Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15. Which of the following events could result in 1250 depreciation recapture? a. Sale at a loss of a depreciable business building held more

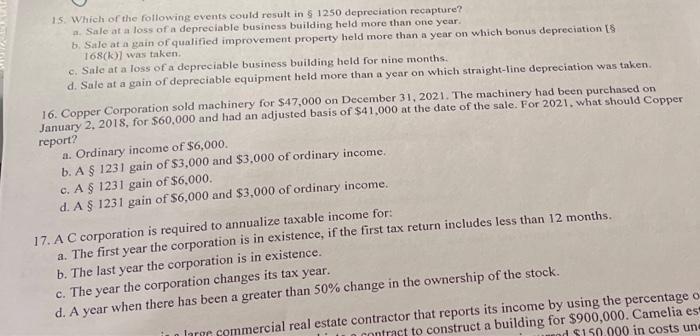

15. Which of the following events could result in 1250 depreciation recapture? a. Sale at a loss of a depreciable business building held more than one year. b. Sale at a gain of qualified improvement property held more than a year on which bonus depreciation [S 168(k)] was taken. c. Sale at a loss of a depreciable business building held for nine months. d. Sale at a gain of depreciable equipment held more than a year on which straight-line depreciation was taken. 16. Copper Corporation sold machinery for $47,000 on December 31, 2021. The machinery had been purchased on January 2, 2018, for $60,000 and had an adjusted basis of $41,000 at the date of the sale. For 2021, what should Copper report? a. Ordinary income of $6,000. b. A 1231 gain of $3,000 and $3,000 of ordinary income. c. A 1231 gain of $6,000. d. A 1231 gain of $6,000 and $3,000 of ordinary income. 17. A C corporation is required to annualize taxable income for: a. The first year the corporation is in existence, if the first tax return includes less than 12 months. b. The last year the corporation is in existence. c. The year the corporation changes its tax year. d. A year when there has been a greater than 50% change in the ownership of the stock. large commercial real estate contractor that reports its income by using the percentage o contract to construct a building for $900,000. Camelia es and $150.000 in costs une

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

15 Answer None of the options is correct Explanation Section 1250 depreciation recapture is applicab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started