(15 points) A power company is preparing a bid to become the lead contractor on a nuclear power plant in Japan. The plant will

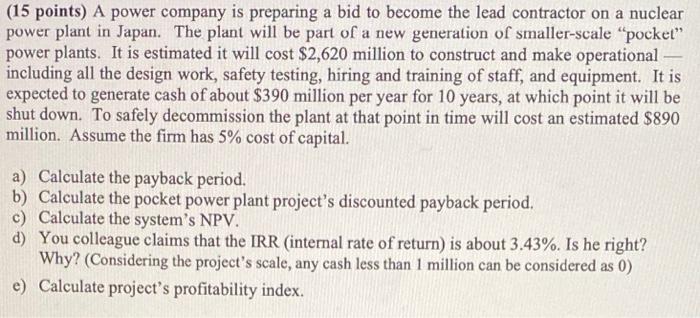

(15 points) A power company is preparing a bid to become the lead contractor on a nuclear power plant in Japan. The plant will be part of a new generation of smaller-scale "pocket" power plants. It is estimated it will cost $2,620 million to construct and make operational including all the design work, safety testing, hiring and training of staff, and equipment. It is expected to generate cash of about $390 million per year for 10 years, at which point it will be shut down. To safely decommission the plant at that point in time will cost an estimated $890 million. Assume the firm has 5% cost of capital. a) Calculate the payback period. b) Calculate the pocket power plant project's discounted payback period. c) Calculate the system's NPV. d) You colleague claims that the IRR (internal rate of return) is about 3.43%. Is he right? Why? (Considering the project's scale, any cash less than 1 million can be considered as 0) e) Calculate project's profitability index.

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Payback period 2620390 672 Years b Year Cash flow P...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started