of earning taxable income. b. bad debts arising from sale of goods or services. c. expenses of a natural person for personal consumption d. None of the above. 16. According to the rules of Article #9 of the KSA VAT "Implementation Regulations", a Non- resident person who changes their tax representative must notify the GAZT within: a. 10 days of the change taking place. b. 15 days of the change taking place. c. 20 days of the change taking place. d. 30 days of the change taking place. 17. A mixed company that files declaration/returns with the GAZT for both income tax and for Zakat, had an ending balance at the Account "Allowance for Uncollectible Accounts which was written off during the fiscal year. All established conditions for writing off these accounts were met except legal prosecution. What is the right treatment of these amounts for Zakat purposes and Income Tax purposes? b c d For Zakat Purposes Allowed as a deductible expense Allowed as a deductible expense Not Allowed as a deductible expense Not Allowed as a deductible expense For Income Tax Purposes Not Allowed as a deductible expense Allowed as a deductible expense Not Allowed as a deductible expense Allowed as a deductible expense 18. Ras Al Khair Company is a joint stock Company owned by Saudis and foreign investors specializes in investment in natural gas in KSA. The RAC company Income Tax base for the year 2018 is SR20,000,000. While the Natural Gas Investment Tax owed by the RAC company is SR9,000,000. The company issued dividends to foreign owners at the amount of SR3,000,000 for the year 2018, Income Tax Natural Gas Investment withholding Tax SR5,800,000 SR9,000,000 SR3,000,000 SR4,000,000 SR5,000,000 None SR2,200,000 SR4,000,000 SR300,000 b c d For Choice, d, all of the above is incorrect and is the right anwwer, write down the correct figures. Calculations