Answered step by step

Verified Expert Solution

Question

1 Approved Answer

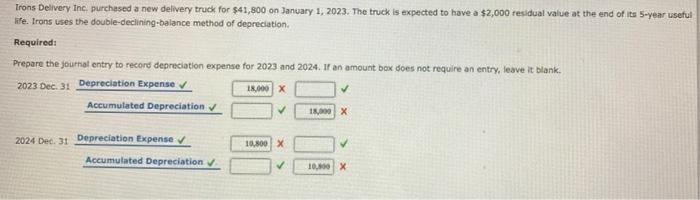

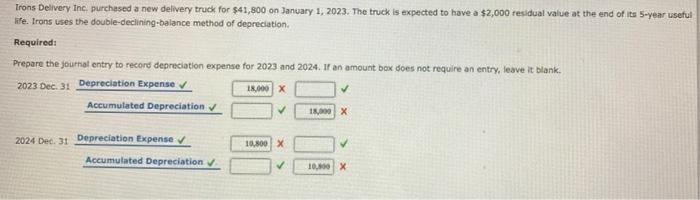

1-5 Trans Delivery Inc. purchased a new delivery truck for $41,800 on January 1, 2023. The truck is expected to have a $2,000 residual value

1-5

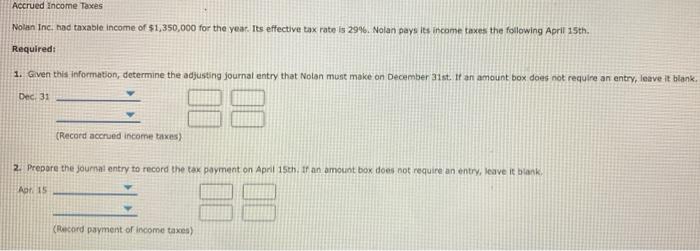

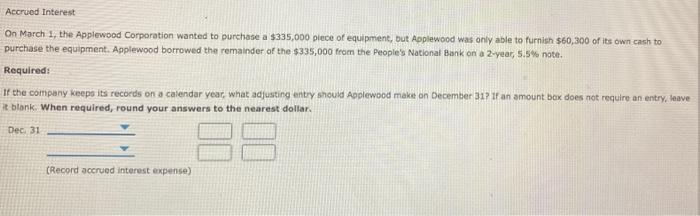

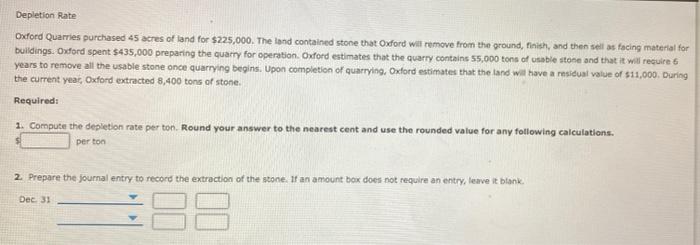

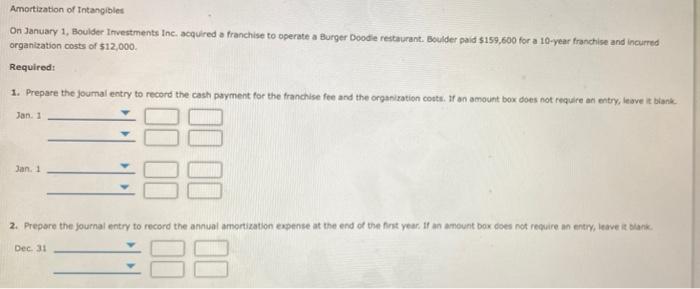

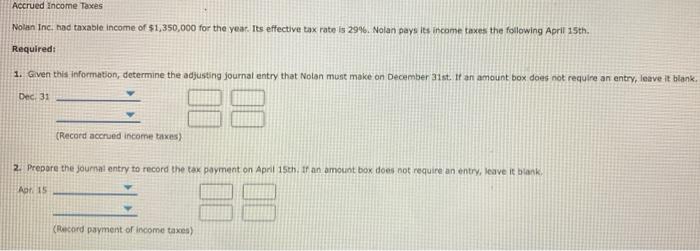

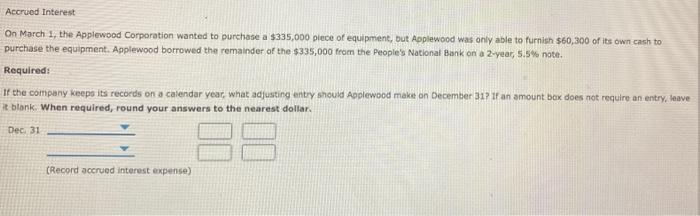

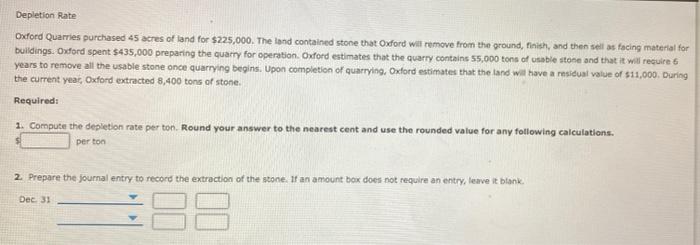

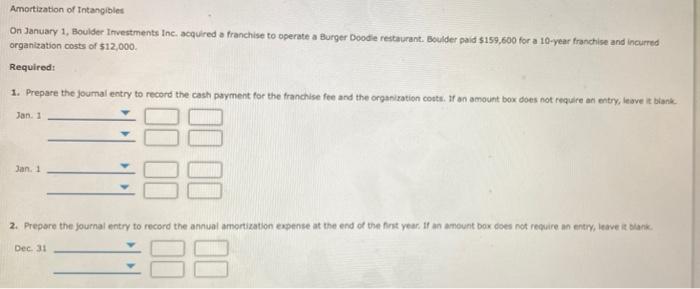

Trans Delivery Inc. purchased a new delivery truck for $41,800 on January 1, 2023. The truck is expected to have a $2,000 residual value at the end of its 5-year useful life. Trons uses the double-declining-balance method of depreciation Required: Prepare the journal entry to record depreciation expense for 2023 and 2024. If an amount box does not require an entry, leave it blank. 2023 Dec. 31 Depreciation Expense 18,000 X Accumulated Depreciation 18,00 X 2024 Dec. 31 Depreciation Expense 10.800 X Accumulated Depreciation 10.80 X Accrued Income Taxes Nolan Inc. had taxable income of 51,350,000 for the year. Its effective tax rate is 29%. Nolan pays its income taxes the following April 15th. Required: 1. Given this information, determine the adjusting journal entry that Nolan must make on December 31st. If an amount box does not require an entry, leave it blank Dec 31 (Record accrued income taxes) 2. Prepare the journal entry to record the tax payment on April 15th. If an amount box does not require an entry, leave it blank Ar. 15 (Record payment of income taxes) Accrued Interest On March 1, the Applewood Corporation wanted to purchase a $335,000 piece of equipment, but Applewood was only able to furnish $60,300 of its own cash to Durchase the equipment. Applewood borrowed the remainder of the $335,000 from the People's National Bank on a 2-year, 5.5% nott. Required: If the company keeps its records on a calendar year, what adjusting entry should Applewood make on December 31? 1 an amount box does not require an entry, teave at blonk. When required, round your answers to the nearest dollar Dec 31 88 (Record accrued interest expense) Depletion Rate Oxford Quarries purchased 45 acres of land for $225,000. The land contained stone that Oxford will remove from the ground, finish, and then sellas facing material for buildings. Osdord spent $435,000 preparing the quarry for operation. Oxford estimates that the quarry contains 55,000 tons of usable stone and that it will require 6 years to remove all the usable stone once quarrying begins. Upon completion of quarrying, Oxford estimates that the land will have a residual value of $11,000. During the current year, Oxford extracted 8,400 tons of stone. Required: 1. Compute the depletion rate per ton. Round your answer to the nearest cent and use the rounded value for any following calculations. perton 2. Prepare the journal entry to record the extraction of the stone. If an amount box does not require an entry, leave it blank. Dec 31 88 Amortization of Intangibles On January 1, Boulder Investments Inc. acquired a franchise to operate a Burger Doodie restaurant. Boulder paid $159,600 for a 10-year franchise and incurred organization costs of $12,000 Required: 1. Prepare the Joumal entry to record the cash payment for the tranchise fee and the organization costs. If an amount box does not require an entry, leave it blank Jan 1 Jan. 1 2. Prepare the journal entry to record the annual amortization expense at the end of the first year. If an amount box does not require an entry, leave it blank Dec. 31 il 100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started